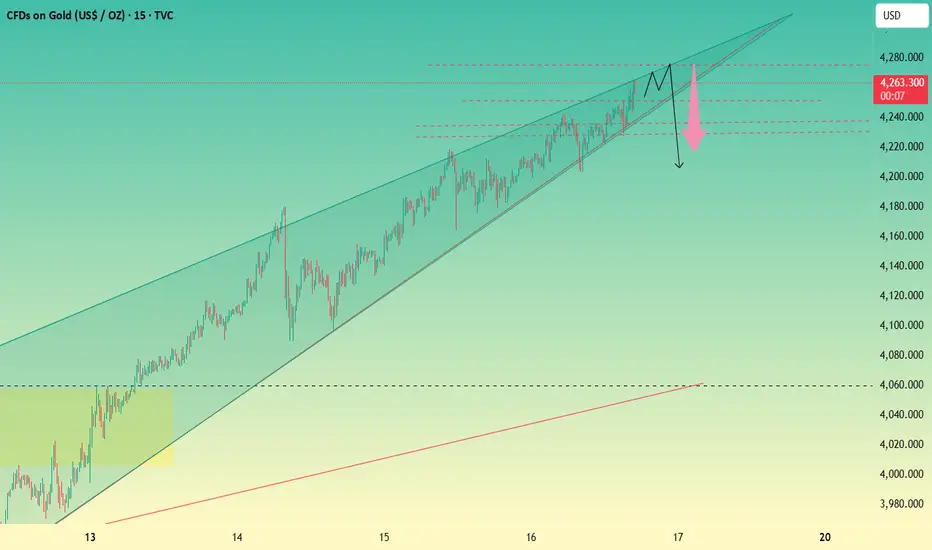

Today, gold opened with a volatile climb and then consolidated at elevated levels. The bulls still have lingering momentum, but gold has been trading above its 5-period moving average for three consecutive days now. Since the start of this unilateral rally from 3,311, gold has consistently advanced with support from the 5-period moving average—only once did it find support at the 10-period moving average. When gold deviates from the 5-period moving average for an extended period and keeps rallying nonstop, a pullback correction is likely to occur. Furthermore, gold is trading at the end of an ascending triangle pattern, leaving little room for further movement, and a trend reversal could happen at any time.

Realistically, due to the U.S. government shutdown, it’s nearly impossible to make reliable judgments based on economic data right now—the data is simply too untrustworthy, and any outcome would come as no surprise. That said, I don’t believe inflation will ease at all. In fact, the U.S. government shutdown has dealt a severe blow to the U.S. economy. Additionally, tariff tensions have never truly subsided; on the contrary, they are currently escalating step by step. Under such circumstances, I don’t think U.S. inflation will slow down—in fact, I lean toward the possibility of further inflationary pressures. If that’s the case, the Federal Reserve will likely put rate cuts on hold. Even if a rate cut is forced through in October, it will impact the progress of future rate cuts. Once inflation heats up, gold faces a high risk of a sharp collapse.

In terms of market trading, gold’s rebound after the previous collapse has only fueled more bullish buying. Paradoxically, this has made the market unafraid of another collapse—traders now assume that any drop will be quickly followed by a rally to new highs. Amid the uptrend, chasing highs remains common, and rightly so, given the impressive gains in recent days. However, this could well be a sense of inertia instilled by the market, designed to make traders trust the bullish trend. If gold falls again, the decline will likely exceed 100 points.

Resistance Levels: 4,275, 4,300

Support Levels: 4,235, 4,220

Trading Strategy

While others are cautious, we’ll be greedy. We plan to consider shorting gold around the 4,275 level in the evening, waiting for a trend reversal.

For specific trading decisions, please follow my real-time updates. I post my trading ideas and strategies daily. If you lack a plan or clear direction for gold trading and struggle to achieve consistent, stable profits, you can refer to and follow my updates as a reference and guide to help you avoid mistakes.

Realistically, due to the U.S. government shutdown, it’s nearly impossible to make reliable judgments based on economic data right now—the data is simply too untrustworthy, and any outcome would come as no surprise. That said, I don’t believe inflation will ease at all. In fact, the U.S. government shutdown has dealt a severe blow to the U.S. economy. Additionally, tariff tensions have never truly subsided; on the contrary, they are currently escalating step by step. Under such circumstances, I don’t think U.S. inflation will slow down—in fact, I lean toward the possibility of further inflationary pressures. If that’s the case, the Federal Reserve will likely put rate cuts on hold. Even if a rate cut is forced through in October, it will impact the progress of future rate cuts. Once inflation heats up, gold faces a high risk of a sharp collapse.

In terms of market trading, gold’s rebound after the previous collapse has only fueled more bullish buying. Paradoxically, this has made the market unafraid of another collapse—traders now assume that any drop will be quickly followed by a rally to new highs. Amid the uptrend, chasing highs remains common, and rightly so, given the impressive gains in recent days. However, this could well be a sense of inertia instilled by the market, designed to make traders trust the bullish trend. If gold falls again, the decline will likely exceed 100 points.

Resistance Levels: 4,275, 4,300

Support Levels: 4,235, 4,220

Trading Strategy

While others are cautious, we’ll be greedy. We plan to consider shorting gold around the 4,275 level in the evening, waiting for a trend reversal.

For specific trading decisions, please follow my real-time updates. I post my trading ideas and strategies daily. If you lack a plan or clear direction for gold trading and struggle to achieve consistent, stable profits, you can refer to and follow my updates as a reference and guide to help you avoid mistakes.

تم فتح الصفقة

The short position has been executed. If you follow the signal, remember to operate with a small position. If the price breaks below the support level, you can increase your position.أغلقت الصفقة: تم الوصول للهدف

Those who have not entered the market yet should pay attention to the resistance level of 4300إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.