📌 Sector: Capital Goods (Pumps)

📌 Market Cap: ₹14,804 Cr

📌 P/E Ratio: ~40.8×

📊 Fundamentals

The company has consistently reduced debt over the past 5 years, strengthening its balance sheet.

Profit Growth: From ₹312 Cr (Jun 2024) → ₹363 Cr (Jun 2025).

Shareholding Pattern: FIIs have trimmed their stake, while DIIs have increased holdings – a sign of domestic institutional confidence.

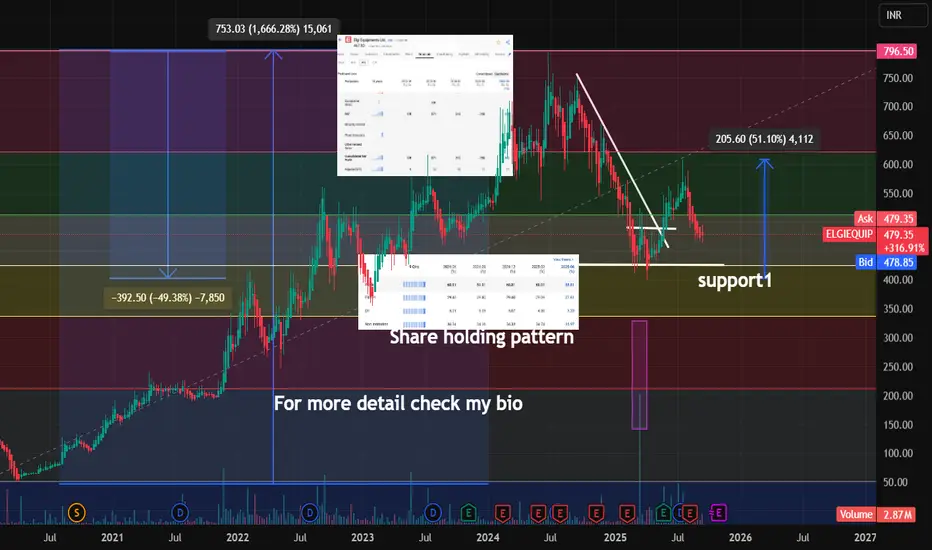

📈 Technical Outlook

All-Time High: ~₹797

Corrected nearly 50% down to ₹400 zone, followed by a 51% recovery towards ₹600.

Key Supports:

₹425 – immediate support zone

₹336 – strong support at 0.60 Fibonacci retracement

🎯 Conclusion

Elgi Equipments remains a fundamentally solid player with consistent profit growth and a healthier balance sheet. However, valuations are on the higher side (P/E ~40×), making entry levels crucial. Technically, the ₹425 and ₹336 zones are major support areas to watch for long-term accumulation.

⚡ Stock is in a recovery phase after a deep correction – patience and levels matter more than chasing momentum.

FOR more query dm me

📌 Market Cap: ₹14,804 Cr

📌 P/E Ratio: ~40.8×

📊 Fundamentals

The company has consistently reduced debt over the past 5 years, strengthening its balance sheet.

Profit Growth: From ₹312 Cr (Jun 2024) → ₹363 Cr (Jun 2025).

Shareholding Pattern: FIIs have trimmed their stake, while DIIs have increased holdings – a sign of domestic institutional confidence.

📈 Technical Outlook

All-Time High: ~₹797

Corrected nearly 50% down to ₹400 zone, followed by a 51% recovery towards ₹600.

Key Supports:

₹425 – immediate support zone

₹336 – strong support at 0.60 Fibonacci retracement

🎯 Conclusion

Elgi Equipments remains a fundamentally solid player with consistent profit growth and a healthier balance sheet. However, valuations are on the higher side (P/E ~40×), making entry levels crucial. Technically, the ₹425 and ₹336 zones are major support areas to watch for long-term accumulation.

⚡ Stock is in a recovery phase after a deep correction – patience and levels matter more than chasing momentum.

FOR more query dm me

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.