DXY Outlook: Volatility Dominates as Fed Uncertainty Persists

DXY (US Dollar Index) Analysis Report

🔎 Technical Outlook

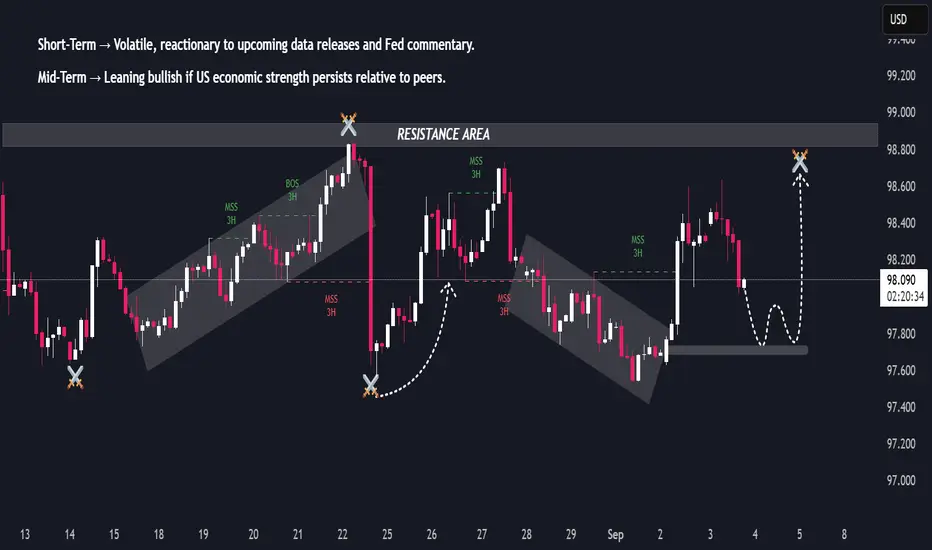

The index recently moved in a clear upward cycle, followed by a sharp rejection, highlighting the market’s sensitivity to macro shifts.

Price action has transitioned into volatile swings, with both bullish and bearish impulses shaping short-term structure.

Current momentum shows cyclical corrections within a broader attempt to sustain bullish rhythm, but intraday moves remain reactive to news flows.

Market behavior suggests traders are seeking liquidity both sides before choosing a decisive directional move.

🌍 Fundamental Outlook

Federal Reserve Policy: Speculation around rate adjustments remains the dominant driver. Softer inflation data has kept expectations for gradual easing alive, while labor market resilience adds uncertainty.

Global Risk Sentiment: Dollar demand fluctuates with equity market flows — stronger equities reduce safe-haven demand, while risk-off tones boost USD.

Geopolitical Factors: Ongoing tensions in trade and global supply chain disruptions support occasional flight-to-safety flows into the dollar.

Comparative Growth: While the US economy shows relative resilience versus peers, diverging central bank policies (ECB, BOJ, BOE) also influence dollar positioning.

Investor Behavior: Large funds are rebalancing exposure — maintaining a neutral to cautiously bullish stance on USD until clearer macro signals emerge.

DXY (US Dollar Index) Analysis Report

🔎 Technical Outlook

The index recently moved in a clear upward cycle, followed by a sharp rejection, highlighting the market’s sensitivity to macro shifts.

Price action has transitioned into volatile swings, with both bullish and bearish impulses shaping short-term structure.

Current momentum shows cyclical corrections within a broader attempt to sustain bullish rhythm, but intraday moves remain reactive to news flows.

Market behavior suggests traders are seeking liquidity both sides before choosing a decisive directional move.

🌍 Fundamental Outlook

Federal Reserve Policy: Speculation around rate adjustments remains the dominant driver. Softer inflation data has kept expectations for gradual easing alive, while labor market resilience adds uncertainty.

Global Risk Sentiment: Dollar demand fluctuates with equity market flows — stronger equities reduce safe-haven demand, while risk-off tones boost USD.

Geopolitical Factors: Ongoing tensions in trade and global supply chain disruptions support occasional flight-to-safety flows into the dollar.

Comparative Growth: While the US economy shows relative resilience versus peers, diverging central bank policies (ECB, BOJ, BOE) also influence dollar positioning.

Investor Behavior: Large funds are rebalancing exposure — maintaining a neutral to cautiously bullish stance on USD until clearer macro signals emerge.

👑 XAU_EMPIRE – XAU/USD Specialist

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑 XAU_EMPIRE – XAU/USD Specialist

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

📊 Professional Forex Trader | Gold Signals Provider

⚡ Smart Money | Technicals | Fundamentals

📈 Daily Accurate Trade Setups & Market Outlook

🔥 Join Exclusive VIP Premium Telegram Channel

t.me/XAUEMPIRE2

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.