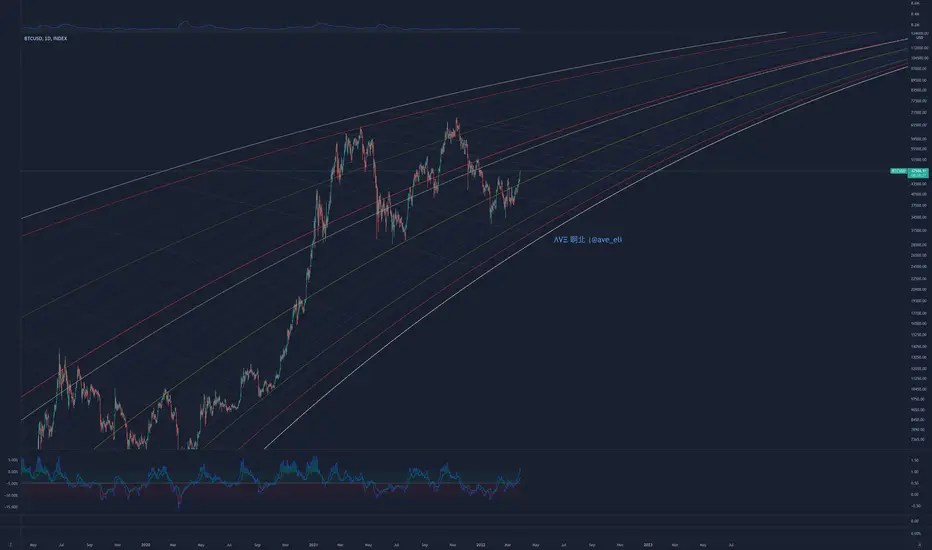

This is one of the most important charts I've ever made for #Bitcoin

There's a lot to these exact angles of approach, they go back to the first bull market and they continue to be relevant even today. And they all converge at 171k USD

The top band in white historically has never been broken by BTC - it retraces there, and then finds new market support. I trace a new band there to 171k, which becomes the support for the next bull - when that band is broken the market capitulates, every time.

BTC - it retraces there, and then finds new market support. I trace a new band there to 171k, which becomes the support for the next bull - when that band is broken the market capitulates, every time.

You can see these supports color-coded across the whole chart, and see their continued significance across in the following bull market cycles. The first BTC market support in yellow, the second in red + white area then the yellow and white again.

BTC market support in yellow, the second in red + white area then the yellow and white again.

A key element in all of this is that the convergence at 171k means the overall chart is rising in a curved Rising Wedge, prices reach the top, falls to the bottom, and breaks down, finds new support, and that new support carries onto the next BTC bull market

BTC bull market

But overall the area of bull market expansion narrows over time - meaning the whole BTC supercycle from $0.06 to today grows into a rising wedge, and it is runnings out of space - 171k being the convergence of all of these log curves.

BTC supercycle from $0.06 to today grows into a rising wedge, and it is runnings out of space - 171k being the convergence of all of these log curves.

For the current #bitcoin price action, every time prices cross one of these old markets supports it capitulates hard. But it is likely to find buyers at the next key one. But if the price loses the last yellow bottom one then the last white one this cycle's real BTC capitulation will hit.

BTC capitulation will hit.

If the BTC price turns bullish either after new capitulation or simply turns above the middle white log curve and runs hard, then it is more likely than not to stop at the white log at the top since #bitcoin has never broken it.

BTC price turns bullish either after new capitulation or simply turns above the middle white log curve and runs hard, then it is more likely than not to stop at the white log at the top since #bitcoin has never broken it.

My guess is that BTC is more likely to break the bottom white log curve support, find a new bottom, then do it all again

BTC is more likely to break the bottom white log curve support, find a new bottom, then do it all again

There's a lot to these exact angles of approach, they go back to the first bull market and they continue to be relevant even today. And they all converge at 171k USD

The top band in white historically has never been broken by

You can see these supports color-coded across the whole chart, and see their continued significance across in the following bull market cycles. The first

A key element in all of this is that the convergence at 171k means the overall chart is rising in a curved Rising Wedge, prices reach the top, falls to the bottom, and breaks down, finds new support, and that new support carries onto the next

But overall the area of bull market expansion narrows over time - meaning the whole

For the current #bitcoin price action, every time prices cross one of these old markets supports it capitulates hard. But it is likely to find buyers at the next key one. But if the price loses the last yellow bottom one then the last white one this cycle's real

If the

My guess is that

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.