PROTECTED SOURCE SCRIPT

[3Commas] Alligator Strategy

The Alligator Strategy

🔷 What it does: This script implements the Alligator Strategy, a trend-following method created by Bill Williams. It uses three customizable moving averages (SMMAs or RMAs) "Jaws," "Teeth," and "Lips" to identify market trends and potential trade opportunities. Additionally, it includes built-in stop-loss and take-profit options for enhanced risk management.

🔷 Who is it for:

🔷 How does it work: The Alligator Jaws, Teeth, and Lips are smoothed moving averages (SMA, EMA, RMA, or WMA) calculated based on the selected source price ( hl2 = (high+low)/2 by default). Their lengths and offsets are customizable:

When the lines align and spread apart (e.g., Lips > Teeth > Jaws for an uptrend), the strategy identifies a trending market.

Entry Conditions:

🔷 Why it’s unique:

🔷 Considerations Before Using the Indicator

🔸Why the Forward Offset: By shifting the averages forward, the Alligator helps traders focus on established trends while filtering out short-term market noise.

The standard configurations of 13-8, 8-5, and 5-3 were selected based on Bill Williams’ studies of market behavior. However, these values can be adjusted to suit different market conditions:

🔸Best Timeframes to Use: The Alligator can be applied across all timeframes, but certain timeframes offer better reliability.

🔸Disadvantages of the Alligator Strategy:

🔸Advantages of the Alligator Strategy:

🔸Important Considerations:

While the Alligator Strategy provides a systematic way to analyze markets, it does not guarantee successful outcomes. Results in trading depend on multiple factors, including market conditions, trader discipline, and risk management. Past performance of the strategy does not ensure future success, and traders should always approach the market with caution.

Risk Management: Define stop-loss levels, position size, and profit targets before entering any trade. Be prepared for the possibility of losses and ensure that your approach aligns with your overall trading plan.

🔷 STRATEGY PROPERTIES

🔷 STRATEGY RESULTS

🔷 HOW TO USE

🔸Adjust the Alligator Settings:

The default values generally work well: Source hl2 | Calculation RMA | Jaw 21-13, Teeth 13-8, Lips 8-5. However, if you want to use it on timeframes smaller than 4H (4 hours), consider increasing the values to better filter market noise.

Please review the "Indicator Settings" section for configuration.

🔸Choose a Symbol that Typically Trends:

Select an asset that tends to create trends. However, the Strategy Tester results may display poor performance, making it less suitable for sending signals to bots.

🔸Add Trend Filters:

You can enable trend filters like MA and SuperTrend. By default, these are disabled as they are often unnecessary, but you can experiment with their configuration to see if they optimize the strategy's results.

Please review the "Indicator Settings" section for configuration.

🔸Enable Stop Loss Levels:

Activate Stop Loss features, such as Stop Loss % or Alligator Stop Loss. If both are enabled, the one closest to the price during the trade will be applied.

Please review the "Indicator Settings" section for configuration.

🔸Enable Take Profit Levels:

Activate Take Profit options, such as Take Profit % or Alligator Fast Exit. If both are enabled, the one that triggers first will be executed.

Please review the "Indicator Settings" section for configuration.

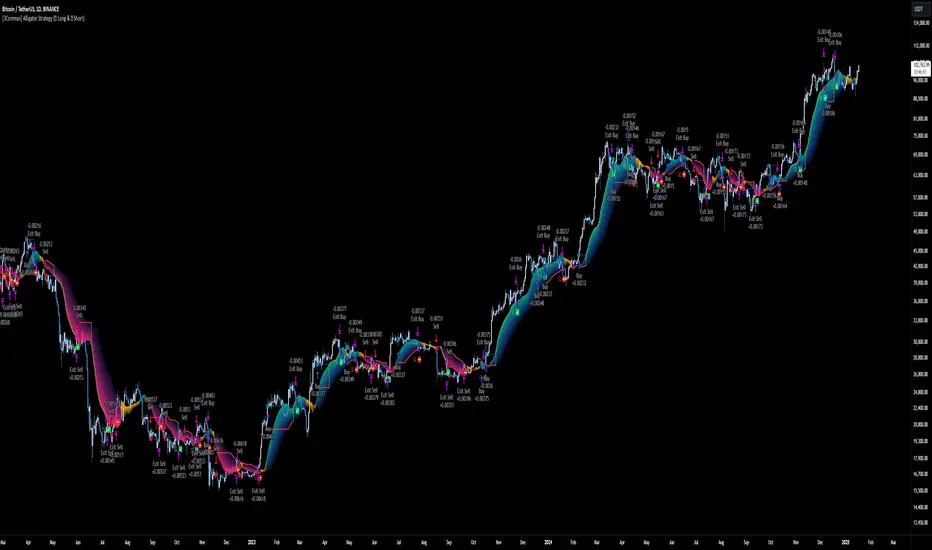

This is an example with the default settings and how Alligator Stop Loss and Alligator Fast Exit are activated:

In this example, we additionally enable the Take Profit at 10%. We can observe that the Alligator Stop Loss is the active one since it is closer to the price. When the price moves 10% in favor or against the trade, the position is closed. Although the Alligator Fast Exit is enabled, it does not activate because the trades are closed beforehand.

🔸Results Review:

It is important to check the Max Drawdown. This value should ideally not exceed 10% of your capital. Consider adjusting the trade size to ensure this threshold is not surpassed.

Remember to include the correct values for commission and slippage according to the symbol and exchange where you are conducting the tests. Otherwise, the results will not be realistic.

If you are satisfied with the results, you may consider automating your trades. However, it is strongly recommended to use a small amount of capital or a demo account to test proper execution before committing real funds.

🔸Create alerts to trigger the DCA Bot

🔷 INDICATOR SETTINGS

🔸Alligator Settings

🔸Alligator Style

🔸MA & SuperTrend Filters

🔸Strategy Tester

🔸3Commas DCA Bot Signals

🔷 CONCLUSION

The Alligator Strategy is a valuable tool for identifying potential trends and improving decision-making. However, no trading strategy is foolproof. Careful consideration of market conditions, proper risk management, and personal trading goals are essential. Use the Alligator as part of a broader trading system, and remember that consistent learning and discipline are key to success in trading.

👨🏻💻💭 We hope this tool helps enhance your trading. Your feedback is invaluable, so feel free to share any suggestions for improvements or new features you'd like to see implemented.

____________________________________________________________________

The information and publications within the 3Commas TradingView account are not meant to be and do not constitute financial, investment, trading, or other types of advice or recommendations supplied or endorsed by 3Commas and any of the parties acting on behalf of 3Commas, including its employees, contractors, ambassadors, etc.

🔷 What it does: This script implements the Alligator Strategy, a trend-following method created by Bill Williams. It uses three customizable moving averages (SMMAs or RMAs) "Jaws," "Teeth," and "Lips" to identify market trends and potential trade opportunities. Additionally, it includes built-in stop-loss and take-profit options for enhanced risk management.

🔷 Who is it for:

- Trend Traders: Those who prefer trading in markets with clear directional movement.

- Advanced Users: Traders who require customizable tools and dynamic risk management features.

- Beginners: Accessible to those new to trading, thanks to its intuitive visual representation of trends and pre-configured settings.

- Bot Users: Supports direct signal integration for bot automation, including entries, take-profits, and stop-losses.

🔷 How does it work: The Alligator Jaws, Teeth, and Lips are smoothed moving averages (SMA, EMA, RMA, or WMA) calculated based on the selected source price ( hl2 = (high+low)/2 by default). Their lengths and offsets are customizable:

- Jaws: Length 21 , offset 13.

- Teeth: Length 13, offset 8.

- Lips: Length 8 , offset 5.

When the lines align and spread apart (e.g., Lips > Teeth > Jaws for an uptrend), the strategy identifies a trending market.

Entry Conditions:

- Long Trades: Triggered when Close > Lips > Teeth > Jaws.

- Short Trades: Triggered when Close < Lips < Teeth < Jaws.

🔷 Why it’s unique:

- Customization: Flexible settings for moving average types and lengths to adapt to different market conditions and strategy tester configurations.

- Built-in Filters: Trend filters that can reduce false signals in certain scenarios, making it more reliable for trending markets.

- Take Profit and Stop Loss:

Configurable as either percentage-based or dynamic.

Stop-loss levels adjust dynamically using the Alligator lines.

Fast exit logic moves the stop-loss closer to the price when trades are in profit. - 3Commas Bot Compatibility: Designed for automated trading, allowing traders to configure and execute the strategy seamlessly.

🔷 Considerations Before Using the Indicator

🔸Why the Forward Offset: By shifting the averages forward, the Alligator helps traders focus on established trends while filtering out short-term market noise.

The standard configurations of 13-8, 8-5, and 5-3 were selected based on Bill Williams’ studies of market behavior. However, these values can be adjusted to suit different market conditions:

- Volatile Markets: Faster settings (e.g., 10-6, 6-4, 3-2) may provide earlier signals.

- Less Volatile Markets: Slower settings (e.g., 21-13, 13-8, 8-5) can help avoid noise and reduce false signals.

🔸Best Timeframes to Use: The Alligator can be applied across all timeframes, but certain timeframes offer better reliability.

- Higher Timeframes (H4, D1, W1): Ideal for identifying significant trends and for swing or position trading.

- Lower Timeframes: Not recommended due to increased noise but may work for scalping with additional confirmation tools.

🔸Disadvantages of the Alligator Strategy:

- Exhausted Entry Levels: High buying levels or low selling levels can lead to momentum exhaustion and potential pullbacks.

- False Signals in Ranges: Consolidating markets can produce unreliable signals.

- Lagging Indicator: As it is based on moving averages, it may delay reacting to sudden price changes.

🔸Advantages of the Alligator Strategy:

- Trend Focused: Simplifies the identification of trending markets.

- Noise Reduction: Forward shifts and smoothed averages help filter out short-term price fluctuations.

- Broad Applicability: Suitable for forex, crypto, stocks, and commodities.

🔸Important Considerations:

While the Alligator Strategy provides a systematic way to analyze markets, it does not guarantee successful outcomes. Results in trading depend on multiple factors, including market conditions, trader discipline, and risk management. Past performance of the strategy does not ensure future success, and traders should always approach the market with caution.

Risk Management: Define stop-loss levels, position size, and profit targets before entering any trade. Be prepared for the possibility of losses and ensure that your approach aligns with your overall trading plan.

🔷 STRATEGY PROPERTIES

- Symbol: BINANCE:BTCUSDT (Spot).

- Timeframe: 1D (Daily Timeframe).

- Test Period: All historical data available.

- Initial Capital: 10000 USDT.

- Order Size per Trade: 1% of Capital, you can use a higher value e.g. 5%, be cautious that the Max Drawdown does not exceed 10%, as it would indicate a very risky trading approach.

- Commission: Binance commission 0.1%, adjust according to the exchange being used, lower numbers will generate unrealistic results. By using low values e.g. 5%, it allows us to adapt over time and check the functioning of the strategy.

- Slippage: 5 ticks, for pairs with low liquidity or very large orders, this number should be increased as the order may not be filled at the desired level.

- Margin for Long and Short Positions: 100%.

- Indicator Settings: Default Configuration.

- Alligator: Source hl2 | Calculation RMA | Jaw 21-13, Teeth 13-8, Lips 8-5.

- Strategy: Long & Short.

- Max Stop Loss per Trade: 10% of Trade Size.

- Exit trades on opposite signal: Enable.

- Alligator Stop Loss: Enable.

- Alligator Fast Exit: Enable.

- Alligator: Source hl2 | Calculation RMA | Jaw 21-13, Teeth 13-8, Lips 8-5.

🔷 STRATEGY RESULTS

- ⚠️Remember, past results do not guarantee future performance.

- Net Profit: +355.68 USDT (+3.56%).

- Total Closed Trades: 103.

- Percent Profitable: 47.57%.

- Profit Factor: 1.927.

- Max Drawdown: -57.99 USDT (-0.56%).

- Average Trade: +3.45 USDT (+3.41%).

- Average # Bars in Trades: 16.

🔷 HOW TO USE

🔸Adjust the Alligator Settings:

The default values generally work well: Source hl2 | Calculation RMA | Jaw 21-13, Teeth 13-8, Lips 8-5. However, if you want to use it on timeframes smaller than 4H (4 hours), consider increasing the values to better filter market noise.

Please review the "Indicator Settings" section for configuration.

🔸Choose a Symbol that Typically Trends:

Select an asset that tends to create trends. However, the Strategy Tester results may display poor performance, making it less suitable for sending signals to bots.

🔸Add Trend Filters:

You can enable trend filters like MA and SuperTrend. By default, these are disabled as they are often unnecessary, but you can experiment with their configuration to see if they optimize the strategy's results.

Please review the "Indicator Settings" section for configuration.

🔸Enable Stop Loss Levels:

Activate Stop Loss features, such as Stop Loss % or Alligator Stop Loss. If both are enabled, the one closest to the price during the trade will be applied.

Please review the "Indicator Settings" section for configuration.

🔸Enable Take Profit Levels:

Activate Take Profit options, such as Take Profit % or Alligator Fast Exit. If both are enabled, the one that triggers first will be executed.

Please review the "Indicator Settings" section for configuration.

This is an example with the default settings and how Alligator Stop Loss and Alligator Fast Exit are activated:

In this example, we additionally enable the Take Profit at 10%. We can observe that the Alligator Stop Loss is the active one since it is closer to the price. When the price moves 10% in favor or against the trade, the position is closed. Although the Alligator Fast Exit is enabled, it does not activate because the trades are closed beforehand.

🔸Results Review:

It is important to check the Max Drawdown. This value should ideally not exceed 10% of your capital. Consider adjusting the trade size to ensure this threshold is not surpassed.

Remember to include the correct values for commission and slippage according to the symbol and exchange where you are conducting the tests. Otherwise, the results will not be realistic.

If you are satisfied with the results, you may consider automating your trades. However, it is strongly recommended to use a small amount of capital or a demo account to test proper execution before committing real funds.

🔸Create alerts to trigger the DCA Bot

- Verify Messages: Ensure the message matches the one specified by the DCA Bot.

- Multi-Pair Configuration: For multi-pair setups, enable the option to add the symbol in the correct format.

- Signal Settings: Enable whether you want to receive long or short signals (Entry | TP | SL), copy and paste the the messages for the DCA Bots configured in 3Commas.

- Alert Setup:

When creating an alert, set the condition to the indicator and choose "alert() function call only.

Enter any desired Alert Name.

Open the Notifications tab, enable Webhook URL, and paste the Webhook URL from 3Commas.

For more details, refer to the 3Commas section: "How to use TradingView Custom Signals. - Finalize Alerts: Click Create, you're done! Alerts will now be sent automatically in the correct format to 3Commas.

🔷 INDICATOR SETTINGS

🔸Alligator Settings

- MA's source: Source price for Alligator moving averages.

- MA's Type: Type of calculation for MA's.

- Jaw and Offset: Jaw length and offset to the right.

- Teeth and Offset: Teethlength and offset to the right.

- Lips and Offset: Lips length and offset to the right.

🔸Alligator Style

- Plot Alligator: Show Alligator Ribbon.

- Plot MA's: Show Alligator MA's.

- Colors: Main and Gradient Colors for Bullish Alligator, Berish Alligator, Neutral Alligator. For gradient colors it is recommended to use an opacity of 15.

🔸MA & SuperTrend Filters

- MA & Plot: Activate MA Filter and Plot MA on the chart.

Long Entries: When activated, it will only execute entries if the price is above the MA

Short Entries: When activated, it will only execute entries if the price is below the MA. - Source: Source price for moving average calculations.

- Length: Candles to be used by the MA calculations.

- Type: Type of calculation for MA.

- Timeframe: Here you can select a larger timeframe for the filter.

- ST & Plot: Activate SuperTrend Filter and Plot SuperTrend on the chart.

Long Entries: When activated, it will only execute entries if the price is above the SuperTrend.

Short Entries: When activated, it will only execute entries if the price is below the SuperTrend. - Source: Source price for SuperTrend calculations.

- Length: Candles to be used by the SuperTrend calculations.

- Factor: ATR multiplier of the SuperTrend.

- Timeframe: Here you can select a larger timeframe for the filter.

🔸Strategy Tester

- Strategy: Order Type direction in which trades are executed.

- Take Profit %: When activated, the entered value will be used as the Take Profit in percentage from the entry price level.

- Stop Loss %: When activated, the entered value will be used as the Stop Loss in percentage from the entry price level. If Alligator Stop Loss is activated, the closest one to the price will be used.

- Exit trades on opposite signal: This option closes the trade if the opposite condition is met. For instance, if we are in a long position and a sell signal is triggered, the long position will be closed, and a short position will be opened. The same applies inversely.

- Alligator Stop Loss: In a long trade, the lower part of the Alligator indicator will be used as a dynamic stop loss. Similarly, in a short trade, the upper part of the indicator will be used.

- Alligator Fast Exit: Its purpose is to attempt to protect movements in favor of the trade's direction. In the case of long trades, once the price and the upper part of the Alligator indicator are above the trade's entry price, the stop loss will be moved to the upper part. For short trades, once the price and the lower part of the Alligator indicator are below the trade's entry price, the stop loss will be moved to the lower part of the Alligator indicator.

- Alligator Squeeze Entry: When activated, entries will only be executed if they meet the condition after a neutral zone of the Alligator indicator.

- Alligator Squeeze Exit: When this option is activated, any open trades will be closed when the Alligator indicator enters a neutral mode.

- Use Custom Test Period: When enabled signals only works in the selected time window. If disabled it will use all historical data available on the chart.

- Test Start and End: Once the Custom Test Period is enabled, here you select the start and end date that you want to analyze.

🔸3Commas DCA Bot Signals

- Check Messages: Enable the table to review the messages to be sent to the bot.

- Entry | TP | SL: Enable this options to send Buy Entry, Take Profit (TP), and Stop Loss (SL) signals to 3Commas.

- Deal Entry and Deal Exit : Copy and paste the message for the deal start signal and close order at Market Price of the DCA Bot you created in 3Commas. This is the message that will be sent with the alert to the Bot, you must verify that it is the same as the 3Commas bot so that it can process properly so that it executes and starts the trade.

- DCA Bot Multi-Pair: You must activate it if you want to use the signals in a DCA Bot Multi-pair in the text box you must enter (using the 3Commas format) the symbol in which you are creating the alert, you can check the format of each symbol when you create the bot.

🔷 CONCLUSION

The Alligator Strategy is a valuable tool for identifying potential trends and improving decision-making. However, no trading strategy is foolproof. Careful consideration of market conditions, proper risk management, and personal trading goals are essential. Use the Alligator as part of a broader trading system, and remember that consistent learning and discipline are key to success in trading.

👨🏻💻💭 We hope this tool helps enhance your trading. Your feedback is invaluable, so feel free to share any suggestions for improvements or new features you'd like to see implemented.

____________________________________________________________________

The information and publications within the 3Commas TradingView account are not meant to be and do not constitute financial, investment, trading, or other types of advice or recommendations supplied or endorsed by 3Commas and any of the parties acting on behalf of 3Commas, including its employees, contractors, ambassadors, etc.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

🤖 It's time to trade smarter with 3Commas!!

📣 Sign up to get up to 25% off

👉 bit.ly/TradingView3Commas

📣 Sign up to get up to 25% off

👉 bit.ly/TradingView3Commas

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

🤖 It's time to trade smarter with 3Commas!!

📣 Sign up to get up to 25% off

👉 bit.ly/TradingView3Commas

📣 Sign up to get up to 25% off

👉 bit.ly/TradingView3Commas

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.