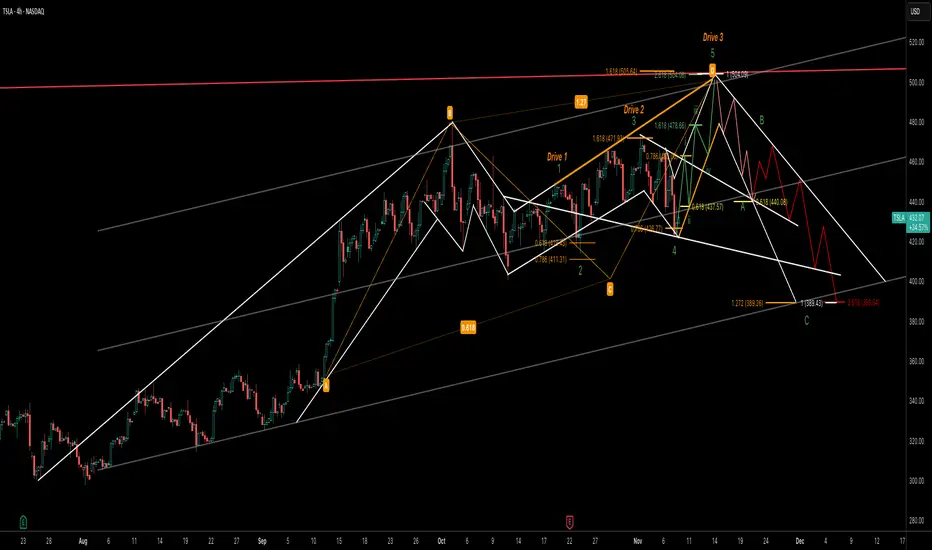

This chart highlights multiple harmonic and Elliott structures aligning for a potential bullish extension in Tesla (TSLA). A well-defined ABCD pattern and 3-Drive pattern suggest momentum building toward the $500 zone, supported by Fibonacci projections and channel resistance.

The current wave structure points to an imminent 5-wave advance, likely completing the “Drive 3” and pattern D confluence area near $500–505. Following that move, a corrective pullback (ABC) is anticipated, possibly retesting prior support near $440–400.

Key elements featured:

ABCD completion zone: around $500

3-Drive pattern: confirming exhaustion at upper trendline

Elliott 5-wave projection: short-term bullish continuation

Possible corrective phase: after the final wave up

📈 Watching for confirmation of Wave iii and potential exhaustion signals near $500 before considering downside setups.

The current wave structure points to an imminent 5-wave advance, likely completing the “Drive 3” and pattern D confluence area near $500–505. Following that move, a corrective pullback (ABC) is anticipated, possibly retesting prior support near $440–400.

Key elements featured:

ABCD completion zone: around $500

3-Drive pattern: confirming exhaustion at upper trendline

Elliott 5-wave projection: short-term bullish continuation

Possible corrective phase: after the final wave up

📈 Watching for confirmation of Wave iii and potential exhaustion signals near $500 before considering downside setups.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.