OPEN-SOURCE SCRIPT

Stochastic Overlay - Regression Channel (Zeiierman)

█ Overview

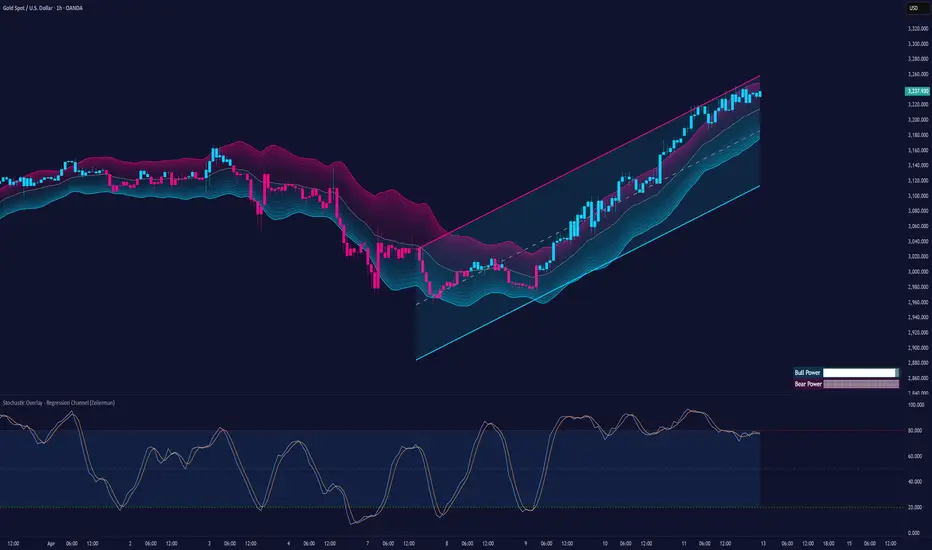

The Stochastic Overlay – Regression Channel (Zeiierman) is a next-generation visualization tool that transforms the traditional Stochastic Oscillator into a dynamic price-based overlay.

Instead of leaving momentum trapped in a lower subwindow, this indicator projects the Stochastic oscialltor directly onto price itself — allowing traders to visually interpret momentum, overbought/oversold conditions, and market strength without ever taking their eyes off price action.

⚪ In simple terms:

When the price moves above the midline → it’s the same as the oscillator moving above 50

When the price breaks above the upper band → it’s the same as Stochastic entering overbought.

When the price reaches the lower band →, think of it like Stochastic being oversold.

This makes market conditions visually intuitive. You’re literally watching the oscillator live on the price chart.

█ How It Works

The indicator layers 3 distinct technical elements into one clean view:

█ How to Use

⚪ Trend Trading

⚪ Mean Reversion

⚪ Momentum Confirmation

⚪ Strength Heatmap

█ Why It Useful

This is not a typical Stochastic or regression tool. The tool is designed for traders who want to:

█ Settings

Stochastic Settings

Stochastic Band

Regression Channel

Heatmap Settings

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

The Stochastic Overlay – Regression Channel (Zeiierman) is a next-generation visualization tool that transforms the traditional Stochastic Oscillator into a dynamic price-based overlay.

Instead of leaving momentum trapped in a lower subwindow, this indicator projects the Stochastic oscialltor directly onto price itself — allowing traders to visually interpret momentum, overbought/oversold conditions, and market strength without ever taking their eyes off price action.

⚪ In simple terms:

▸ The Bands = The Stochastic Oscillator — but on price.

▸ The Midline = Stochastic 50 level

▸ Upper Band = Stochastic Overbought Threshold

▸ Lower Band = Stochastic Oversold Threshold

When the price moves above the midline → it’s the same as the oscillator moving above 50

When the price breaks above the upper band → it’s the same as Stochastic entering overbought.

When the price reaches the lower band →, think of it like Stochastic being oversold.

This makes market conditions visually intuitive. You’re literally watching the oscillator live on the price chart.

█ How It Works

The indicator layers 3 distinct technical elements into one clean view:

⚪ Stochastic Momentum Engine

Tracks overbought/oversold conditions and directional strength using:

- %K Line → Momentum of price

- %D Line → Smoothing filter of %K

- Overbought/Oversold Bands → Highlight potential reversal zones

⚪ Volatility Adaptive Bands

Dynamic bands plotted above and below price using:

- ATR * Stochastic Scaling → Creates wider bands during volatile periods & tighter bands in calm conditions

- Basis → Moving average centerline (EMA, SMA, WMA, HMA, RMA selectable)

This means:→ In strong trends: Bands expand

→ In consolidations: Bands contract

⚪ Regression Channel

Projects trend direction with different models:

- Logarithmic → Captures non-linear growth (perfect for crypto or exponential stocks)

- Linear → Classic regression fit

- Adaptive → Dynamically adjusts sensitivity

- Leading → Projects trend further ahead (aggressive mode)

Channels include:

- Midline → Fair value trend

- Upper/Lower Bounds → Deviation-based support/resistance

⚪ Heatmap - Bull & Bear Power Strength

Visual heatmeter showing:

- % dominance of bulls vs bears (based on close > or < Band Basis)

- Automatic normalization regardless of timeframe

- Table display on-chart for quick visual insight

- Dynamic highlighting when extreme levels are reached

⚪ Trend Candlestick Coloring

Bars auto-color based on trend filter:

- Above Basis → Bullish Color

- Below Basis → Bearish Color

█ How to Use

⚪ Trend Trading

→ Use Band direction + Regression Channel to identify trend alignment

→ Longs favored when price holds above the Basis

→ Shorts favored when price stays below the Basis

→ Use the Bull & Bear heatmap to asses if the bulls or the bears are in control.

⚪ Mean Reversion

→ Look for price to interact with Upper or Lower Band extremes

→ Stochastic reaching OB/OS zones further supports reversals

⚪ Momentum Confirmation

→ Crossovers between %K and %D can confirm continuation or divergence signals

→ Especially powerful when happening at band boundaries

⚪ Strength Heatmap

→ Quickly visualize current buyer vs seller control

→ Sharp spikes in Bull Power = Aggressive buying

→ Sharp spikes in Bear Power = Heavy selling pressure

█ Why It Useful

This is not a typical Stochastic or regression tool. The tool is designed for traders who want to:

- React dynamically to price volatility

- Map momentum into volatility context

- Use adaptive regression channels across trend styles

- Visualize bull vs bear power in real-time

- Follow trends with built-in reversal logic

█ Settings

Stochastic Settings

- Stochastic Length → Period of calculation. Higher = smoother, Lower = faster signals.

- %K Smoothing → Smooths the Stochastic line itself.

- %D Smoothing → Smooths the moving average of %K for slower signals.

Stochastic Band

- Band Length → Length of the Moving Average Basis.

- Volatility Multiplier → Controls band width via ATR scaling.

- Band Type → Choose MA type (EMA, SMA, WMA, HMA, RMA).

Regression Channel

- Regression Type → Logarithmic / Linear / Adaptive / Leading.

- Regression Length → Number of bars for regression calculation.

Heatmap Settings

- Heatmap Length → Number of bars to calculate bull/bear dominance.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.