Setups (A++ first)

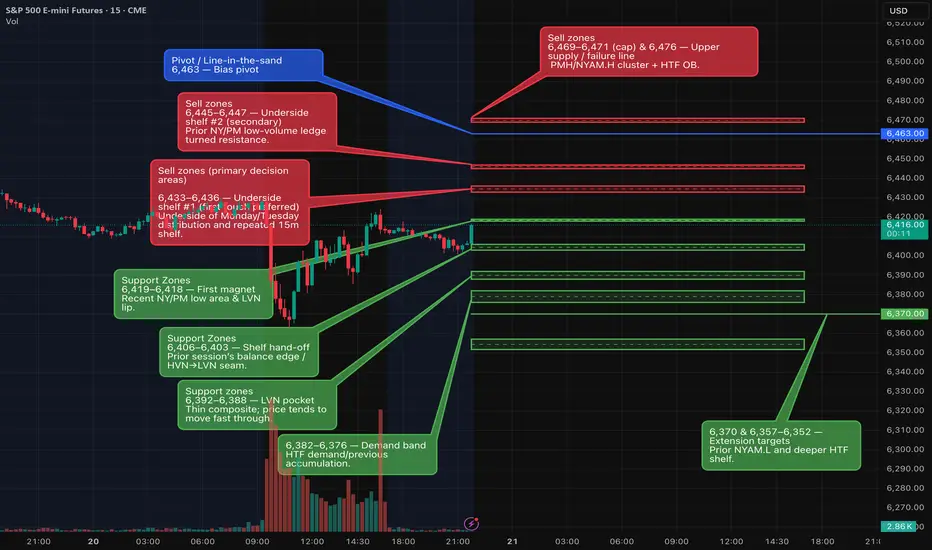

1) SHORT — Retest-and-fail of supply (preferred)

• Zones: 6,433–36 or 6,445–47 (upper band 6,469–71).

• Trigger: 5-minute bearish close back below the shelf (no retest required); size to full only if a 15-minute bearish prints within the next 3×5m bars.

• Risk: entry +6–8 pts.

• TPs: +15 / +27 / +42 pts from entry (e.g., 6,445 → 6,430 / 6,418 / 6,403).

• Continuation guard: within 2×5m price must extend the low or print a lower high while failing to reclaim the shelf; otherwise cut ½ or scratch to BE.

2) SHORT — Breakdown & acceptance

• Trigger: 5m close < 6,418 and no immediate reclaim next bar.

• Risk: entry +6–8 pts.

• TPs: toward 6,406 → 6,392 → 6,382–76.

3) LONG — Only if promoted

• Trigger: 5m close & hold ≥ 6,436 (offers pull/flip; next bar holds).

• Risk: 6–8 pts (around 6,430).

• TPs: 6,451 → 6,459–60 → 6,471–72.

• Stand-down: lose 6,436 on a 5m close or see offers reload overhead.

Execution windows: 9:45–10:45 ET and 13:50–15:30 ET; avoid new risk 11:30–13:30 without momentum/confirmation.

Key levels (from HTF → LTF)

• Pivot / line-in-sand: 6,463 (short bias while ≤ this).

• Supply / sell zones: 6,433–36, 6,445–47, 6,469–71 (cap), 6,476.

• Supports / magnets: 6,419–18, 6,406–03, 6,392–88, 6,382–76, 6,370, 6,357–52.

Fundamentals — Thu, Aug 21, 2025 (ET)

• 08:30 — Weekly Initial Jobless Claims (DOL). Weekly claims are published Thursdays at 8:30 a.m. ET.

• 08:30 — Philadelphia Fed Manufacturing Index (Aug). Next release Aug 21, 8:30 a.m. ET.

• 10:00 — Existing Home Sales (July, NAR). NAR schedules the Jul report for Thu, Aug 21 at 10:00 a.m. ET.

• 10:00 — Conference Board LEI (July). Thu, Aug 21, 10:00 a.m. ET.

• 10:30 — EIA Weekly Natural Gas Storage. Standard release Thursdays 10:30 a.m. ET; next release Aug 21.

• S&P Global Flash US PMI (Aug). Scheduled for Thursday (check S&P calendar; release times shown in UTC on their site).

• Jackson Hole Economic Policy Symposium begins (Aug 21–23). 2025 theme: “Labor Markets in Transition.”

How I’ll adapt intraday

• A stronger-than-expected Claims/PMI/Philly Fed that lifts yields and the USD into 6,433–36 / 6,445–47 favors setup #1 (fade the pop).

• EHS/LEI at 10:00 can whipsaw a breakdown—prefer acceptance before pressing setup #2.

• If Jackson Hole headlines skew risk-on and we accept ≥ 6,436, switch to setup #3 toward 6,451/60/71–72.

1) SHORT — Retest-and-fail of supply (preferred)

• Zones: 6,433–36 or 6,445–47 (upper band 6,469–71).

• Trigger: 5-minute bearish close back below the shelf (no retest required); size to full only if a 15-minute bearish prints within the next 3×5m bars.

• Risk: entry +6–8 pts.

• TPs: +15 / +27 / +42 pts from entry (e.g., 6,445 → 6,430 / 6,418 / 6,403).

• Continuation guard: within 2×5m price must extend the low or print a lower high while failing to reclaim the shelf; otherwise cut ½ or scratch to BE.

2) SHORT — Breakdown & acceptance

• Trigger: 5m close < 6,418 and no immediate reclaim next bar.

• Risk: entry +6–8 pts.

• TPs: toward 6,406 → 6,392 → 6,382–76.

3) LONG — Only if promoted

• Trigger: 5m close & hold ≥ 6,436 (offers pull/flip; next bar holds).

• Risk: 6–8 pts (around 6,430).

• TPs: 6,451 → 6,459–60 → 6,471–72.

• Stand-down: lose 6,436 on a 5m close or see offers reload overhead.

Execution windows: 9:45–10:45 ET and 13:50–15:30 ET; avoid new risk 11:30–13:30 without momentum/confirmation.

Key levels (from HTF → LTF)

• Pivot / line-in-sand: 6,463 (short bias while ≤ this).

• Supply / sell zones: 6,433–36, 6,445–47, 6,469–71 (cap), 6,476.

• Supports / magnets: 6,419–18, 6,406–03, 6,392–88, 6,382–76, 6,370, 6,357–52.

Fundamentals — Thu, Aug 21, 2025 (ET)

• 08:30 — Weekly Initial Jobless Claims (DOL). Weekly claims are published Thursdays at 8:30 a.m. ET.

• 08:30 — Philadelphia Fed Manufacturing Index (Aug). Next release Aug 21, 8:30 a.m. ET.

• 10:00 — Existing Home Sales (July, NAR). NAR schedules the Jul report for Thu, Aug 21 at 10:00 a.m. ET.

• 10:00 — Conference Board LEI (July). Thu, Aug 21, 10:00 a.m. ET.

• 10:30 — EIA Weekly Natural Gas Storage. Standard release Thursdays 10:30 a.m. ET; next release Aug 21.

• S&P Global Flash US PMI (Aug). Scheduled for Thursday (check S&P calendar; release times shown in UTC on their site).

• Jackson Hole Economic Policy Symposium begins (Aug 21–23). 2025 theme: “Labor Markets in Transition.”

How I’ll adapt intraday

• A stronger-than-expected Claims/PMI/Philly Fed that lifts yields and the USD into 6,433–36 / 6,445–47 favors setup #1 (fade the pop).

• EHS/LEI at 10:00 can whipsaw a breakdown—prefer acceptance before pressing setup #2.

• If Jackson Hole headlines skew risk-on and we accept ≥ 6,436, switch to setup #3 toward 6,451/60/71–72.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

If you want to contact me here is my Discord channel discord.gg/wPHfYgv892

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.