OPEN-SOURCE SCRIPT

CVD Oscillator - Short Term SwiftEdge

Overview

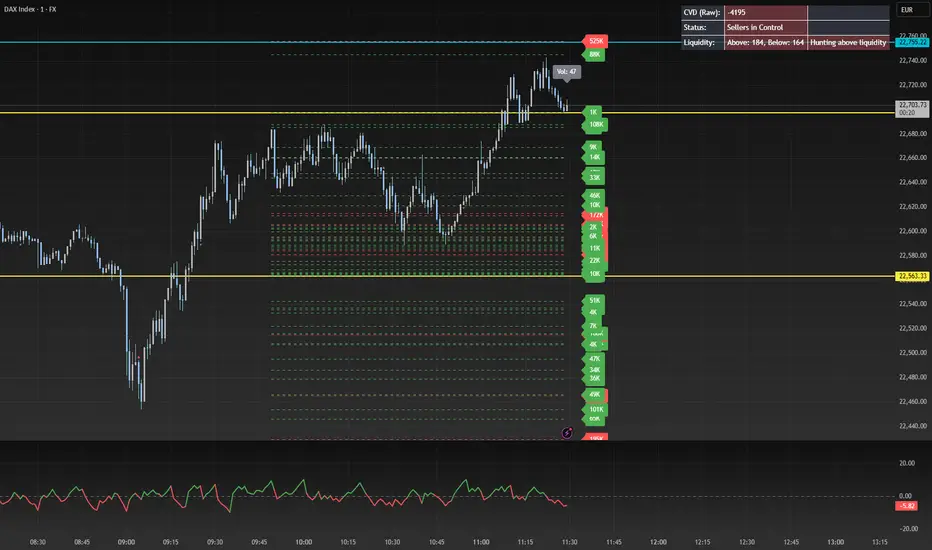

The CVD Oscillator - Short Term is a technical indicator designed to assist traders in identifying short-term buying and selling pressure in the market. It calculates the Cumulative Volume Delta (CVD) to measure the net volume difference between buying and selling activity, displayed as an oscillator in a separate panel. This indicator is tailored for short-term trading strategies, such as scalping or day trading, on low timeframes (e.g., 1-minute, 5-minute, or 15-minute charts).

How It Works

Cumulative Volume Delta (CVD): The indicator calculates CVD by assigning volume to buyers (when close > open) or sellers (when close < open). If close = open, the volume is neutral.

Short-Term Focus: The CVD is calculated over a user-defined lookback period (default: 10 candles), making it sensitive to recent market activity.

Normalization: The raw CVD is normalized by dividing it by the average volume (over a short period, default: 5 candles) and scaled to fit within a range of -100 to +100, creating an oscillator-like behavior.

Reset Options: Users can reset the CVD at specific intervals (e.g., every minute, 5 minutes, 15 minutes, or daily) to focus on intraday movements.

Live CVD Value: The raw (unnormalized) CVD value is displayed as a label on each candle for real-time monitoring.

Key Features

Customizable Lookback Period: Adjust the number of recent candles (default: 10) to calculate CVD, allowing for precise short-term analysis.

Flexible Reset Periods: Choose to reset the CVD every 1 minute, 5 minutes, 15 minutes, daily, or never, to suit your trading style.

Normalized Oscillator: The CVD is scaled between -100 and +100, making it easier to visualize short-term momentum.

Live CVD Labels: Displays the raw CVD value on each candle, with options to position the label above or below the oscillator line.

How to Use

Add to Chart: Apply the indicator to your chart on a low timeframe (e.g., 1m, 5m, or 15m) for short-term trading.

Interpret the Oscillator:

Above 0 (Green): Indicates buying pressure dominates.

Below 0 (Red): Indicates selling pressure dominates.

Near 0: Suggests neutral market conditions.

Monitor Live CVD: Use the raw CVD value (shown in the label) to assess the exact net volume difference over the lookback period.

Combine with Other Tools: Use the oscillator alongside price action, support/resistance levels, or other indicators to confirm trading decisions.

Adjust Settings:

CVD Lookback Period: Set to a small value (e.g., 5-20 candles) for scalping.

CVD Reset Period: Choose "1m" or "5m" for intraday resets to focus on very short-term trends.

Volume Average Length: Use a short length (e.g., 3-5) for faster responsiveness.

Scale Factor: Increase (e.g., 2.0-3.0) to amplify small changes in CVD.

Settings

CVD Reset Period: Defines when to reset the CVD calculation ("None", "D" for daily, "15m", "5m", "1m").

CVD Lookback Period (Candles): Number of recent candles to calculate CVD (default: 10).

Volume Average Length: Period for averaging volume to normalize CVD (default: 5).

CVD Scale Factor: Adjusts the sensitivity of the normalized CVD (default: 2.0).

CVD Label Position: Choose to display the raw CVD label above or below the oscillator line.

CVD Label Color: Customize the color of the CVD label (default: white).

Limitations

Not a Standalone Tool: This indicator should be used in conjunction with other technical analysis tools, as it does not guarantee profitable trades.

Volume Dependency: The accuracy of CVD relies on the quality of volume data provided by your broker or exchange.

Short-Term Focus: The indicator is optimized for low timeframes and may produce noise on higher timeframes unless adjusted.

No Predictive Claims: The CVD Oscillator reflects past and current market activity but does not predict future price movements.

Notes

This indicator is designed for informational purposes and does not constitute financial advice. Trading involves risk, and past performance is not indicative of future results.

Test the indicator on a demo account to understand its behavior before using it in live trading.

Feedback is welcome! If you have suggestions for improvements, feel free to share them in the comments.

The CVD Oscillator - Short Term is a technical indicator designed to assist traders in identifying short-term buying and selling pressure in the market. It calculates the Cumulative Volume Delta (CVD) to measure the net volume difference between buying and selling activity, displayed as an oscillator in a separate panel. This indicator is tailored for short-term trading strategies, such as scalping or day trading, on low timeframes (e.g., 1-minute, 5-minute, or 15-minute charts).

How It Works

Cumulative Volume Delta (CVD): The indicator calculates CVD by assigning volume to buyers (when close > open) or sellers (when close < open). If close = open, the volume is neutral.

Short-Term Focus: The CVD is calculated over a user-defined lookback period (default: 10 candles), making it sensitive to recent market activity.

Normalization: The raw CVD is normalized by dividing it by the average volume (over a short period, default: 5 candles) and scaled to fit within a range of -100 to +100, creating an oscillator-like behavior.

Reset Options: Users can reset the CVD at specific intervals (e.g., every minute, 5 minutes, 15 minutes, or daily) to focus on intraday movements.

Live CVD Value: The raw (unnormalized) CVD value is displayed as a label on each candle for real-time monitoring.

Key Features

Customizable Lookback Period: Adjust the number of recent candles (default: 10) to calculate CVD, allowing for precise short-term analysis.

Flexible Reset Periods: Choose to reset the CVD every 1 minute, 5 minutes, 15 minutes, daily, or never, to suit your trading style.

Normalized Oscillator: The CVD is scaled between -100 and +100, making it easier to visualize short-term momentum.

Live CVD Labels: Displays the raw CVD value on each candle, with options to position the label above or below the oscillator line.

How to Use

Add to Chart: Apply the indicator to your chart on a low timeframe (e.g., 1m, 5m, or 15m) for short-term trading.

Interpret the Oscillator:

Above 0 (Green): Indicates buying pressure dominates.

Below 0 (Red): Indicates selling pressure dominates.

Near 0: Suggests neutral market conditions.

Monitor Live CVD: Use the raw CVD value (shown in the label) to assess the exact net volume difference over the lookback period.

Combine with Other Tools: Use the oscillator alongside price action, support/resistance levels, or other indicators to confirm trading decisions.

Adjust Settings:

CVD Lookback Period: Set to a small value (e.g., 5-20 candles) for scalping.

CVD Reset Period: Choose "1m" or "5m" for intraday resets to focus on very short-term trends.

Volume Average Length: Use a short length (e.g., 3-5) for faster responsiveness.

Scale Factor: Increase (e.g., 2.0-3.0) to amplify small changes in CVD.

Settings

CVD Reset Period: Defines when to reset the CVD calculation ("None", "D" for daily, "15m", "5m", "1m").

CVD Lookback Period (Candles): Number of recent candles to calculate CVD (default: 10).

Volume Average Length: Period for averaging volume to normalize CVD (default: 5).

CVD Scale Factor: Adjusts the sensitivity of the normalized CVD (default: 2.0).

CVD Label Position: Choose to display the raw CVD label above or below the oscillator line.

CVD Label Color: Customize the color of the CVD label (default: white).

Limitations

Not a Standalone Tool: This indicator should be used in conjunction with other technical analysis tools, as it does not guarantee profitable trades.

Volume Dependency: The accuracy of CVD relies on the quality of volume data provided by your broker or exchange.

Short-Term Focus: The indicator is optimized for low timeframes and may produce noise on higher timeframes unless adjusted.

No Predictive Claims: The CVD Oscillator reflects past and current market activity but does not predict future price movements.

Notes

This indicator is designed for informational purposes and does not constitute financial advice. Trading involves risk, and past performance is not indicative of future results.

Test the indicator on a demo account to understand its behavior before using it in live trading.

Feedback is welcome! If you have suggestions for improvements, feel free to share them in the comments.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.