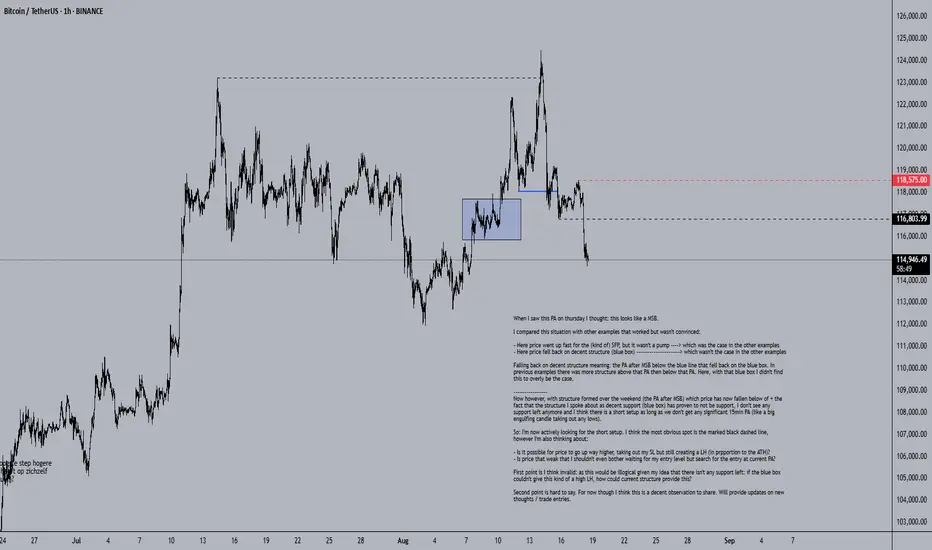

When I saw this PA on thursday I thought: this looks like a MSB.

I compared this situation with other examples that worked but wasn't convinced:

- Here price went up fast for the (kind of) SFP, but it wasn't a pump ----> which was the case in the other examples

- Here price fell back on decent structure (blue box) -----------------------> which wasn't the case in the other examples

Falling back on decent structure meaning: the PA after MSB below the blue line that fell back on the blue box. In previous examples there was more structure above that PA then below that PA. Here, with that blue box I didn't find this to overly be the case.

------------------

Now however, with structure formed over the weekend (the PA after MSB) which price has now fallen below of + the fact that the structure I spoke about as decent support (blue box) has proven to not be support, I don't see any support left anymore and I think there is a short setup as long as we don't get any significant 15min PA (like a big engulfing candle taking out any lows).

So: I'm now actively looking for the short setup. I think the most obvious spot is the marked black dashed line, however I'm also thinking about:

- Is it possible for price to go up way higher, taking out my SL but still creating a LH (in prpportion to the ATH)?

- Is price that weak that I shouldn't even bother waiting for my entry level but search for the entry at current PA?

First point is I think invalid: as this would be illogical given my idea that there isn't any support left: if the blue box couldn't give this kind of a high LH, how could current structure provide this?

Second point is hard to say. For now though I think this is a decent observation to share. Will provide updates on new thoughts / trade entries.

I compared this situation with other examples that worked but wasn't convinced:

- Here price went up fast for the (kind of) SFP, but it wasn't a pump ----> which was the case in the other examples

- Here price fell back on decent structure (blue box) -----------------------> which wasn't the case in the other examples

Falling back on decent structure meaning: the PA after MSB below the blue line that fell back on the blue box. In previous examples there was more structure above that PA then below that PA. Here, with that blue box I didn't find this to overly be the case.

------------------

Now however, with structure formed over the weekend (the PA after MSB) which price has now fallen below of + the fact that the structure I spoke about as decent support (blue box) has proven to not be support, I don't see any support left anymore and I think there is a short setup as long as we don't get any significant 15min PA (like a big engulfing candle taking out any lows).

So: I'm now actively looking for the short setup. I think the most obvious spot is the marked black dashed line, however I'm also thinking about:

- Is it possible for price to go up way higher, taking out my SL but still creating a LH (in prpportion to the ATH)?

- Is price that weak that I shouldn't even bother waiting for my entry level but search for the entry at current PA?

First point is I think invalid: as this would be illogical given my idea that there isn't any support left: if the blue box couldn't give this kind of a high LH, how could current structure provide this?

Second point is hard to say. For now though I think this is a decent observation to share. Will provide updates on new thoughts / trade entries.

تم فتح الصفقة

Hmmm, we've got the SFP in this current structure ------> thic could cap price --------> I entered here in current structure.I don't know if price can still go up from here to my entry, but I do know that I think this is a valid short setup so I shouldn't wait for the entry and just suck up the worse R:R.

ملاحظة

Rookie mistake with this entry:In this case there was only a valid SFP if price would drop below this structure ending the structure. You would then have a new structure with an SFP on top as a fine invalidation for when price pushes above it.

I shorted within the structure, anticipating on the drop but we didn't get the drop and the SFP proved to be invalid: it was just another high within the structure.

God my perfectionism goes mayhem with this mistake, but hey: lets first see if price will actually even hit my entry and even more important: will this actually be a valid setup? Got 1R on it...

تم إغلاق الصفقة يدويًا

Closed here for -0.15R. I think it lacks momentum to break down further as price didn't manage to close below the low of yesterday on the 15min TF. It tried twice, then went back up to the high but wasn't an SFP ----> I think the chances of price pushing up further are high now.ملاحظة

It could SFP yesterday's high because there's still lots of structure above the high. If we then get a new LL this SFP is the perfect SL and I will re-enter the trade.ملاحظة

The 15min TF is smoking me, I love that 15min TF Zoomed In-pack.Anyways, new breakdown = new structure = even more convincing of a full breakdown.

I still can't stand messing up the entry yesterday. A bad entry immediately messes up trade management: would I have had the right entry, this would be up with yesterday's high --------> then waiting for the SFP of this high would be much more +ev than closing in advance because if price would indeed go back to this high and it wouldn't be an SFP, then the -R loss would have been minimal. Instead, with current entry, no SFP and having to close would be a big -R loss. So that's why I rather choose to close in advance and wait for more 'convinction' in current environment (eg new breakdown) to then re-enter then to wait to see what happens IF price gets to the high. And a big if as you can now see that price never got back to this high.

I now re-entered with an even tighter SL (high of US Open) as I do think price can't go up to this point anymore because all the structure of the new structure is below this point + the further price goes down here, the more likelyhood that there indeed isn't any support left and this can turn into a downtrend.

All good if I'm right as the new trade is higher in potential R gain (I likely wouldn't have re-entered with a new SL if I was still in the old trade).

Also, this whole environment is a great one to study which could lead to better conclusions about reading MS (1H TF zoomed out is king) and better rules for 15min TF.

ملاحظة

Closed for 0.05R. Don't know what to do when you get the 15min engulfing candle SFP at the lows + price pushing out of current structure vs the structure above (with my SL in it): can price push above this structure now, because of the engulfing candle or have I again messed up? Hopefully missing my original entry won't haunt me again because I'd definitely let it test the structure above to see what would happen, but now I won't because me being wrong would lead to a -1R. إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.