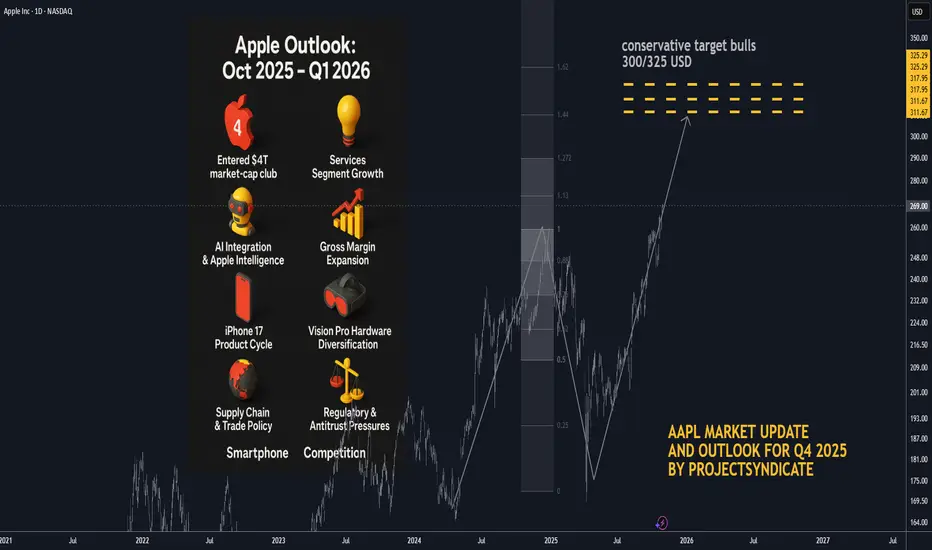

🍏 Apple Outlook: Oct 2025 – Q1 2026

🧠 Status and Tape Read. Apple (AAPL) has entered the $4 T market-cap club on Oct 28–29 2025, propelled by strong iPhone 17 sell-through and Services momentum. Shares pushed toward the $270 area intraday before easing, marking a powerful reversal from mid-year consolidation. Near-term, positioning is elevated into Thursday’s print; options imply ~±4% move on earnings.

📈 Path into Q1’26. Our base case shifts from a prolonged correction to a higher-low / buy-the-dip regime: dips toward the mid-$240s–$250s should attract sponsorship unless Services rolls over or China iPhone demand fades. A constructive tape through Q1’26 hinges on (1) Apple Intelligence engagement metrics, (2) iPhone 17 replacement/Android switcher rates, and (3) regulatory overhang.

📰 What’s New and recent headlines

🏆 Apple hits $4 T market value for the first time, joining Nvidia and Microsoft. Drivers: iPhone 17 traction and Services strength; stock up sharply since spring.

🗓️ Earnings set for Thu, Oct 30 (after-close); Street looking for growth in revenue/EPS; Services eyed >$100 B annual run-rate.

🔼 Loop Capital upgraded AAPL to Buy with $315 PT ahead of the move, citing iPhone cycle acceleration.

🧾 “Who Bought 8 Million Shares?”

🧺 JPMorgan Large Cap Growth Fund (SEEGX) increased its Apple position by ~8.15 million shares to ~32.9 million shares, per latest fund tracking.

⚙️ Catalysts Shaping Apple’s Stock Price in 2025–26

🤖 AI Integration & Apple Intelligence — Strength: 9/10

Rollout of on-device Apple Intelligence and upgraded Siri remains the core narrative into 2026. Look for user engagement datapoints and third-party app integrations at/after earnings. A positive read-through would validate the iPhone super-cycle argument.

💡 Services Segment Growth — Strength: 8.5/10

Consensus expects Services to push past a $100 B annual clip; durability watched versus regulatory pressure (DMA in EU, global app store scrutiny). A sustained >13% YoY growth print keeps multiple support intact.

📊 Gross Margin Expansion & Cost Efficiencies — Strength: 8/10

Management has guided 46–47% GM for FQ4 (tariff headwind embedded). Mix shift to Services + component deflation support FY26 margin resilience.

📱 iPhone 17 Product Cycle — Strength: 8/10 (↑ from 7.5)

Early sell-through outpacing prior gen in the U.S. and China within first days; the iPhone 17 (incl. “Air”) is the incremental driver restoring unit momentum.

🥽 Vision Pro & Hardware Diversification — Strength: 7/10

Next-gen devices + Apple Intelligence tie-ins create optionality; still niche near-term but adds ecosystem gravity.

💵 Capital Returns — Strength: 7/10

$110 B buyback authorization remains a floor; watch cadence vs. stock at ATHs and post-print cash deployment commentary.

🌏 Supply Chain & Trade Policy — Strength: 6.5/10

China exposure/tariffs remain a swing factor; Apple has been absorbing some costs rather than pushing through prices on key models.

⚖️ Regulatory & Antitrust Pressures — Strength: 6/10

DMA compliance and global app store cases could trim Services take-rate; monitor any remedial changes called out on the call.

📈 Macro & Rates — Strength: 5/10

“Higher for longer” limits multiple expansion; any disinflation/soft-landing upside would expand P/E support.

🥊 Smartphone Competition — Strength: 5/10

Android OEM velocity still high in EM; Apple’s cycle needs sustained switcher share to outrun.

💼 Earnings Set-Up: FQ4 reporting Thu Oct 30 2025

📅 Consensus into print:

• Revenue: ~$101–104 B (TipRanks ref: $102.2 B)

• EPS: ~$1.74–$1.82 (TipRanks ref: $1.78)

• Gross Margin guide: 46–47% (company indication)

• Services: watch for >$100 B annualized pace confirmation

• Implied move: options pricing ~±4%

🎧 Watch items on the call: Apple Intelligence activation/MAUs, iPhone 17 channel inventory, China mix, Services take-rate headwinds (EU), GM puts/takes (tariffs), cap-return cadence.

🎯 Street Positioning & Targets

🔼 Loop Capital: Buy, PT $315 (Oct 20/21 2025).

📊 General take: Many houses remain Overweight; focus turning to 2026 EPS power and AI monetization path.

🧭 Tactical View 0–3 Months

📈 Into/after print: Choppy but constructive. Chasing at ATHs is risky; prefer buy-on-weakness zones near $248–255 with stop discipline. A bullish guide/Services beat could sustain a breakout; a light AI engagement update or China wobble likely gets faded back into the mid-$250s.

⚠️ Risk-case: Regulatory headline or guide below mid-single-digit growth could quickly compress P/E and retest the $240s.

🚀 Bull-case: Clean beat/raise + AI usage KPIs → re-rate toward $290–300 into holiday.

🏁 Quick Milestone Recap

🥇 $4 Trillion Market Cap achieved on Oct 28–29 2025, making Apple the third public company (after Nvidia, Microsoft) to reach the level; iPhone 17 momentum and Services strength cited across coverage.

🧠 Status and Tape Read. Apple (AAPL) has entered the $4 T market-cap club on Oct 28–29 2025, propelled by strong iPhone 17 sell-through and Services momentum. Shares pushed toward the $270 area intraday before easing, marking a powerful reversal from mid-year consolidation. Near-term, positioning is elevated into Thursday’s print; options imply ~±4% move on earnings.

📈 Path into Q1’26. Our base case shifts from a prolonged correction to a higher-low / buy-the-dip regime: dips toward the mid-$240s–$250s should attract sponsorship unless Services rolls over or China iPhone demand fades. A constructive tape through Q1’26 hinges on (1) Apple Intelligence engagement metrics, (2) iPhone 17 replacement/Android switcher rates, and (3) regulatory overhang.

📰 What’s New and recent headlines

🏆 Apple hits $4 T market value for the first time, joining Nvidia and Microsoft. Drivers: iPhone 17 traction and Services strength; stock up sharply since spring.

🗓️ Earnings set for Thu, Oct 30 (after-close); Street looking for growth in revenue/EPS; Services eyed >$100 B annual run-rate.

🔼 Loop Capital upgraded AAPL to Buy with $315 PT ahead of the move, citing iPhone cycle acceleration.

🧾 “Who Bought 8 Million Shares?”

🧺 JPMorgan Large Cap Growth Fund (SEEGX) increased its Apple position by ~8.15 million shares to ~32.9 million shares, per latest fund tracking.

⚙️ Catalysts Shaping Apple’s Stock Price in 2025–26

🤖 AI Integration & Apple Intelligence — Strength: 9/10

Rollout of on-device Apple Intelligence and upgraded Siri remains the core narrative into 2026. Look for user engagement datapoints and third-party app integrations at/after earnings. A positive read-through would validate the iPhone super-cycle argument.

💡 Services Segment Growth — Strength: 8.5/10

Consensus expects Services to push past a $100 B annual clip; durability watched versus regulatory pressure (DMA in EU, global app store scrutiny). A sustained >13% YoY growth print keeps multiple support intact.

📊 Gross Margin Expansion & Cost Efficiencies — Strength: 8/10

Management has guided 46–47% GM for FQ4 (tariff headwind embedded). Mix shift to Services + component deflation support FY26 margin resilience.

📱 iPhone 17 Product Cycle — Strength: 8/10 (↑ from 7.5)

Early sell-through outpacing prior gen in the U.S. and China within first days; the iPhone 17 (incl. “Air”) is the incremental driver restoring unit momentum.

🥽 Vision Pro & Hardware Diversification — Strength: 7/10

Next-gen devices + Apple Intelligence tie-ins create optionality; still niche near-term but adds ecosystem gravity.

💵 Capital Returns — Strength: 7/10

$110 B buyback authorization remains a floor; watch cadence vs. stock at ATHs and post-print cash deployment commentary.

🌏 Supply Chain & Trade Policy — Strength: 6.5/10

China exposure/tariffs remain a swing factor; Apple has been absorbing some costs rather than pushing through prices on key models.

⚖️ Regulatory & Antitrust Pressures — Strength: 6/10

DMA compliance and global app store cases could trim Services take-rate; monitor any remedial changes called out on the call.

📈 Macro & Rates — Strength: 5/10

“Higher for longer” limits multiple expansion; any disinflation/soft-landing upside would expand P/E support.

🥊 Smartphone Competition — Strength: 5/10

Android OEM velocity still high in EM; Apple’s cycle needs sustained switcher share to outrun.

💼 Earnings Set-Up: FQ4 reporting Thu Oct 30 2025

📅 Consensus into print:

• Revenue: ~$101–104 B (TipRanks ref: $102.2 B)

• EPS: ~$1.74–$1.82 (TipRanks ref: $1.78)

• Gross Margin guide: 46–47% (company indication)

• Services: watch for >$100 B annualized pace confirmation

• Implied move: options pricing ~±4%

🎧 Watch items on the call: Apple Intelligence activation/MAUs, iPhone 17 channel inventory, China mix, Services take-rate headwinds (EU), GM puts/takes (tariffs), cap-return cadence.

🎯 Street Positioning & Targets

🔼 Loop Capital: Buy, PT $315 (Oct 20/21 2025).

📊 General take: Many houses remain Overweight; focus turning to 2026 EPS power and AI monetization path.

🧭 Tactical View 0–3 Months

📈 Into/after print: Choppy but constructive. Chasing at ATHs is risky; prefer buy-on-weakness zones near $248–255 with stop discipline. A bullish guide/Services beat could sustain a breakout; a light AI engagement update or China wobble likely gets faded back into the mid-$250s.

⚠️ Risk-case: Regulatory headline or guide below mid-single-digit growth could quickly compress P/E and retest the $240s.

🚀 Bull-case: Clean beat/raise + AI usage KPIs → re-rate toward $290–300 into holiday.

🏁 Quick Milestone Recap

🥇 $4 Trillion Market Cap achieved on Oct 28–29 2025, making Apple the third public company (after Nvidia, Microsoft) to reach the level; iPhone 17 momentum and Services strength cited across coverage.

ملاحظة

🚀 Apple Outlook (Oct 2025 – Q1 2026)🍏 Hit $4 T market cap, third company ever to reach the milestone.

🤖 Apple Intelligence & AI rollout driving next growth wave.

📱 iPhone 17 cycle strong, fueling demand recovery.

💡 Services segment on track for >$100 B annual run-rate.

📊 Gross margins guided at 46–47%, resilient vs. tariffs.

🥽 Expanding Vision Pro & AR/VR hardware ecosystem.

💵 $110 B buyback and dividends underpin valuation floor.

🌏 Supply-chain shift to India & Vietnam continues.

⚖️ Regulatory pressures in EU/US remain medium-term risk.

🧭 Base case: Buy-on-dips near $250 → target $290-300 if AI metrics beat.

ملاحظة

let me know your thoughts on the above in the comments section 🔥🏧🚀ملاحظة

🎁Please hit the like button and🎁Leave a comment to support our team!

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.