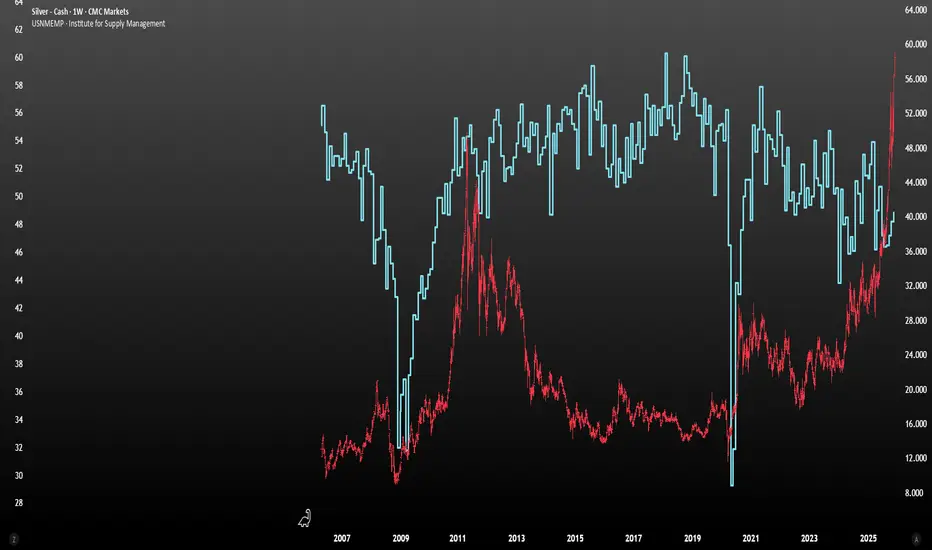

After breaking out of what appeared to be a cup-and-handle pattern on 25 November, silver prices have surged from around $51.40 to $58.65. The metal now looks overextended, with the RSI at 75.25, and trading above its upper Bollinger Band for the fourth consecutive day. This suggests that silver may be due for a retest of the 20-day moving average or for a few days of sideways consolidation before the next move is established.

On the hourly chart, silver prices have formed what appears to be a trading range since 30 November, broadly between $56.60 and $58.90, with $58.90 acting as resistance and $56.60 as support. A break below $56.60 could set up a move back towards $53.90, which would then become an important level of support. If that were to be broken, silver could potentially fall further towards $50.75. Such a development might also indicate that a larger reversal is starting to take shape, although it is far too early to make that assumption.

Conversely, a breakout above $58.90 would be a very bullish signal and would suggest that silver’s move higher could extend for some time. While a precise price objective is difficult to determine, using a 100% extension of the breakout to the recent high at $58.90 would imply that silver could rise to around $67.10.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

On the hourly chart, silver prices have formed what appears to be a trading range since 30 November, broadly between $56.60 and $58.90, with $58.90 acting as resistance and $56.60 as support. A break below $56.60 could set up a move back towards $53.90, which would then become an important level of support. If that were to be broken, silver could potentially fall further towards $50.75. Such a development might also indicate that a larger reversal is starting to take shape, although it is far too early to make that assumption.

Conversely, a breakout above $58.90 would be a very bullish signal and would suggest that silver’s move higher could extend for some time. While a precise price objective is difficult to determine, using a 100% extension of the breakout to the recent high at $58.90 would imply that silver could rise to around $67.10.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.