The short-term drop in SFM is a sharp correction after the stock became excessively overvalued (too expensive) earlier this year, and the company recently gave investors a reason to lose confidence.

The Bearish Narrative (Why the Stock is Dropping)

Slowing Momentum: Sprouts reported disappointing forward guidance in its most recent earnings (Q3 2025). While their profit (EPS) was okay, they signaled that the key measure of success for a grocery store—same-store sales growth (how much older stores are growing)—will be much weaker than Wall Street expected for the next quarter.

Simple Translation: The excitement over their growth story is slowing down, suggesting the company is hitting some resistance in attracting new customers to existing stores.

Overvaluation Correction: For much of the year, the stock price was running far ahead of what its fundamental business performance could justify (as seen by the $182 peak mentioned in the search results). The latest weak guidance provided the catalyst—or the excuse—for traders to aggressively sell the stock and bring the price back down to a more realistic level.

Simple Translation: The stock was a 'hot air balloon' that got a pinprick, causing it to fall quickly.

Competition Pressure: The specialized natural and organic grocery space is getting crowded. Traditional supermarkets (like Kroger and Walmart) and mass retailers are now carrying more organic products, which increases competition for Sprouts and makes it harder for them to maintain high prices and profit margins.

Simple Translation: Sprouts' special niche isn't so special anymore, making it harder to grow aggressively.

Trade Idea:

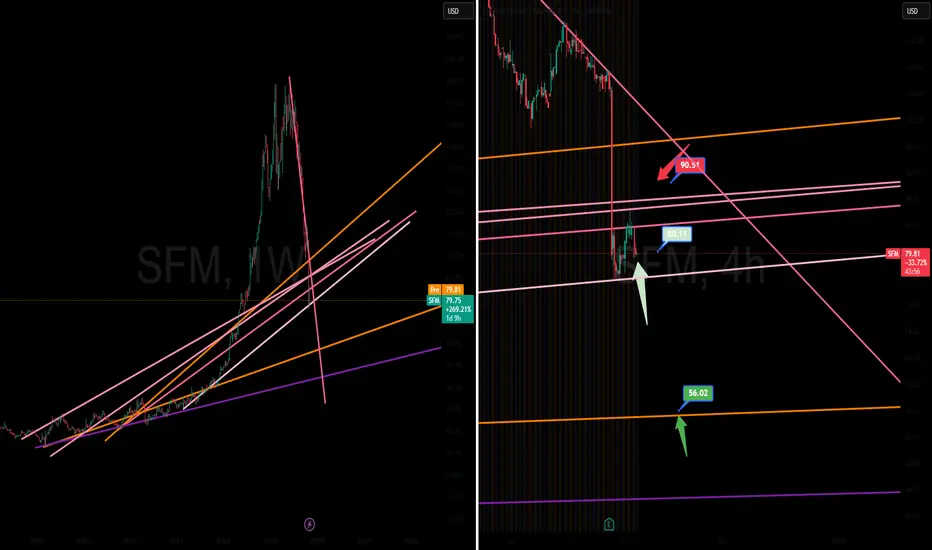

Buy Small position at current levels(80.38) Add to the position for better average at 56.98(if it drops to that level)

Exit at 90.00

The Bearish Narrative (Why the Stock is Dropping)

Slowing Momentum: Sprouts reported disappointing forward guidance in its most recent earnings (Q3 2025). While their profit (EPS) was okay, they signaled that the key measure of success for a grocery store—same-store sales growth (how much older stores are growing)—will be much weaker than Wall Street expected for the next quarter.

Simple Translation: The excitement over their growth story is slowing down, suggesting the company is hitting some resistance in attracting new customers to existing stores.

Overvaluation Correction: For much of the year, the stock price was running far ahead of what its fundamental business performance could justify (as seen by the $182 peak mentioned in the search results). The latest weak guidance provided the catalyst—or the excuse—for traders to aggressively sell the stock and bring the price back down to a more realistic level.

Simple Translation: The stock was a 'hot air balloon' that got a pinprick, causing it to fall quickly.

Competition Pressure: The specialized natural and organic grocery space is getting crowded. Traditional supermarkets (like Kroger and Walmart) and mass retailers are now carrying more organic products, which increases competition for Sprouts and makes it harder for them to maintain high prices and profit margins.

Simple Translation: Sprouts' special niche isn't so special anymore, making it harder to grow aggressively.

Trade Idea:

Buy Small position at current levels(80.38) Add to the position for better average at 56.98(if it drops to that level)

Exit at 90.00

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

GoldenTraders is a premier trading community dedicated to helping you navigate the complexities of the financial markets with confidence and clarity.

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

Please join for more trade Ideas.

GoldenTraders: discord.gg/nrCvUT8yzt

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.