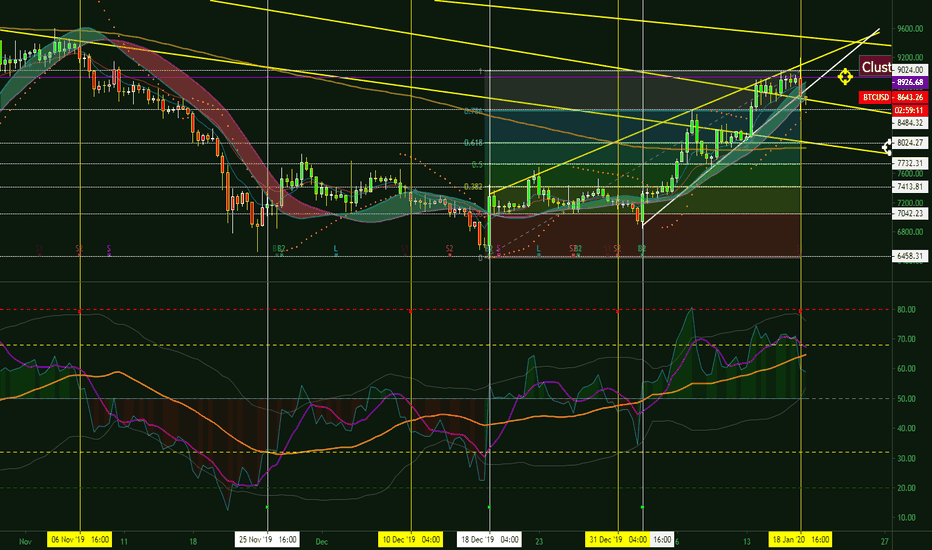

Wedge broke bearish & market maker move (aka manipulator meme)

I tried to make the graph speak for itself, but will describe the setups which I see briefly.

We got momentum shifting south, after price pumping, without proper correction to produce a sustainable upwards momentum.

There is a CME gap which could provide a golden R:R short. But the momentum to the downside is pretty strong, so probably we will see a retrace to 8000 support zone, before market manipulators try to fill the gap.

If we retrace to 8000 and consolidate, a base on which proper upwards momentum can be build could provide a nice long setup.

If we fill the gap before we consolidate around proper support, my limit sell orders will be filled. My short position will be pretty big, because distance from entry at 8950 with stop above 200 day ma around 9050 is pretty tight! *dollar sing in eyes*

So to summarize I'm looking for the following setups:

If price moves to 8000, open long -> sl below 7700 - tp 8950 (close cme gap), (in case of consolidation around 8300 add tp -> 9150, 9450, 9600, 9950)

If price moves sideways, place limit sells at 8950, in case cme gaps get closed -> Sl above 200 day ma, main tp around 8400-8300 (keep some short contracts open, risk free, and scale out of position in case price starts consolidating)

We got momentum shifting south, after price pumping, without proper correction to produce a sustainable upwards momentum.

There is a CME gap which could provide a golden R:R short. But the momentum to the downside is pretty strong, so probably we will see a retrace to 8000 support zone, before market manipulators try to fill the gap.

If we retrace to 8000 and consolidate, a base on which proper upwards momentum can be build could provide a nice long setup.

If we fill the gap before we consolidate around proper support, my limit sell orders will be filled. My short position will be pretty big, because distance from entry at 8950 with stop above 200 day ma around 9050 is pretty tight! *dollar sing in eyes*

So to summarize I'm looking for the following setups:

If price moves to 8000, open long -> sl below 7700 - tp 8950 (close cme gap), (in case of consolidation around 8300 add tp -> 9150, 9450, 9600, 9950)

If price moves sideways, place limit sells at 8950, in case cme gaps get closed -> Sl above 200 day ma, main tp around 8400-8300 (keep some short contracts open, risk free, and scale out of position in case price starts consolidating)

ملاحظة

If 200 day ma is broken, try to long retest, but I don't really see this happening before any consolidation around 8000 support...ملاحظة

yellow line around 8000 zone should be white...ملاحظة

Strong sell signal, produces by script from tradingview.com/u/TBTS/

تم فتح الصفقة

This pa is nerve reckingly boring.... Hodling my cash position, did not get my my limit sell orders at 8925 filled and price heading towards support at around 8000إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.