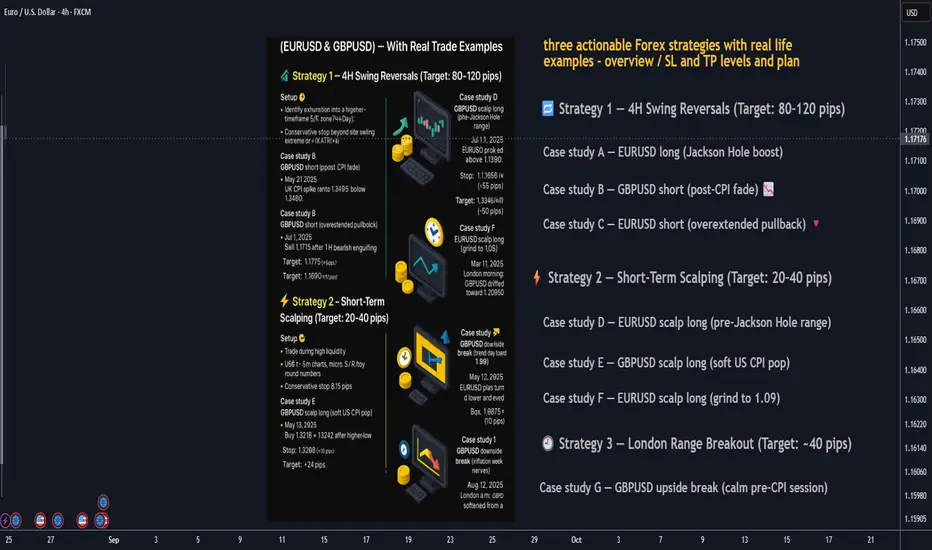

👋 Below are three practical strategies you can plug into your playbook today:

1. swing reversals (80+ pips), 2) short-term scalps (20–40 pips), and 3) the London range breakout (≈40 pips). Each section includes rules of engagement, risk management, and three real-market case studies on EURUSD and GBPUSD with conservative stops.

________________________________________

🔁 Strategy 1 — 4H Swing Reversals (Target: 80–120 pips)

Setup 🧩

• Identify exhaustion into a higher-timeframe S/R zone (4H/Day).

• Look for a reversal signal (engulfing/pin bar, momentum shift, or divergence) and a confirmation close.

• Conservative stop: beyond the swing extreme or ~1× ATR(14) on the entry timeframe.

• Take-profit: next HTF level or ≥ 1.8R, aiming for 80+ pips.

Case study A — EURUSD long (Jackson Hole boost) 📈

• When: Aug 22, 2025, NY session after Powell; EURUSD pushed above 1.1700 on broad USD weakness.

• Plan: After a 4H close back above 1.1700, buy a retest ~1.1705.

• Stop: 1.1650 (≈55 pips).

• Target: 1.1790 (≈85 pips).

Case study B — GBPUSD short (post-CPI fade) 📉

• When: May 21, 2025, UK CPI spike ran to 1.34695 then faded.

• Plan: After a 15–30m lower high below 1.3460, sell break of 1.3435.

• Stop: 1.3490 (≈55 pips).

• Target: 1.3345 (≈90 pips).

Case study C — EURUSD short (overextended pullback) 🔻

• When: Jul 1, 2025, EURUSD briefly poked above 1.1800 then eased.

• Plan: Sell 1.1775 after a 1H bearish engulfing.

• Stop: 1.1825 (≈50 pips).

• Target: 1.1690 (≈85 pips).

________________________________________

⚡ Strategy 2 — Short-Term Scalping (Target: 20–40 pips)

Setup 🧩

• Trade during high liquidity (London open or London/NY overlap).

• Use 1–5m charts: micro S/R + round numbers, quick momentum bursts.

• Conservative stop: 8–15 pips (just beyond the micro structure).

• Take-profit: 20–40 pips or to next intraday level.

Case study D — EURUSD scalp long (pre-Jackson Hole range) ⏱️

• When: Aug 21, 2025, Europe a.m.; EURUSD near 1.1650.

• Plan: Buy break-and-retest 1.1665.

• Stop: 1.1652 (≈13 pips).

• Target: 1.1687 (≈22 pips).

Case study E — GBPUSD scalp long (soft US CPI pop) 💥

• When: May 13, 2025, post-US CPI tone lifted risk; GBPUSD ~1.3226.

• Plan: Buy 1.3218 → 1.3242 after higher-low.

• Stop: 1.3208 (≈10 pips).

• Target: +24 pips.

Case study F — EURUSD scalp long (grind to 1.09) 🚀

• When: Mar 11, 2025, London morning; EURUSD nudged to 1.0890 / kissed 1.0900.

• Plan: Buy 1.0885 on retest.

• Stop: 1.0875 (≈10 pips).

• Target: 1.0905 (≈20 pips).

________________________________________

🕘 Strategy 3 — London Range Breakout (Target: ~40 pips)

Setup 🧩

• Mark the Asian/Late-Asia range before 08:00 London.

• Trade the first clean break/close outside the box.

• Entry: stop order beyond the box high/low.

• Conservative stop: opposite side of the box or box size + buffer (≤40–50 pips).

• Take-profit: ~40 pips (scale at 20 pips).

Case study G — GBPUSD upside break (calm pre-CPI session) 📦➡️📈

• When: Mar 25, 2025, London a.m.; GBPUSD drifted toward 1.2950.

• Box: 05:00–08:00 London ~22 pips.

• Plan: Buy box high +3 pips (≈1.2953).

• Stop: 1.2930 (≈23 pips).

• Target: 1.2993 (≈40 pips).

Case study H — EURUSD downside break (trend day toward 1.09) 📦➡️📉

• When: May 12, 2025, EURUSD bias turned lower and eyed the 1.09 handle.

• Box: 05:00–08:00 London ~28 pips.

• Plan: Sell box low −3 pips (≈1.0978).

• Stop: 1.1008 (≈30 pips).

• Target: 1.0938 (≈40 pips).

Case study I — GBPUSD downside break (inflation-week nerves) 📦➡️🔻

• When: Aug 12, 2025, London a.m.; GBPUSD softened from a two-week high.

• Box: 05:00–08:00 London ~24 pips.

• Plan: Sell box low −2 pips (≈1.3446).

• Stop: 1.3472 (≈26 pips).

• Target: 1.3406 (≈40 pips).

________________________________________

🛡️ Risk Management (applies to all three)

• Risk small per trade (e.g., 0.5–1%).

• Stops beyond structure: previous swing/box edge or ATR-based to avoid noise.

• News filter: avoid fresh entries seconds before major economic data.

________________________________________

🧰 Quick Checklists

Swing reversal (4H) ✅

🎯 Level picked • 📉 Reversal signal • 🛑 Stop beyond swing/ATR • 📐 ≥1.8R • 📰 No imminent shock

Scalp (1–5m) ✅

⏱️ Active session • 🔍 Micro S/R & round numbers • 🛑 8–15 pip stop • 🎯 20–40 pips • ✂️ Partial at +10–15

London breakout ✅

🕗 Box 05:00–08:00 • 📦 Reasonable width • 🚀 First break/close • 🛑 Stop other side • 🎯 ≈40 pips

________________________________________

⚠️ Final word

These examples show how setups map onto real market context. Adapt entries/levels to your feed and spreads. Nothing here is financial advice—test and size appropriately.

________________________________________

1. swing reversals (80+ pips), 2) short-term scalps (20–40 pips), and 3) the London range breakout (≈40 pips). Each section includes rules of engagement, risk management, and three real-market case studies on EURUSD and GBPUSD with conservative stops.

________________________________________

🔁 Strategy 1 — 4H Swing Reversals (Target: 80–120 pips)

Setup 🧩

• Identify exhaustion into a higher-timeframe S/R zone (4H/Day).

• Look for a reversal signal (engulfing/pin bar, momentum shift, or divergence) and a confirmation close.

• Conservative stop: beyond the swing extreme or ~1× ATR(14) on the entry timeframe.

• Take-profit: next HTF level or ≥ 1.8R, aiming for 80+ pips.

Case study A — EURUSD long (Jackson Hole boost) 📈

• When: Aug 22, 2025, NY session after Powell; EURUSD pushed above 1.1700 on broad USD weakness.

• Plan: After a 4H close back above 1.1700, buy a retest ~1.1705.

• Stop: 1.1650 (≈55 pips).

• Target: 1.1790 (≈85 pips).

Case study B — GBPUSD short (post-CPI fade) 📉

• When: May 21, 2025, UK CPI spike ran to 1.34695 then faded.

• Plan: After a 15–30m lower high below 1.3460, sell break of 1.3435.

• Stop: 1.3490 (≈55 pips).

• Target: 1.3345 (≈90 pips).

Case study C — EURUSD short (overextended pullback) 🔻

• When: Jul 1, 2025, EURUSD briefly poked above 1.1800 then eased.

• Plan: Sell 1.1775 after a 1H bearish engulfing.

• Stop: 1.1825 (≈50 pips).

• Target: 1.1690 (≈85 pips).

________________________________________

⚡ Strategy 2 — Short-Term Scalping (Target: 20–40 pips)

Setup 🧩

• Trade during high liquidity (London open or London/NY overlap).

• Use 1–5m charts: micro S/R + round numbers, quick momentum bursts.

• Conservative stop: 8–15 pips (just beyond the micro structure).

• Take-profit: 20–40 pips or to next intraday level.

Case study D — EURUSD scalp long (pre-Jackson Hole range) ⏱️

• When: Aug 21, 2025, Europe a.m.; EURUSD near 1.1650.

• Plan: Buy break-and-retest 1.1665.

• Stop: 1.1652 (≈13 pips).

• Target: 1.1687 (≈22 pips).

Case study E — GBPUSD scalp long (soft US CPI pop) 💥

• When: May 13, 2025, post-US CPI tone lifted risk; GBPUSD ~1.3226.

• Plan: Buy 1.3218 → 1.3242 after higher-low.

• Stop: 1.3208 (≈10 pips).

• Target: +24 pips.

Case study F — EURUSD scalp long (grind to 1.09) 🚀

• When: Mar 11, 2025, London morning; EURUSD nudged to 1.0890 / kissed 1.0900.

• Plan: Buy 1.0885 on retest.

• Stop: 1.0875 (≈10 pips).

• Target: 1.0905 (≈20 pips).

________________________________________

🕘 Strategy 3 — London Range Breakout (Target: ~40 pips)

Setup 🧩

• Mark the Asian/Late-Asia range before 08:00 London.

• Trade the first clean break/close outside the box.

• Entry: stop order beyond the box high/low.

• Conservative stop: opposite side of the box or box size + buffer (≤40–50 pips).

• Take-profit: ~40 pips (scale at 20 pips).

Case study G — GBPUSD upside break (calm pre-CPI session) 📦➡️📈

• When: Mar 25, 2025, London a.m.; GBPUSD drifted toward 1.2950.

• Box: 05:00–08:00 London ~22 pips.

• Plan: Buy box high +3 pips (≈1.2953).

• Stop: 1.2930 (≈23 pips).

• Target: 1.2993 (≈40 pips).

Case study H — EURUSD downside break (trend day toward 1.09) 📦➡️📉

• When: May 12, 2025, EURUSD bias turned lower and eyed the 1.09 handle.

• Box: 05:00–08:00 London ~28 pips.

• Plan: Sell box low −3 pips (≈1.0978).

• Stop: 1.1008 (≈30 pips).

• Target: 1.0938 (≈40 pips).

Case study I — GBPUSD downside break (inflation-week nerves) 📦➡️🔻

• When: Aug 12, 2025, London a.m.; GBPUSD softened from a two-week high.

• Box: 05:00–08:00 London ~24 pips.

• Plan: Sell box low −2 pips (≈1.3446).

• Stop: 1.3472 (≈26 pips).

• Target: 1.3406 (≈40 pips).

________________________________________

🛡️ Risk Management (applies to all three)

• Risk small per trade (e.g., 0.5–1%).

• Stops beyond structure: previous swing/box edge or ATR-based to avoid noise.

• News filter: avoid fresh entries seconds before major economic data.

________________________________________

🧰 Quick Checklists

Swing reversal (4H) ✅

🎯 Level picked • 📉 Reversal signal • 🛑 Stop beyond swing/ATR • 📐 ≥1.8R • 📰 No imminent shock

Scalp (1–5m) ✅

⏱️ Active session • 🔍 Micro S/R & round numbers • 🛑 8–15 pip stop • 🎯 20–40 pips • ✂️ Partial at +10–15

London breakout ✅

🕗 Box 05:00–08:00 • 📦 Reasonable width • 🚀 First break/close • 🛑 Stop other side • 🎯 ≈40 pips

________________________________________

⚠️ Final word

These examples show how setups map onto real market context. Adapt entries/levels to your feed and spreads. Nothing here is financial advice—test and size appropriately.

________________________________________

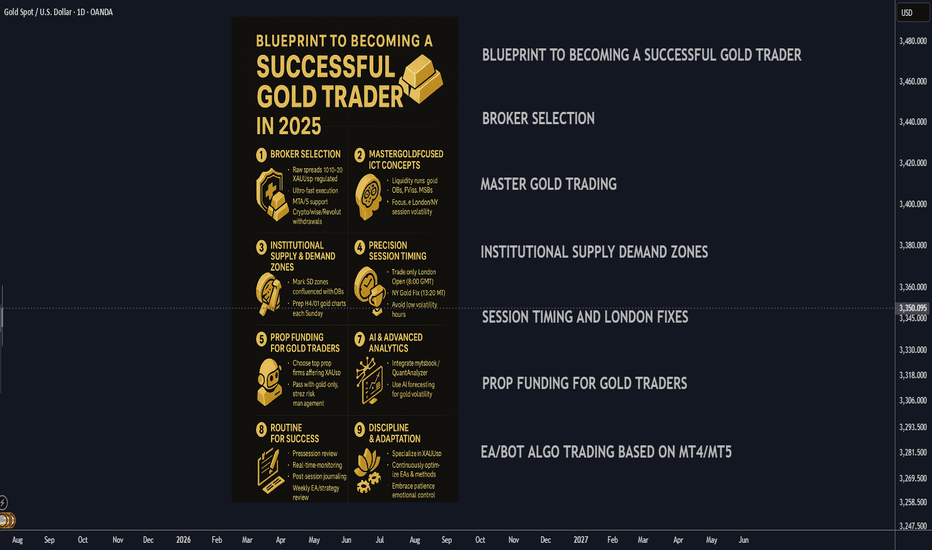

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.