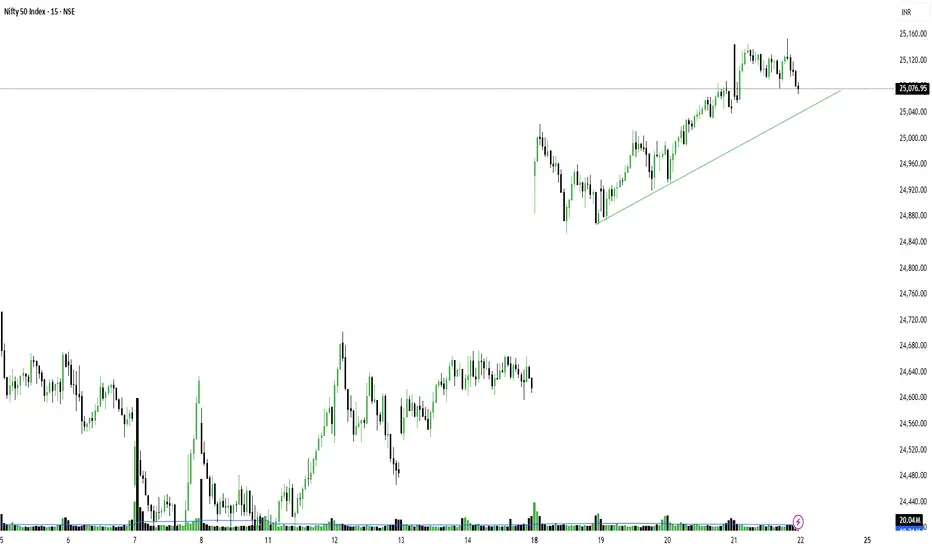

As we discussed earlier,  NIFTY did move up because buyers were stronger than sellers. But by the end of the day it closed lower, which shows it was more of a long unwinding day.

NIFTY did move up because buyers were stronger than sellers. But by the end of the day it closed lower, which shows it was more of a long unwinding day.

Yesterday sellers’ volume was higher by 29 million compared to buyers. Pivot has shifted up to 25097, and Pivot percentile is 0.5%.

Now, for today – Pivot is up but sellers’ volume is heavier. This means range has expanded because of short covering, not fresh buying. So pivot point will guide us. If Nifty opens below pivot and stays there for an hour, chances are we may see a bearish day. But this dip can actually be a good chance to add fresh long positions for next week.

Also, don’t forget we’re close to monthly expiry. So volatility in both index and stocks is normal in this phase.

Resistance to watch is 25104. If Nifty manages to close above this, 25500 opens up on the upside.

On the downside, 25000 is strong psychological support. If that breaks, then 24888 can come next week. That would be a healthy pullback for bulls to reload.

One more thing – I feel market is still waiting for a shakeout. So if you see a sudden drop in your holdings, don’t panic-exit. Use closing-based stop loss and ride out the noise.

BANKNIFTY , on the other hand, looks calm but it feels like it’s suppressing the trend for a manipulative move. Sellers were higher by 10 million yesterday but momentum hasn’t really faded. Resistance is 55990 and support is 55288 in short term.

BANKNIFTY , on the other hand, looks calm but it feels like it’s suppressing the trend for a manipulative move. Sellers were higher by 10 million yesterday but momentum hasn’t really faded. Resistance is 55990 and support is 55288 in short term.

For swing traders, IPO names and auto component stocks should stay on your radar.

That’s all for today. Trade safe, and make it a profitable day.

Yesterday sellers’ volume was higher by 29 million compared to buyers. Pivot has shifted up to 25097, and Pivot percentile is 0.5%.

Now, for today – Pivot is up but sellers’ volume is heavier. This means range has expanded because of short covering, not fresh buying. So pivot point will guide us. If Nifty opens below pivot and stays there for an hour, chances are we may see a bearish day. But this dip can actually be a good chance to add fresh long positions for next week.

Also, don’t forget we’re close to monthly expiry. So volatility in both index and stocks is normal in this phase.

Resistance to watch is 25104. If Nifty manages to close above this, 25500 opens up on the upside.

On the downside, 25000 is strong psychological support. If that breaks, then 24888 can come next week. That would be a healthy pullback for bulls to reload.

One more thing – I feel market is still waiting for a shakeout. So if you see a sudden drop in your holdings, don’t panic-exit. Use closing-based stop loss and ride out the noise.

For swing traders, IPO names and auto component stocks should stay on your radar.

That’s all for today. Trade safe, and make it a profitable day.

TrendX INC

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

TrendX INC

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.