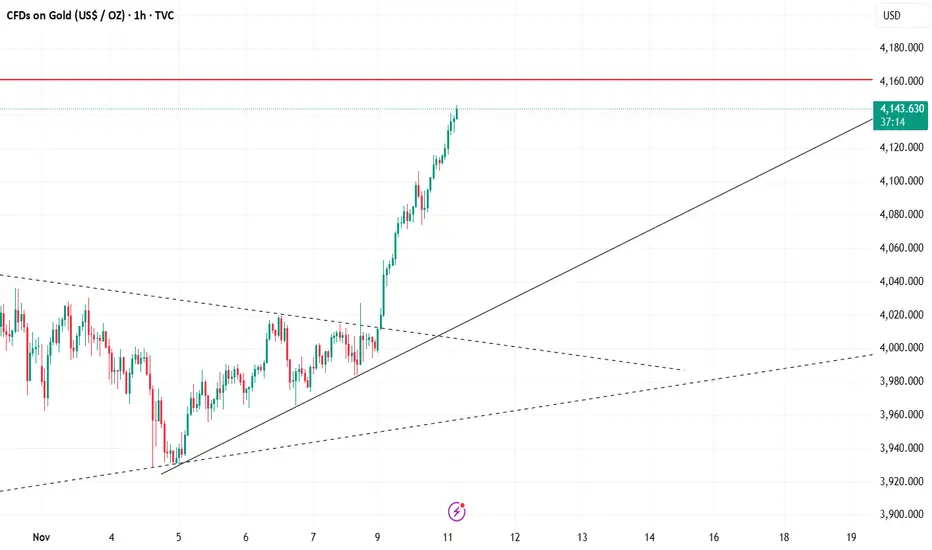

Accurate prediction of an upward trend has arrived as expected.

The protracted US government shutdown is finally coming to an end! The Senate has cleared procedural hurdles, and the temporary funding bill has passed a procedural vote, ensuring government funding until January. The shutdown is likely to end this weekend.

As soon as the news came out, the market went from cloudy to sunny – the previous shutdown had tightened liquidity, but now it seems to be easing, and the precious metals market is leading the rebound. Although the shutdown isn't completely resolved, the resumption of negotiations between the two parties has sent a positive signal, boosting risk appetite and relieving the anxiety of watching partisan infighting.

To put it simply, this "temporary extension" by the US government is like a reassurance to the market. Investors who were panicking before the shutdown can now breathe a sigh of relief. All that's left is to wait for the final decision so that the government can fully "reopen for business"!

Gold broke out of a two-week low-level triangle pattern in the previous trading session, ushering in a strong upward trend. Yesterday's market exhibited a three-stage upward trend: higher in the Asian session, continued gains in the European session, and accelerated gains in the US session. Each rally was followed by a period of consolidation without significant pullbacks, a classic characteristic of extremely strong market conditions.

Regarding the future trend, the bullish outlook remains unchanged for today.

On one hand, the current situation strongly suggests a period of high-level consolidation: given the current extremely strong pattern, gold is more likely to continue its "time-for-space" consolidation, digesting pressure before resuming its upward movement. If this pattern holds, aggressive long positions can be considered before the European session.

On the other hand, if a pullback occurs: the 4116-4110 range should be closely watched, as this will act as a crucial support level. If the price retraces to this range and stabilizes, long positions can be considered on the pullback.

As soon as the news came out, the market went from cloudy to sunny – the previous shutdown had tightened liquidity, but now it seems to be easing, and the precious metals market is leading the rebound. Although the shutdown isn't completely resolved, the resumption of negotiations between the two parties has sent a positive signal, boosting risk appetite and relieving the anxiety of watching partisan infighting.

To put it simply, this "temporary extension" by the US government is like a reassurance to the market. Investors who were panicking before the shutdown can now breathe a sigh of relief. All that's left is to wait for the final decision so that the government can fully "reopen for business"!

Gold broke out of a two-week low-level triangle pattern in the previous trading session, ushering in a strong upward trend. Yesterday's market exhibited a three-stage upward trend: higher in the Asian session, continued gains in the European session, and accelerated gains in the US session. Each rally was followed by a period of consolidation without significant pullbacks, a classic characteristic of extremely strong market conditions.

Regarding the future trend, the bullish outlook remains unchanged for today.

On one hand, the current situation strongly suggests a period of high-level consolidation: given the current extremely strong pattern, gold is more likely to continue its "time-for-space" consolidation, digesting pressure before resuming its upward movement. If this pattern holds, aggressive long positions can be considered before the European session.

On the other hand, if a pullback occurs: the 4116-4110 range should be closely watched, as this will act as a crucial support level. If the price retraces to this range and stabilizes, long positions can be considered on the pullback.

تم فتح الصفقة

The price has been rising steadily on the 4-hour chart, with pullbacks being minor corrections. This type of market is relatively easy to trade as there are not many fluctuations. The first resistance level after the rise is at 4160-4180, which is a key resistance level that was tested after the double top at 4380.Buy on dips, use small positions and enter in batches.

أغلقت الصفقة: تم الوصول للهدف

Gold has risen to around 4142, in line with our expectation of going long today. Those who bought following the signal are now enjoying significant profits. The resistance level is at 4160 - 4180. I won't notify everyone to exit one by one.Join my telegram channel for free t.me/GoldBitcoinSharing To follow the link, click on the globe icon on the next line

منشورات ذات صلة

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join my telegram channel for free t.me/GoldBitcoinSharing To follow the link, click on the globe icon on the next line

منشورات ذات صلة

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.