PROTECTED SOURCE SCRIPT

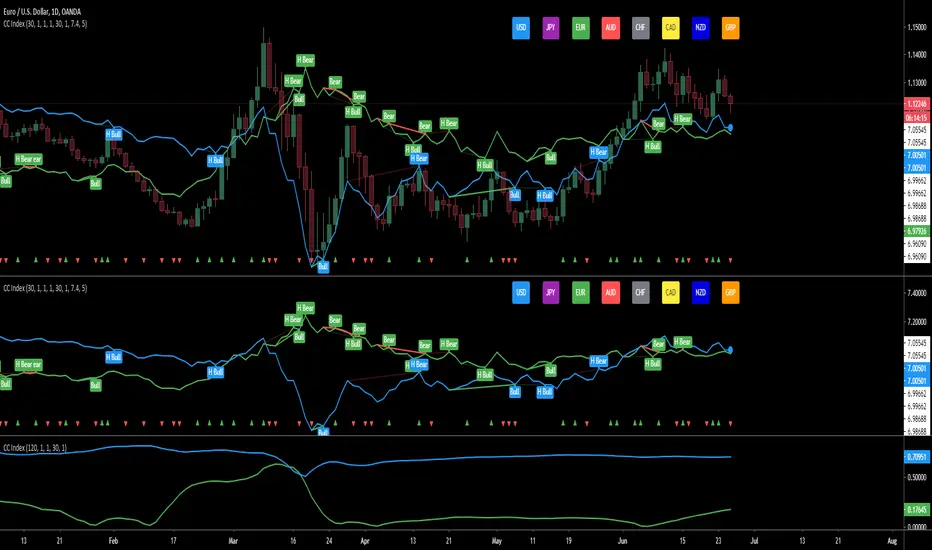

تم تحديثه Currency Index - based on Correlation Coefficient

The script is calculating the correlation between the current pair and the corresponding indexes and then displays the driving index based on the higher correlation.

for example: on EURUSD - calculates the correlation between EURUSD with the USD index and the correlation between EURUSD with the EUR index and then displays the winning/driving index.

- the arrows at the bottom are showing when both indexes are going in the same direction

- there are options to show divergences on the winning index

- option to display either the correlation or the winning index

- and option to be able to use while in replay mode for back testing, based on the last close to avoid repainting

- option for the length of the correlation

- the last color of the driving index is related to the index that is being displayed where:

AUD - red

CAD - yellow

CHF - grey

EUR - green

GBP - orange

JPY - magenta

NZD - dark blue

USD - light blue

- it works automatically on all the major pairs

- the last 4 options are for finding divergences between the price and the index

for example: on EURUSD - calculates the correlation between EURUSD with the USD index and the correlation between EURUSD with the EUR index and then displays the winning/driving index.

- the arrows at the bottom are showing when both indexes are going in the same direction

- there are options to show divergences on the winning index

- option to display either the correlation or the winning index

- and option to be able to use while in replay mode for back testing, based on the last close to avoid repainting

- option for the length of the correlation

- the last color of the driving index is related to the index that is being displayed where:

AUD - red

CAD - yellow

CHF - grey

EUR - green

GBP - orange

JPY - magenta

NZD - dark blue

USD - light blue

- it works automatically on all the major pairs

- the last 4 options are for finding divergences between the price and the index

ملاحظات الأخبار

- fixed a bug from the previous version: even though the colors and correlations were correct ....the driver index displayed was always the second one .... the inverse quote currency index.- as the base currency index has values around 7 and the inverse quote currency index had values around 0.14 ..... displaying both on the same chart would look bad because of the scale difference....

as a result of that and some pinescript limitations, i have normalized the inverse quote currency index, based on the min and max values of the quote so they get displayed nicely

- the Driving index will have a circle/dot in the same color of the index plotted on top of the last value

- I am not super happy about the way the divergence works and will get revamped soon

ملاحظات الأخبار

I have updated the divergences. It now displays regular and hidden divergences on each index separately. Calculations are made between each index and the highs/lows of the pair.- regular bullish divergence = green line

- hidden bullish divergence = 50% transparent green line

- regular bearish divergence = red line

- hidden bearish divergence = 50% transparent green line

- the background of the labels have the same color as the index that the divergence is referring to

ملاحظات الأخبار

-Added labelsنص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.