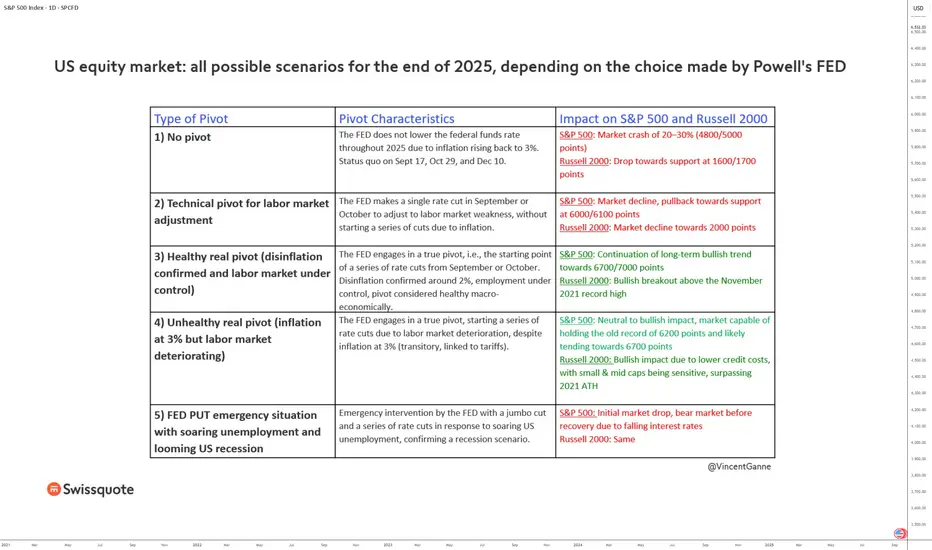

The Federal Reserve’s monetary policy decision on Wednesday, September 17, will be decisive for the trajectory of U.S. equity markets at the end of 2025. Depending on Jerome Powell’s choice, scenarios range from a stock market crash to a new all-time high, with more neutral consolidation phases in between. Five possible options emerge, each with specific implications for the S&P 500 and the Russell 2000, which I describe below.

First case: no pivot.

If the Fed decides to keep rates unchanged throughout 2025 due to overly resilient inflation, then the scenario is clearly bearish. The lack of monetary support would suffocate market momentum, triggering a 20–30% crash in the S&P 500, dropping it to between 4,800 and 5,000 points. The Russell 2000, more fragile and sensitive to the macroeconomic environment, would retreat toward its critical support zone of 1,600–1,700 points.

Second case: a limited technical pivot.

The Fed might opt for just one rate cut in September or October, justified by a temporary adjustment to the labor market. In this case, markets would not see it as a strong easing signal but rather as a circumstantial gesture. Result: the S&P 500 would decline toward the 6,000–6,100 area, with a parallel correction of the Russell 2000 around 2,000 points.

Third case: a real and healthy pivot.

This is the most favorable scenario for Wall Street. Disinflation is confirmed near 2%, employment remains under control, and the Fed initiates a genuine rate-cutting cycle starting in September or October. In this context, the underlying bullish trend would regain full strength: the S&P 500 would head toward 6,700–7,000 points, while the Russell 2000 would break out of its consolidation to surpass its November 2021 record.

Fourth case: an unhealthy pivot.

Here, the Fed cuts rates in a more fragile environment: inflation remains near 3%, but it is primarily labor market deterioration that drives the decision. Markets could still find support from lower credit costs. The S&P 500 would preserve its former record at 6,200 points and likely aim for 6,700 points. The Russell 2000, more sensitive to financing conditions, would fully benefit from this easing, also surpassing its 2021 high.

Fifth case: the emergency Fed Put.

Finally, in the darkest scenario, a shock to employment would trigger a brutal Fed intervention, with a “jumbo cut” and a series of rapid rate reductions. While this support might contain the recession, the immediate reaction would be a sharp drop: the S&P 500 would plunge into bear market territory before a potential recovery tied to monetary easing. The Russell 2000 would follow the same trajectory.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

First case: no pivot.

If the Fed decides to keep rates unchanged throughout 2025 due to overly resilient inflation, then the scenario is clearly bearish. The lack of monetary support would suffocate market momentum, triggering a 20–30% crash in the S&P 500, dropping it to between 4,800 and 5,000 points. The Russell 2000, more fragile and sensitive to the macroeconomic environment, would retreat toward its critical support zone of 1,600–1,700 points.

Second case: a limited technical pivot.

The Fed might opt for just one rate cut in September or October, justified by a temporary adjustment to the labor market. In this case, markets would not see it as a strong easing signal but rather as a circumstantial gesture. Result: the S&P 500 would decline toward the 6,000–6,100 area, with a parallel correction of the Russell 2000 around 2,000 points.

Third case: a real and healthy pivot.

This is the most favorable scenario for Wall Street. Disinflation is confirmed near 2%, employment remains under control, and the Fed initiates a genuine rate-cutting cycle starting in September or October. In this context, the underlying bullish trend would regain full strength: the S&P 500 would head toward 6,700–7,000 points, while the Russell 2000 would break out of its consolidation to surpass its November 2021 record.

Fourth case: an unhealthy pivot.

Here, the Fed cuts rates in a more fragile environment: inflation remains near 3%, but it is primarily labor market deterioration that drives the decision. Markets could still find support from lower credit costs. The S&P 500 would preserve its former record at 6,200 points and likely aim for 6,700 points. The Russell 2000, more sensitive to financing conditions, would fully benefit from this easing, also surpassing its 2021 high.

Fifth case: the emergency Fed Put.

Finally, in the darkest scenario, a shock to employment would trigger a brutal Fed intervention, with a “jumbo cut” and a series of rapid rate reductions. While this support might contain the recession, the immediate reaction would be a sharp drop: the S&P 500 would plunge into bear market territory before a potential recovery tied to monetary easing. The Russell 2000 would follow the same trajectory.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.