We present you with our selection from the open-source indicators published this month on TradingView. These scripts are the ones that caught our attention while analyzing the two thousand or so scripts published each month in TradingView's Public Library, the greatest repository of indicators in the world. If we missed any, please let us know.

This superb body of work constitutes unmistakable proof of the liveliness, ingenuity, and relentless creativity of the generous traders/programmers who not only give their time to write amazing scripts, but share their code with the world. Kudos to these very special humans.

Enjoy!

LSMA - A Fast And Simple Alternative Calculation

alexgrover's code is often so compact it's often difficult to believe it does everything it does. It is also among the fastest Pine code you will find in the Public Library. Here, he reinvents the calculation of the least squares moving average.

Extrapolated Pivot Connector - Lets Make Support And Resistances

alexgrover's take on Support & Resistance.

Hancock - RSI Volume

ahancock uses volume instead of price to calculate an RSI line.

Grover Llorens Activator Strategy Analysis

alexgrover makes a model presentation of a strategy.

BERLIN Range Index | Bar color version

lejmer comes up with an original way of spotting trending/ranging markets.

Average Volume at Time (AVAT)

danilogalisteu cumulates volume for a user-specified period of time. Well done.

Congestion Index by Katsanos

ceyhun publishes a Katsanos (inventor or VFI) indicator aiming to distinguish ranging and trending markets.

Function Highest/Lowest

RicardoSantos, the Pine Maestro, updates his famous highest/lowest functions to v4, and gives us 2 different flavors to chose from.

How To Set Backtest Time Ranges

allanster presents code to filter strategy entries/exits by date AND time periods.

Time Series Lag Reduction Filter

theheirophant gives us a lag-reduction technique here.

Volatility Stop MTF

TradingView publishes a multi-timeframe version of admin's Volatility Stop.

BEST Dollar Cost Average

Daveatt creates a script to help traders DCA.

Reflex & Trendflex

e2e4mfck brings us a version of two new Ehlers indicators, and...

![[e2] Reflex & Trendflex](https://s3.tradingview.com/6/6tSfPE3W_mid.png)

Reflex Oscillator - Dr. John Ehlers

midtownsk8rguy also publishes his take on them, in two separate packages.

Workaround for Arrays in pine and Bubble sort

MichelT comes up with a super ingenious workaround to implement an array in Pine. He also published other examples.

This superb body of work constitutes unmistakable proof of the liveliness, ingenuity, and relentless creativity of the generous traders/programmers who not only give their time to write amazing scripts, but share their code with the world. Kudos to these very special humans.

Enjoy!

LSMA - A Fast And Simple Alternative Calculation

alexgrover's code is often so compact it's often difficult to believe it does everything it does. It is also among the fastest Pine code you will find in the Public Library. Here, he reinvents the calculation of the least squares moving average.

Extrapolated Pivot Connector - Lets Make Support And Resistances

alexgrover's take on Support & Resistance.

Hancock - RSI Volume

ahancock uses volume instead of price to calculate an RSI line.

Grover Llorens Activator Strategy Analysis

alexgrover makes a model presentation of a strategy.

BERLIN Range Index | Bar color version

lejmer comes up with an original way of spotting trending/ranging markets.

Average Volume at Time (AVAT)

danilogalisteu cumulates volume for a user-specified period of time. Well done.

Congestion Index by Katsanos

ceyhun publishes a Katsanos (inventor or VFI) indicator aiming to distinguish ranging and trending markets.

Function Highest/Lowest

RicardoSantos, the Pine Maestro, updates his famous highest/lowest functions to v4, and gives us 2 different flavors to chose from.

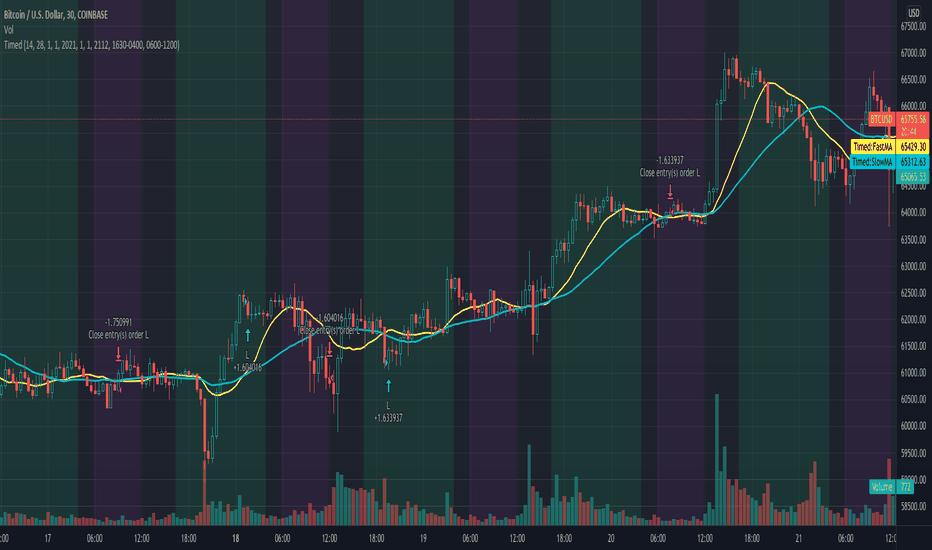

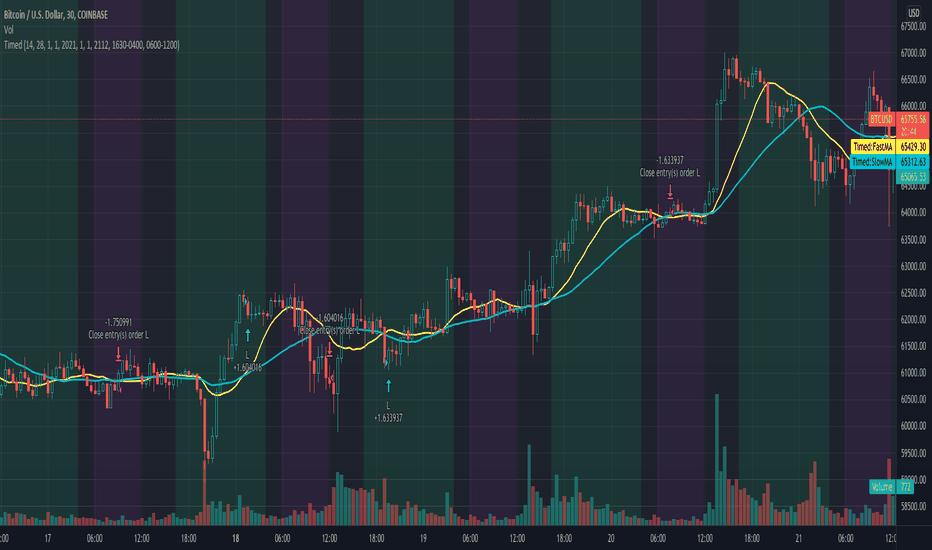

How To Set Backtest Time Ranges

allanster presents code to filter strategy entries/exits by date AND time periods.

Time Series Lag Reduction Filter

theheirophant gives us a lag-reduction technique here.

Volatility Stop MTF

TradingView publishes a multi-timeframe version of admin's Volatility Stop.

BEST Dollar Cost Average

Daveatt creates a script to help traders DCA.

Reflex & Trendflex

e2e4mfck brings us a version of two new Ehlers indicators, and...

![[e2] Reflex & Trendflex](https://s3.tradingview.com/6/6tSfPE3W_mid.png)

Reflex Oscillator - Dr. John Ehlers

midtownsk8rguy also publishes his take on them, in two separate packages.

Workaround for Arrays in pine and Bubble sort

MichelT comes up with a super ingenious workaround to implement an array in Pine. He also published other examples.

Who are PineCoders? tradingview.com/chart/SSP/yW5eOqtm-Who-are-PineCoders/

Tools and ideas for all Pine coders: pinecoders.com

Tools and ideas for all Pine coders: pinecoders.com

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

Who are PineCoders? tradingview.com/chart/SSP/yW5eOqtm-Who-are-PineCoders/

Tools and ideas for all Pine coders: pinecoders.com

Tools and ideas for all Pine coders: pinecoders.com

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.