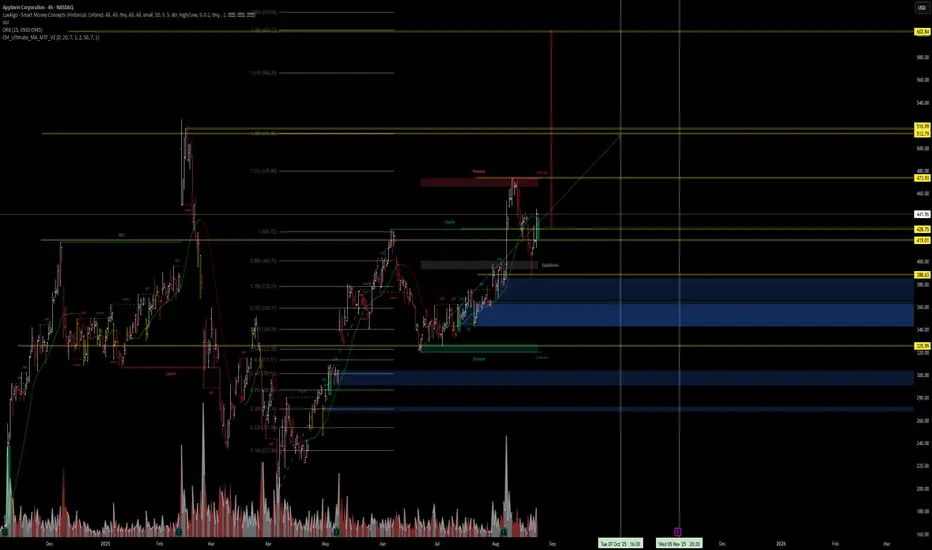

APP (AppLovin) — AI & Smart Money Bust Open Path to $500–$517

Body Text:

AppLovin appears primed for another leg higher—AI models, technical structure, and institutional flow all aligning bullish:

⮕ AI Forecast targets $497.93 (30-day) — logical first major resistance zone. Thru there, $512–$517 opens up as next supply/pumping zone.

⮕ Call sweeps at $462–$470 (Aug 29) show serious bullish wagers in motion.

⮕ Chart Structure: Reclaiming $428–$430 pivot (former supply now support). Cleanup through $473–$480 resistance could clear the way to $500+.

⮕ Fundamentals & Sentiment: Stellar Q2 beat and guidance raise; IBD comp rating now elite at 98; continued analyst upgrades and S&P inclusion talk add fuel.

Probabilistic Targets:

Base Case (~40%): Target zone $490–$500 — aligns with AI and near-term supply breakout.

Extended (~20%): Run to $512–$517 if momentum sustains and broader market holds.

Failure (~40%): Rejection below $428 pivot could re-test $400–$405 demand.

Trade Setup

Entry: $442

Stop-Loss: Ideally $430–$435 (under pivot)

Convert into scale-out or trailing above $497–$500

This is AI + Flow + Structure convergence — textbook and high-probability asymmetric setup.

#APP #TradingView #AITrading #OptionsFlow #BreakoutSetup #AppLovin #TechnicalAnalysis

Body Text:

AppLovin appears primed for another leg higher—AI models, technical structure, and institutional flow all aligning bullish:

⮕ AI Forecast targets $497.93 (30-day) — logical first major resistance zone. Thru there, $512–$517 opens up as next supply/pumping zone.

⮕ Call sweeps at $462–$470 (Aug 29) show serious bullish wagers in motion.

⮕ Chart Structure: Reclaiming $428–$430 pivot (former supply now support). Cleanup through $473–$480 resistance could clear the way to $500+.

⮕ Fundamentals & Sentiment: Stellar Q2 beat and guidance raise; IBD comp rating now elite at 98; continued analyst upgrades and S&P inclusion talk add fuel.

Probabilistic Targets:

Base Case (~40%): Target zone $490–$500 — aligns with AI and near-term supply breakout.

Extended (~20%): Run to $512–$517 if momentum sustains and broader market holds.

Failure (~40%): Rejection below $428 pivot could re-test $400–$405 demand.

Trade Setup

Entry: $442

Stop-Loss: Ideally $430–$435 (under pivot)

Convert into scale-out or trailing above $497–$500

This is AI + Flow + Structure convergence — textbook and high-probability asymmetric setup.

#APP #TradingView #AITrading #OptionsFlow #BreakoutSetup #AppLovin #TechnicalAnalysis

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.