Orders

Overview

An order is a request to buy or sell a financial instrument at a specified price and quantity. In the UI, users can place orders via the Order Ticket.

When the chart is initially loaded, the library calls the orders method from the Broker API implementation.

As a result, your implementation should return either a PlacedOrder or BracketOrder object.

The object should contain data about orders that a user already had before the chart was created.

You can refer to the step-by-step example and the Bracket orders article to learn how these objects should be used.

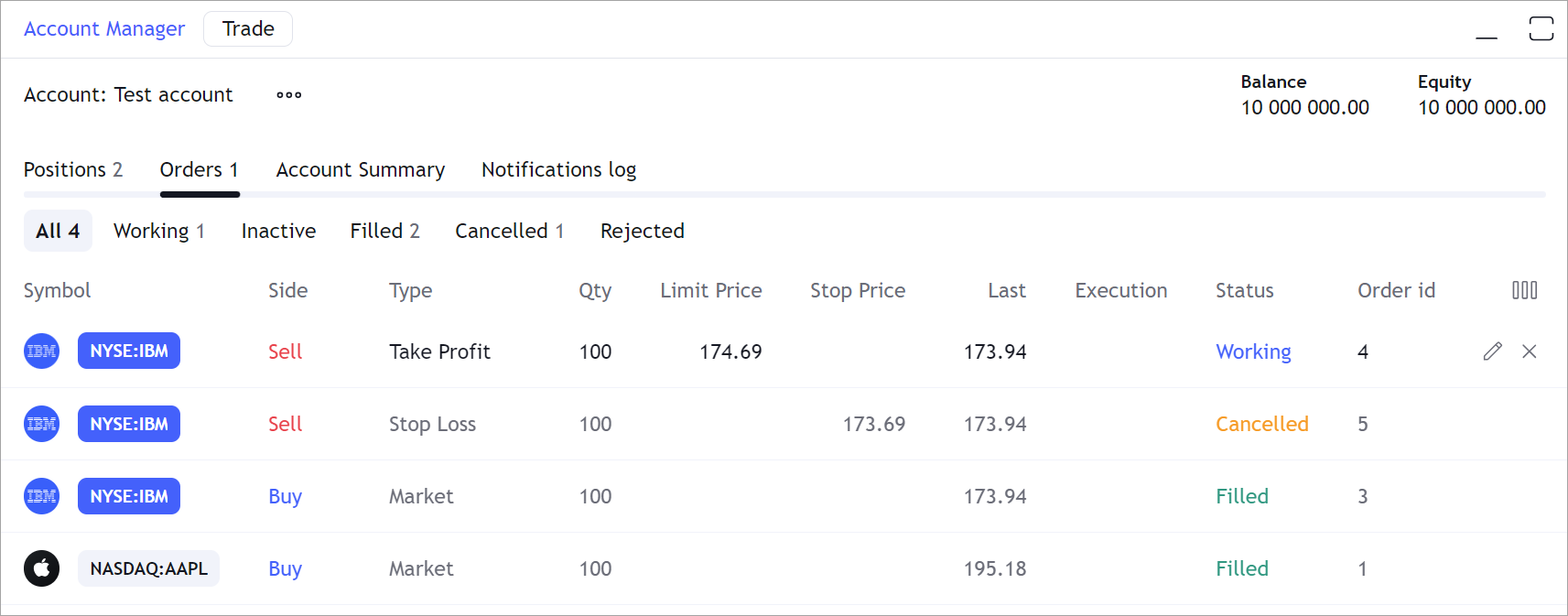

All user's orders are displayed in the Account Manager → Orders page.

Order types

Order types allow users to place orders according to their specific strategies and risk tolerance. The library supports four order types:

- Market order is an order to buy or sell a financial instrument at the current market price. This order type guarantees immediate execution but does not guarantee a specific price.

- Limit order is an order to buy or sell a financial instrument when a given or better price is reached. This order type guarantees a specific price but does not guarantee immediate execution.

- Stop order is an order to buy or sell a financial instrument at the market price as soon as it reaches a certain level.

- Stop-limit order is an order that combines a stop price and a limit price.

You can configure which types you want to support. Refer to Configure order types for more information.

Bracket orders

Trading Platform supports creating bracket orders for positions. A bracket order is an order that helps users limit their losses and secure their profits by bracketing positions with two opposing stop-loss and take-profit orders.

- Stop-loss order is a type of order designed to limit losses by automatically closing a position at a given price when it moves unfavorably.

- Take-profit order is a type of limit order that closes a position at a specific price to secure a profit.

Refer to Bracket orders for more information.

Order statuses

When an order is placed, it enters the execution process. In this process, orders have statuses that can be divided into two groups:

-

Transitional

- Placing: an order is registered by the broker, but the exchange has not confirmed the status yet.

- Working: an order is created and approved by the exchange but not executed yet.

- Inactive: an order is in the system, but not at work. Applied to bracket orders.

-

Final

- Filled: an order is executed.

- Canceled: an order is canceled by a user.

- Rejected: an order is rejected for some reason, for example, the exchange rejected the order.

Note that the order status can only change from transitional to final, not vice versa. Refer to a step-by-step example to see the whole order process: from placement to execution.