Volatility, expressed through standard deviation, quantifies market elasticity and presents a level of probability and precision that humbles us all.

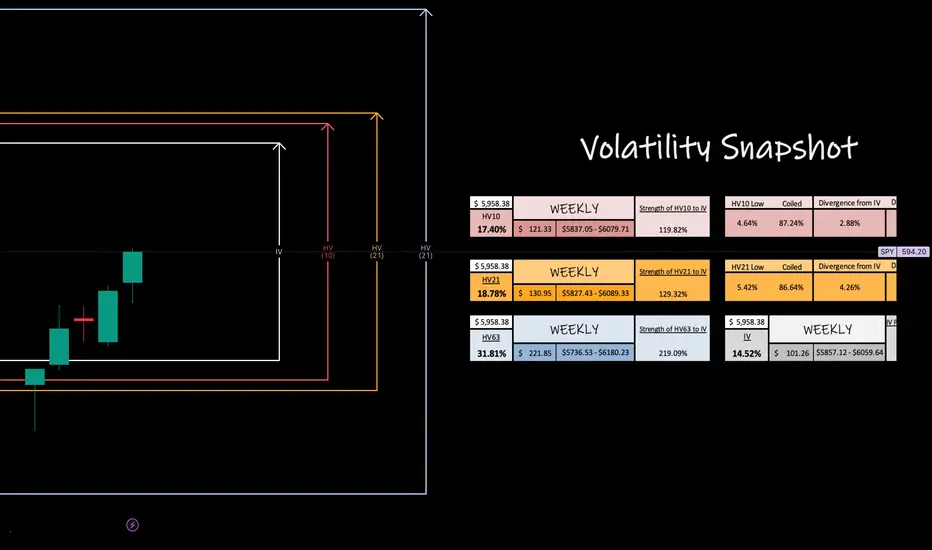

This week with SPY bi-weekly trends have risen to just below our monthly values and are currently expansive over the markets IV prediction. Right now as I see it, HV10 is going resonate alongside our monthly values showing continued strength over IV. We could full regression to quarterly means as we move our of corrective territory then see consolidation to cool the markets down.

SPY bi-weekly trends have risen to just below our monthly values and are currently expansive over the markets IV prediction. Right now as I see it, HV10 is going resonate alongside our monthly values showing continued strength over IV. We could full regression to quarterly means as we move our of corrective territory then see consolidation to cool the markets down.

BOOST the post, drop a follow and comment, BUT don't forget to circle back at the end of the week to revisit and observe how our trending markets preformed!

This week with

BOOST the post, drop a follow and comment, BUT don't forget to circle back at the end of the week to revisit and observe how our trending markets preformed!

تم إغلاق الصفقة يدويًا

The broader markets increased in volatility throughout the week after gapping up by continuing to sell off past monthly trending values but falling short of quarterly means. With going into a short week we might be looking at consolidation after the V recovery out of correction.Dive deeper into the world of volatility with me — Post a comment, ask a question, and BOOST the post if you’d like.

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

Dive deeper into the world of volatility with me — Post a comment, ask a question, and BOOST the post if you’d like.

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.