Potential Reversal on ORDERUSDT.P: Key Support Levels to watch

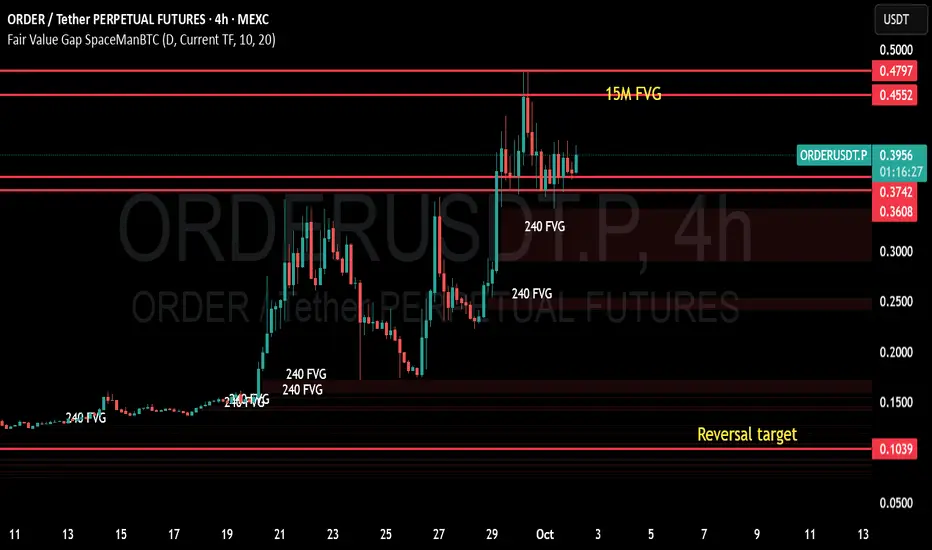

Analyzing the current price action of ORDERUSDT.P suggests a possible reversal, with expectations of a retracement back to the 10-cent level. Notably, a bottomless wick on the 4-hour candle at this level indicates strong support. Additionally, a Fair Value Gap (FVG) below the current price reinforces the likelihood of a return to that zone. The market typically seeks to fill FVGs above the current price, which aligns with this potential move.

However, a bearish Head and Shoulders pattern is forming at the top, signaling possible downside momentum. An FVG is also present at the top of the daily candle, serving as a potential resistance level.

Traders should monitor these key levels and patterns to inform their entries and exits. Caution is advised given the conflicting signals—support at 10 cents versus bearish pattern formation at the top.

However, a bearish Head and Shoulders pattern is forming at the top, signaling possible downside momentum. An FVG is also present at the top of the daily candle, serving as a potential resistance level.

Traders should monitor these key levels and patterns to inform their entries and exits. Caution is advised given the conflicting signals—support at 10 cents versus bearish pattern formation at the top.

تم فتح الصفقة

Here is what's on this chart.4H bottomless wick at 0.10 → That’s a liquidity magnet. Price almost always wants to rebalance and “fill in” these inefficiencies. So yes, odds are high it will eventually sweep that level.

Big FVG below current PA → Another magnet. Market rarely leaves that behind without a visit.

Daily close with an FVG (15 M) above → This is the short-term “pull” to the upside. It’s like the market is dangling a carrot to get people long before it reverses and goes down to clean the liquidity below.

So structure says: first upside sweep → then downside draw to 0.10.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.