📣 Southwind | FCPO Weekly Roundup

🗓 Week ending: Aug 29, 2025

📰 Policy driver

- 🇮🇩 Indonesia sets Sept CPO reference at USD 954.71/MT → export tax ~USD 124/MT; with 10% levy, total burden ~USD 219/MT vs ~USD 165 in Aug (+USD 54).

- Implication: higher Indonesian costs can shift some demand toward Malaysia and support FCPO spreads in Sept.

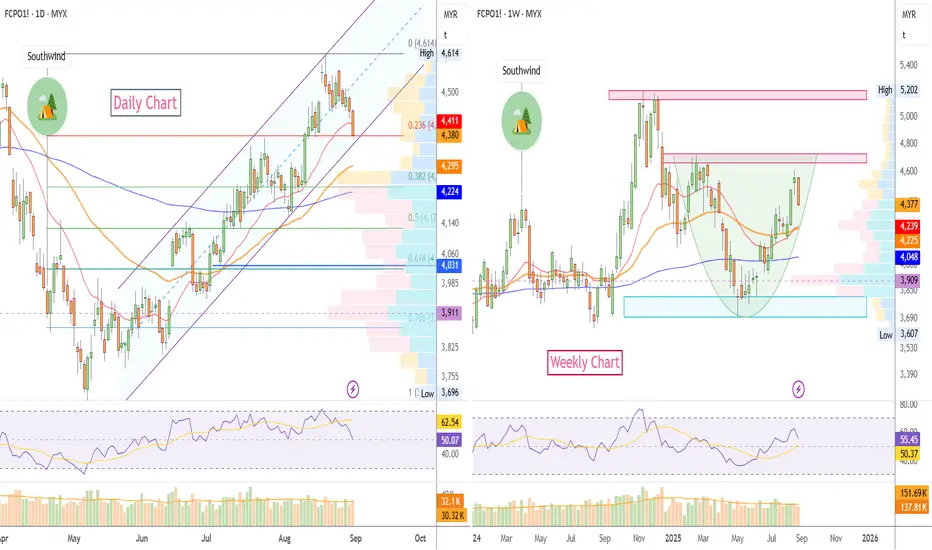

📈 Technicals (Daily)

- 🔺 Price at rising‑channel support; reclaiming short DMAs often reopens upside toward prior swing highs in trends.

- 🔎 Watch a clean close back above fast MAs for momentum confirmation.

🗂 Technicals (Weekly)

- 🥄 Rounded base still intact; resistance stacked 4,600–4,800, with higher lows keeping structure constructive into Q4.

- 📊 Break-and-close above the band would validate a base break and extend upside potential.

🎯 Levels

- 🛡 Supports: channel lower rail/MA cluster; a decisive break risks deeper mean‑reversion to prior range supports.

- 🚧 Resistances: 4,450 first, then 4,600–4,800 on weekly supply.

🌍 Fundamentals to watch

- 🛢 Indonesia’s monthly tax/levy grid and spread impact.

- 🚢 Malaysia exports vs inventories; stocks elevated but outlook seen steady-to-firm on demand momentum.

✅ Bias

- Overall: cautiously **bullish** while the daily channel holds and weekly higher lows persist; aiming for retests into the 4,600s on a strong MA reclaim.

🗓 Week ending: Aug 29, 2025

📰 Policy driver

- 🇮🇩 Indonesia sets Sept CPO reference at USD 954.71/MT → export tax ~USD 124/MT; with 10% levy, total burden ~USD 219/MT vs ~USD 165 in Aug (+USD 54).

- Implication: higher Indonesian costs can shift some demand toward Malaysia and support FCPO spreads in Sept.

📈 Technicals (Daily)

- 🔺 Price at rising‑channel support; reclaiming short DMAs often reopens upside toward prior swing highs in trends.

- 🔎 Watch a clean close back above fast MAs for momentum confirmation.

🗂 Technicals (Weekly)

- 🥄 Rounded base still intact; resistance stacked 4,600–4,800, with higher lows keeping structure constructive into Q4.

- 📊 Break-and-close above the band would validate a base break and extend upside potential.

🎯 Levels

- 🛡 Supports: channel lower rail/MA cluster; a decisive break risks deeper mean‑reversion to prior range supports.

- 🚧 Resistances: 4,450 first, then 4,600–4,800 on weekly supply.

🌍 Fundamentals to watch

- 🛢 Indonesia’s monthly tax/levy grid and spread impact.

- 🚢 Malaysia exports vs inventories; stocks elevated but outlook seen steady-to-firm on demand momentum.

✅ Bias

- Overall: cautiously **bullish** while the daily channel holds and weekly higher lows persist; aiming for retests into the 4,600s on a strong MA reclaim.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.