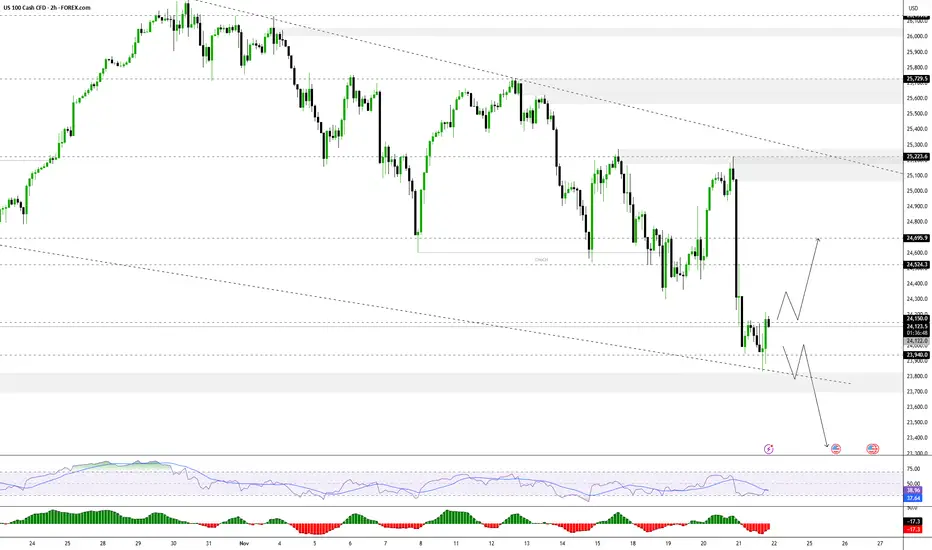

NASDAQ Market Outlook | Potential for Upside if Positive Tone is Maintained

Currently, the NAS index remains under bearish pressure. Concerns about an AI bubble continue to weigh on technology stocks, even though Nvidia recently reported its highest revenue ever of $57 billion with strong growth guidance.

However, investors remain cautious due to the massive increase in spending on AI, perceived overvaluation of stocks, and the market's reliance on a few mega-cap companies.

Under these conditions, selling pressure in the technology sector continues and is affecting the movement of the USNAS100 index.

Price movement direction based on key levels:

As long as the price is below 23,940 → the trend remains bearish.

If the decline continues, the gradual decline target is in the following areas:

🔻 23,700 → 23,340 → 23,050

If the price rises and closes above 24,150 on the H1 timeframe → potential bullish correction

The corrective upward trend has the potential to move towards:

🔺 24,350 → 24,570

Analysis Conclusion

USNAS100 remains in a bearish trend as long as the price is unable to break through and maintain above the 23,940 level. Selling pressure is expected to intensify if the 23,700 support level is broken, opening the opportunity for a decline towards the 23,340 to 23,050 area.

Currently, the NAS index remains under bearish pressure. Concerns about an AI bubble continue to weigh on technology stocks, even though Nvidia recently reported its highest revenue ever of $57 billion with strong growth guidance.

However, investors remain cautious due to the massive increase in spending on AI, perceived overvaluation of stocks, and the market's reliance on a few mega-cap companies.

Under these conditions, selling pressure in the technology sector continues and is affecting the movement of the USNAS100 index.

Price movement direction based on key levels:

As long as the price is below 23,940 → the trend remains bearish.

If the decline continues, the gradual decline target is in the following areas:

🔻 23,700 → 23,340 → 23,050

If the price rises and closes above 24,150 on the H1 timeframe → potential bullish correction

The corrective upward trend has the potential to move towards:

🔺 24,350 → 24,570

Analysis Conclusion

USNAS100 remains in a bearish trend as long as the price is unable to break through and maintain above the 23,940 level. Selling pressure is expected to intensify if the 23,700 support level is broken, opening the opportunity for a decline towards the 23,340 to 23,050 area.

منشورات ذات صلة

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

منشورات ذات صلة

إخلاء المسؤولية

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.