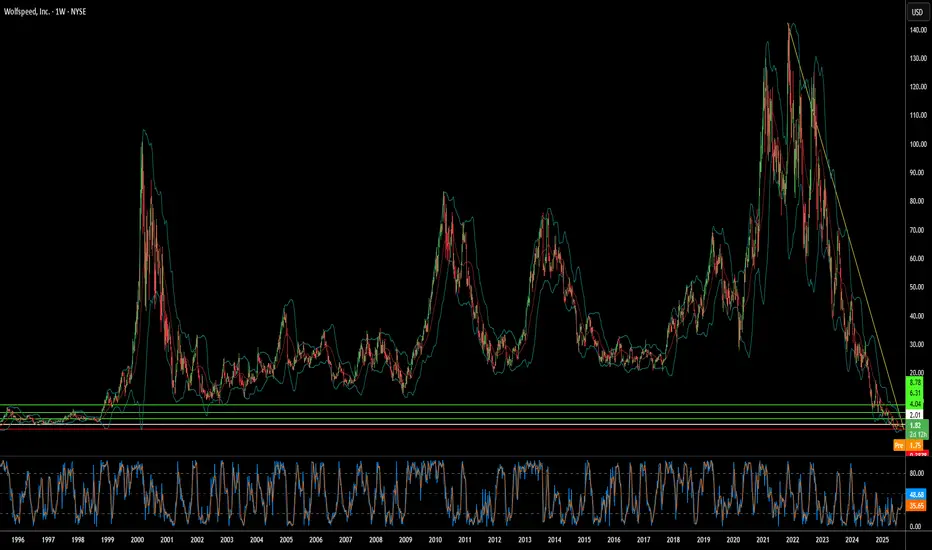

Wolfspeed's dramatic 60% stock surge following court approval of its Chapter 11 restructuring plan signals a potential turning point for the struggling semiconductor company. The bankruptcy resolution eliminates 70% of Wolfspeed's $6.5 billion debt burden and reduces interest obligations by 60%, freeing up billions in cash flow for operations and new fabrication facilities. With 97% creditor support backing the plan, investors appear confident that the financial overhang has been cleared, positioning the company for a cleaner emergence from bankruptcy.

The company's recovery prospects are bolstered by its leadership position in silicon carbide (SiC) technology, a critical component for electric vehicles and renewable energy systems. Wolfspeed's unique capability to produce 200mm SiC wafers at scale, combined with its vertically integrated supply chain and substantial patent portfolio, provides competitive advantages in a rapidly growing market. Global EV sales exceeded 17 million units in 2024, with projections of 20-30% annual growth, while each new electric vehicle requires more SiC chips for improved efficiency and faster charging capabilities.

Geopolitical factors further strengthen Wolfspeed's strategic position, with the U.S. CHIPS Act providing up to $750 million in funding for domestic SiC manufacturing capacity. As the U.S. government classifies silicon carbide as critical for national security and clean energy, Wolfspeed's fully domestic supply chain becomes increasingly valuable amid rising export controls and cybersecurity concerns. However, the company faces intensifying competition from well-funded Chinese rivals, including a new Wuhan facility capable of producing 360,000 SiC wafers annually.

Despite these favorable tailwinds, significant risks remain that could derail the recovery. Current shareholders face severe dilution, retaining only 3-5% of the restructured equity, while execution challenges persist regarding ramping the novel 200mm fabrication technology. The company continues operating at a loss with high enterprise value relative to current financial performance, and expanding global SiC capacity from competitors threatens to pressure pricing and market share. Wolfspeed's turnaround represents a high-stakes bet on whether technological leadership and strategic government support can overcome financial restructuring challenges in a competitive marketplace.

The company's recovery prospects are bolstered by its leadership position in silicon carbide (SiC) technology, a critical component for electric vehicles and renewable energy systems. Wolfspeed's unique capability to produce 200mm SiC wafers at scale, combined with its vertically integrated supply chain and substantial patent portfolio, provides competitive advantages in a rapidly growing market. Global EV sales exceeded 17 million units in 2024, with projections of 20-30% annual growth, while each new electric vehicle requires more SiC chips for improved efficiency and faster charging capabilities.

Geopolitical factors further strengthen Wolfspeed's strategic position, with the U.S. CHIPS Act providing up to $750 million in funding for domestic SiC manufacturing capacity. As the U.S. government classifies silicon carbide as critical for national security and clean energy, Wolfspeed's fully domestic supply chain becomes increasingly valuable amid rising export controls and cybersecurity concerns. However, the company faces intensifying competition from well-funded Chinese rivals, including a new Wuhan facility capable of producing 360,000 SiC wafers annually.

Despite these favorable tailwinds, significant risks remain that could derail the recovery. Current shareholders face severe dilution, retaining only 3-5% of the restructured equity, while execution challenges persist regarding ramping the novel 200mm fabrication technology. The company continues operating at a loss with high enterprise value relative to current financial performance, and expanding global SiC capacity from competitors threatens to pressure pricing and market share. Wolfspeed's turnaround represents a high-stakes bet on whether technological leadership and strategic government support can overcome financial restructuring challenges in a competitive marketplace.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.