OPEN-SOURCE SCRIPT

تم تحديثه PGO For Loop | mad_tiger_slayer

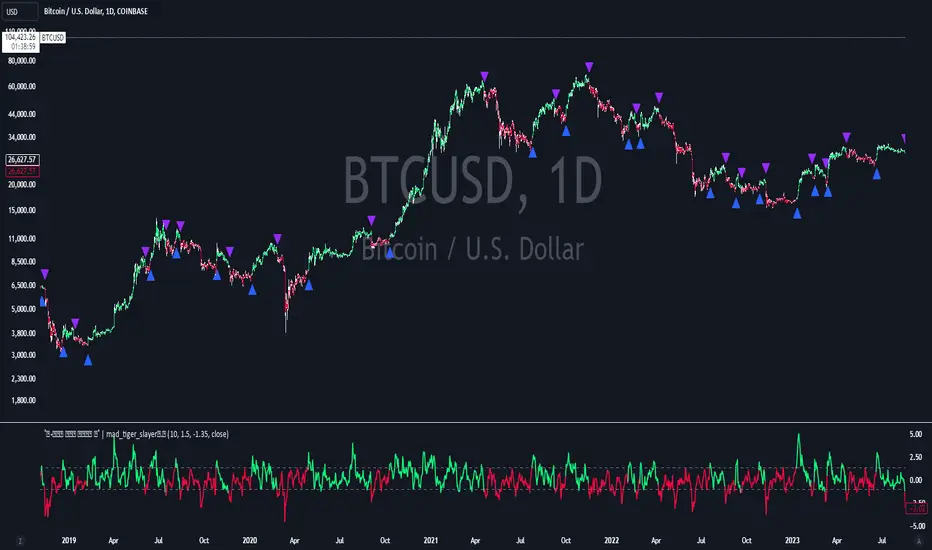

PGO For Loop Indicator

The PGO For Loop indicator, inspired by Alex Orekhov's "Pretty Good Oscillator," and indicator originally made by Mark Johnson, the PGO designed as a fast and responsive tool to capture quick price movements in financial markets. This oscillator leverages a combination of moving averages and Average True Range (ATR) to measure price deviations, providing a concise yet powerful framework for identifying potential trade entry and exit points. What makes this

"enhanced" PGO indicator special is its ability to identify trending periods more accurately. By using thresholds, this allows the script to enter accurate long and short conditions extremely quickly.

Intended Uses:

NOT Intended Uses:

Key Features:

How It Works:

Oscillator Calculation:

Note:

This indicator is intentionally "noisy," as it prioritizes capturing fast movements over filtering out minor fluctuations. Users should pair it with other tools or techniques to confirm signals and manage risk effectively.

The PGO For Loop indicator, inspired by Alex Orekhov's "Pretty Good Oscillator," and indicator originally made by Mark Johnson, the PGO designed as a fast and responsive tool to capture quick price movements in financial markets. This oscillator leverages a combination of moving averages and Average True Range (ATR) to measure price deviations, providing a concise yet powerful framework for identifying potential trade entry and exit points. What makes this

"enhanced" PGO indicator special is its ability to identify trending periods more accurately. By using thresholds, this allows the script to enter accurate long and short conditions extremely quickly.

Intended Uses:

- Used to capture long-term trends:

- Used to identify quick reversals:

- Used on higher timeframes above 8hrs for more accurate signals

- Used in strategies to enter and exit trades quickly

- Can be used for Scalping

NOT Intended Uses:

- Not to be used as Mean Reversion

- Not to be used as valuation (Overbought or Oversold)

Key Features:

Quick Detection of Market Movements:- The indicator's primary focus is on speed, making it suitable for medium-term traders looking to capitalize on rapid price changes. It is particularly effective in trending or volatile markets.

Customizable Thresholds: - Users can set upper and lower thresholds to define long and short conditions, offering flexibility to adapt the indicator to different trading styles and asset classes.

Noisy but Purposeful: - While the PGO For Loop may generate frequent signals, it is specifically tuned for traders aiming to enter and exit trades quickly, embracing the noise as part of its effectiveness in capturing rapid market dynamics.

Integrated Visuals: - The script plots key levels and provides dynamic visual feedback through colored candles and shapes, enabling intuitive and quick decision-making.

How It Works:

Oscillator Calculation:

- The PGO value is derived by comparing the source price's deviation from its moving average to the ATR. This highlights price movements relative to recent volatility.

Signal Identification: - When the oscillator exceeds the upper threshold, it signals potential long opportunities UNTIL the PGO reaches the lower threshold.

When the oscillator drops below the lower threshold, it signals potential short opportunities UNTIL the oscillator reaches above the upper threshold.

No signals occur when the oscillator lies between these thresholds.

Visual Cues: - Color-coded candles indicate market bias (green for long, red for short, gray for neutral).

Upward and downward triangles highlight changes in signal direction.

Note:

This indicator is intentionally "noisy," as it prioritizes capturing fast movements over filtering out minor fluctuations. Users should pair it with other tools or techniques to confirm signals and manage risk effectively.

ملاحظات الأخبار

Updated thumbnail for compliancy ملاحظات الأخبار

Added a simple "Switch" function to change the MA style. Creds to TYBOAR and EternalFlame5 for inspiration and the idea.نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

⌛️ Get Invite-Only Access To Our World Class Systems ⬇️

whop.com/quantlapse-systems/

whop.com/quantlapse-systems/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

⌛️ Get Invite-Only Access To Our World Class Systems ⬇️

whop.com/quantlapse-systems/

whop.com/quantlapse-systems/

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.