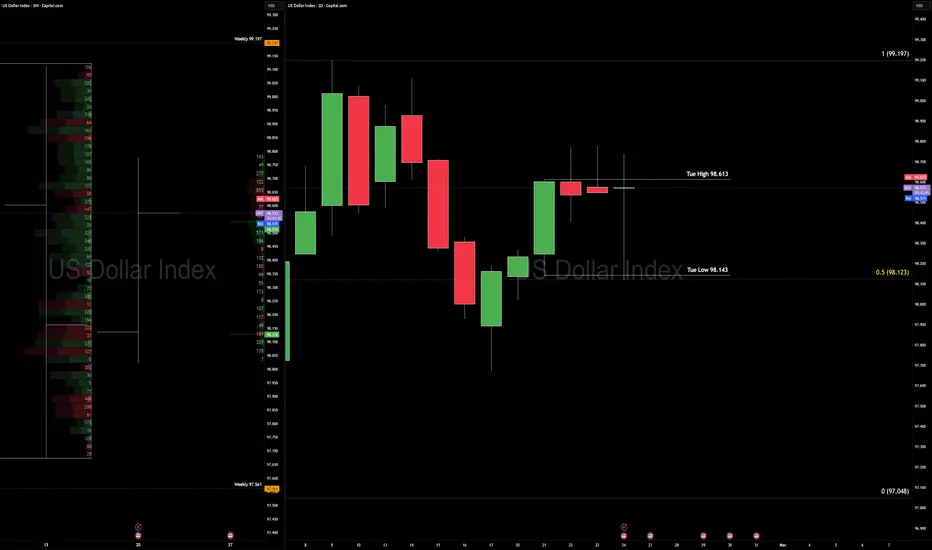

The U.S. Dollar Index is locking in tight — 3rd consecutive weekly inside bar, and a 4th possible daily inside bar — as U.S. inflation holds firm and Japan’s core inflation uptick adds fuel.

Context

We’re locked in structural compression: three weeks of internal price action, and today presents a 4th daily inside bar formation.

Weekly key range: low 97.561 and high 99.197. Price is stuck in the mid-zone, patiently waiting.

For bias confirmation: Break of Tuesday’s 21 Oct daily candle low at 98.143 or high at 98.613 will signal directional bias.

Macro queue: Big data hits next week (inflation prints, central-bank focus). Volatility is coiled.

Technical

Weekly frame: Still inside the bearish range (97.561 – 99.197).

Daily frame: Bias leans bullish until the range breaks — think “bullish inside bar pending expansion”.

In symmetrical measures: Risk of overbought cognition; if today’s low holds and Monday fails to trade through it, we may see a higher low setup. Execution: Wait for clean breakout of the inside bar structure; use volume confirmation; avoid getting sucked into a false squeeze.

Fundamentals

U.S. inflation: The Consumer Price Index for September is published today (24 Oct) after delay due to shutdown.

Bureau of Labor Statistics +2

The Financial Express +2

Japan inflation: September core inflation rose to 2.9% YoY, moving above the Bank of Japan target and adding pressure to the JPY‐rate story.

Trading Economics

+2

Bloomberg

+2

Impact mechanism: Sticky inflation → reduces odds of immediate rate cuts → supports USD strength; yet structural squeeze in DXY means the market is holding its breath for breakout.

Plan & Mindset

Plan: Hold off trading until Monday’s price action gives clarity through breakout of the inside-bar structure. Then map cross-assets (EURUSD, GBPUSD) accordingly.

Mindset

Structure rules story. Don’t fight a tight coil. Today you “wait with purpose.” If price breaks, act decisively; if it breaks wrong, adapt quickly.

- Like waiting for the popcorn — you don’t eat the kernels while still heating.

Daniel Fadeley — Trader & Coach | Founder of CORE5 Tradecraft™

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

Daniel Fadeley — Trader & Coach | Founder of CORE5 Tradecraft™

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

Data-driven strategies connecting market structure, volume flow, and real economic drivers.

Institutional Logic. Modern Technology. Real Freedom.

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.