GameStop Corp. (NYSE: GME) reported its third-quarter 2025 financial results, delivering a sharp recovery in profitability despite softer revenues. Net sales came in at $821 million, down from $860.3 million a year earlier, reflecting continued weakness in physical gaming demand and a slower software cycle. However, the company’s internal restructuring efforts significantly improved financial efficiency. SG&A expenses were reduced to $221.4 million, a substantial drop from $282 million, highlighting GameStop’s aggressive cost-cutting strategy.

Operating income rose to $41.3 million, a strong reversal from the prior year’s $33.4 million operating loss. Adjusted operating income also improved to $52.1 million, signaling healthier core operations. Net income jumped to $77.1 million, considerably higher than last year’s $17.4 million, boosted by improved margins and reduced expenses. On an adjusted basis, net income surged to $139.3 million, underscoring the company’s operational momentum.

GameStop ended the quarter with an impressive $8.8 billion in cash, cash equivalents, and marketable securities—nearly double last year’s $4.6 billion. The company also reported $519.4 million worth of Bitcoin holdings, reflecting its continued exposure to digital assets as part of its treasury diversification strategy.

Technical Analysis

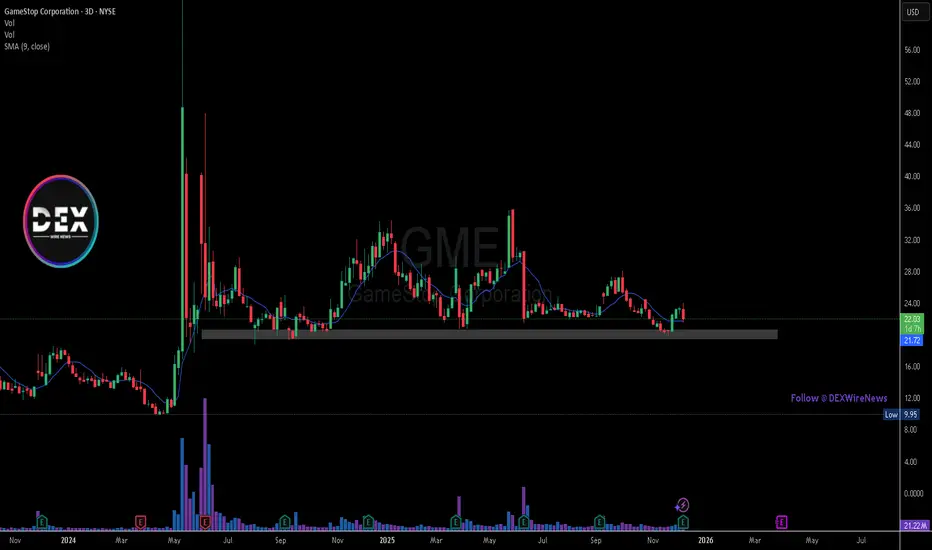

From a technical perspective, GME is still consolidating within a long-term support range between $20–$22, an area that has historically acted as a demand zone. Price recently bounced cleanly off this structure, showing early signs of renewed buying interest. A sustained close above $24–$25 could open the door for a move toward $28–$30.

However, failure to hold the support region may expose GME to downside risk toward $15–$16, especially if market conditions weaken. Volume remains subdued, suggesting accumulation rather than speculative momentum. For now, the chart favors cautious bullishness as long as support remains intact.

Operating income rose to $41.3 million, a strong reversal from the prior year’s $33.4 million operating loss. Adjusted operating income also improved to $52.1 million, signaling healthier core operations. Net income jumped to $77.1 million, considerably higher than last year’s $17.4 million, boosted by improved margins and reduced expenses. On an adjusted basis, net income surged to $139.3 million, underscoring the company’s operational momentum.

GameStop ended the quarter with an impressive $8.8 billion in cash, cash equivalents, and marketable securities—nearly double last year’s $4.6 billion. The company also reported $519.4 million worth of Bitcoin holdings, reflecting its continued exposure to digital assets as part of its treasury diversification strategy.

Technical Analysis

From a technical perspective, GME is still consolidating within a long-term support range between $20–$22, an area that has historically acted as a demand zone. Price recently bounced cleanly off this structure, showing early signs of renewed buying interest. A sustained close above $24–$25 could open the door for a move toward $28–$30.

However, failure to hold the support region may expose GME to downside risk toward $15–$16, especially if market conditions weaken. Volume remains subdued, suggesting accumulation rather than speculative momentum. For now, the chart favors cautious bullishness as long as support remains intact.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.