Understanding market structure is key to trading well.

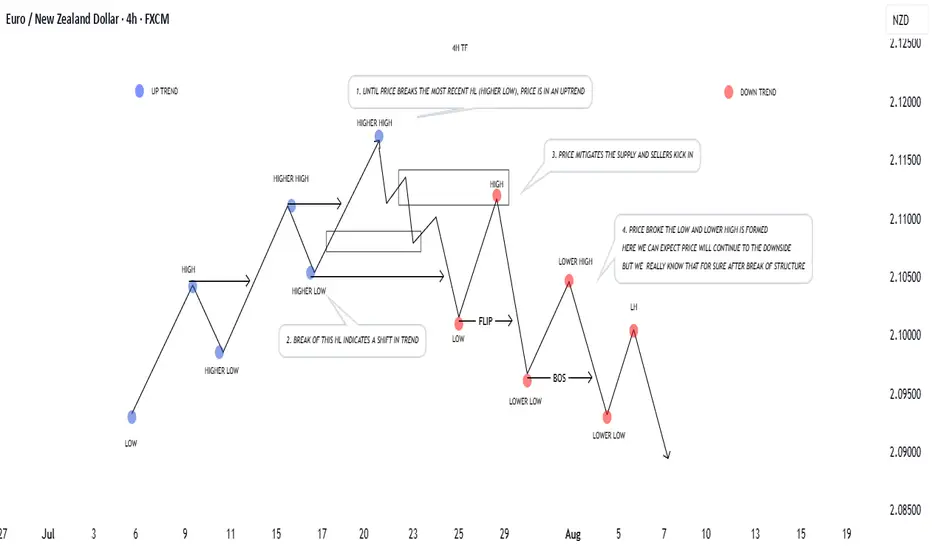

📈 In an uptrend, price forms a sequence of Higher Highs (HH) and Higher Lows (HL). As long as the most recent HL is respected, buyers remain in control. Pullbacks into demand often provide continuation opportunities.

📉 Once the most recent HL is broken, structure shifts — buyers lose control, and the market can flip into a downtrend with Lower Highs (LH) and Lower Lows (LL). Pullbacks into supply confirm bearish momentum.

🔑 Remember:

Market structure is fractal — always check higher timeframes for better understanding of price action.

A break of any important structure ( lows, highs ) tells us that either price is continuing or reversing.

Supply and demand zones are where reversals usually begin. And that is due to volatility and orders, volume coming into the market.

Don’t fight momentum — align with structure, and let the market confirm direction before you do anything.

Keep this framework in mind, and reading trends will become much clearer.

Blessings, T

📈 In an uptrend, price forms a sequence of Higher Highs (HH) and Higher Lows (HL). As long as the most recent HL is respected, buyers remain in control. Pullbacks into demand often provide continuation opportunities.

📉 Once the most recent HL is broken, structure shifts — buyers lose control, and the market can flip into a downtrend with Lower Highs (LH) and Lower Lows (LL). Pullbacks into supply confirm bearish momentum.

🔑 Remember:

Market structure is fractal — always check higher timeframes for better understanding of price action.

A break of any important structure ( lows, highs ) tells us that either price is continuing or reversing.

Supply and demand zones are where reversals usually begin. And that is due to volatility and orders, volume coming into the market.

Don’t fight momentum — align with structure, and let the market confirm direction before you do anything.

Keep this framework in mind, and reading trends will become much clearer.

Blessings, T

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.