🔎Overview

____________________________________________________________

📌 How to Use

____________________________________________________________

📊 Chart Explanation

____________________________________________________________

👀 Observations

____________________________________________________________

💡 Why It Matters

____________________________________________________________

✅ Conclusion

____________________________________________________________

⚠️ Disclaimer

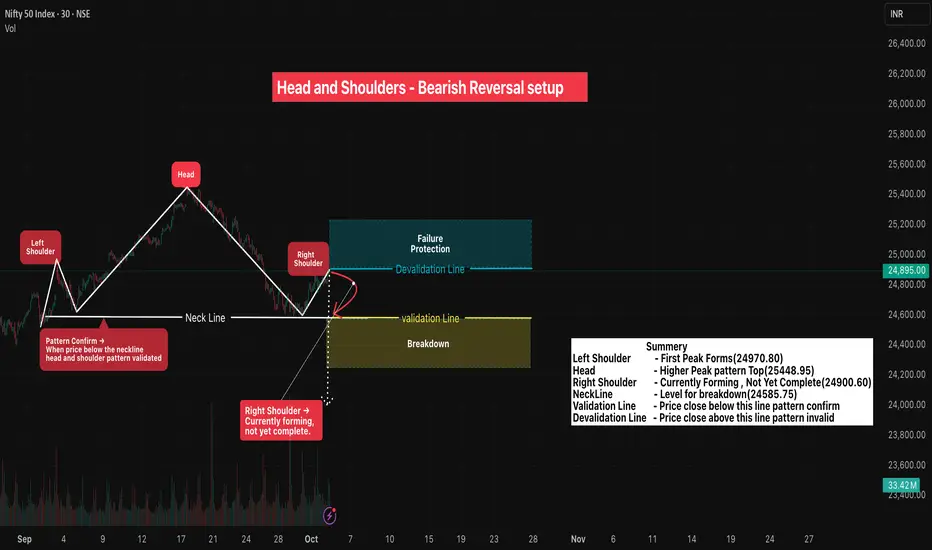

The Head and Shoulders Pattern is a classic bearish reversal formation that signals a potential change in trend from uptrend to downtrend.

It is formed by three peaks:

- Left Shoulder → Price rises, forms a peak, then retraces.

- Head → Price moves higher than the left shoulder, creating the tallest peak, then falls back.

- Right Shoulder → Price rises again but fails to surpass the head, showing loss of momentum.

- Neckline → A line drawn through the two troughs between the shoulders and the head. A breakdown below the neckline confirms bearish sentiment.

This pattern reflects weakening buying pressure and strengthening selling interest, often appearing at the end of strong rallies.

____________________________________________________________

📌 How to Use

• ✅ Pattern Confirmed → When candle closes below the Validation Line

• ❌ Pattern Invalid → If candle closes above the Devalidation Line(Failure Protection).

• Protects against false signals & ensures structured risk management.

____________________________________________________________

📊 Chart Explanation

• Symbol →NIFTY

• Timeframe → 30m

• Left Shoulder Peak - 24970.30

• Head (Highest Peak) - 25448.95

• Right Shoulder Peak - 24900.80

• Neckline → Drawn by connecting the two troughs between shoulders and head.

• Validation Level → 24,585.75 → Close below = Pattern Confirmed.

• Devalidation Level → 24,910.65 → Close above = Pattern Invalid.

____________________________________________________________

👀 Observations

- The right shoulder often appears weaker, highlighting reduced buyer confidence.

- Once the neckline is tested multiple times, probability of a breakdown increases.

- Volume generally decreases during formation and expands during breakdown, strengthening confirmation.

- This setup helps traders anticipate major reversals rather than chasing late entries.

- Head and Shoulders is widely followed, making it self-fulfilling as many traders act on the same signal.

____________________________________________________________

💡 Why It Matters

Head & Shoulders is one of the most reliable reversal patterns, giving clear validation/devalidation levels for structured risk management. It helps avoid false breakouts and provides traders with predefined stop-loss and target zones.

____________________________________________________________

✅ Conclusion

Breakdown below the Validation Lineconfirms bearish reversal bias. Combine this with broader market context, volume confirmation, and disciplined position sizing for effective trading decisions.

____________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.