🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 High/Close: $4,024.9 → ~$4,003 — sellers faded upticks; weekly close soft but back above the round $4k.

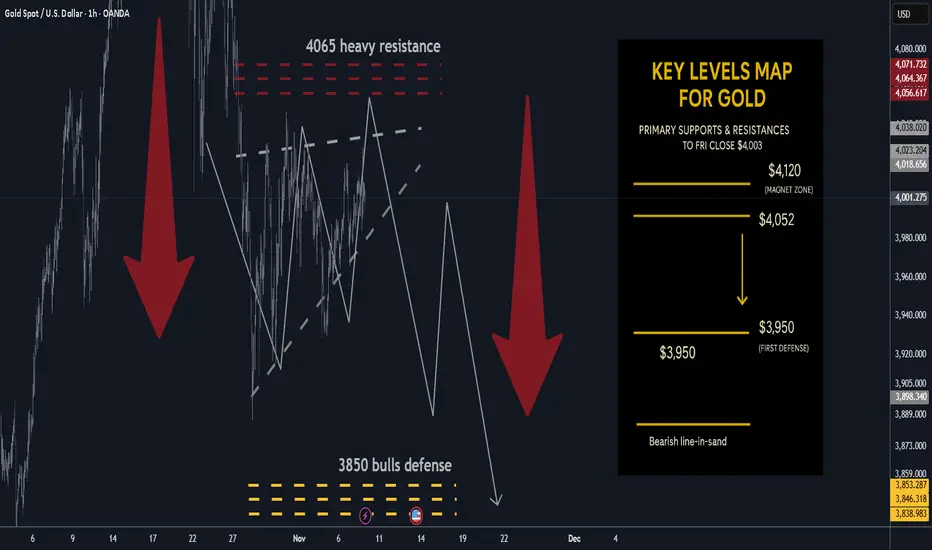

📈 Trend: Neutral / mild correction inside range; not expecting immediate new highs while <$4,080–4,120.

🛡 Supports: $3,950 → $3,900 → $3,850 — pivotal shelves for bears’ take-profit and control.

🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply zones; first taps favored for fades.

🧭 Bias next week: Short sells into $4,040–$4,120; TP $3,950 then $3,850 (your plan). Invalidation on sustained reclaim > $4,120–$4,175; loss of $3,850 risks extension lower.

🌍 Macro tailwinds/headwinds (this week’s tape):

• Narrative tone: Kitco flagged “razor’s edge” near $4,000 with mixed views (bubble vs. consolidation), while another Kitco piece framed the stall as a “healthy pause.”

• WSJ flow: Headlines oscillated between “slips below $4,000” and modest up-days; net read is consolidation around $4k with quick two-way trade.

• Levels: Spot finished the week essentially on $4k; intrawEEK high couldn’t clear early-week $4.02–4.03k cap.

🎯 Street view: After last month’s print above $4,000 (first ever), WSJ tone shifted to digestion; rallies still attract supply until a decisive reclaim of upper resistance.

________________________________________

🔝 Key Resistance Zones

• $4,040 — immediate ceiling; weekly high proximity, likely to cap first tests.

• $4,080 — secondary supply ledge from recent failures.

• $4,120 — upper band; acceptance above here starts to neutralize the correction.

🛡 Support Zones

• $3,950 — first defense / first TP.

• $3,900 — round-number shelf; loss invites momentum probes.

• $3,850 — critical structural base and second TP; break risks downside acceleration.

________________________________________

⚖️ Base Case Scenario

Compression within a rising-wedge-like structure, ranging $3,850–$4,120. First pushes into $4,040–$4,120 are sellable for rotations toward $3,950 → $3,850 while the market respects weekly lower highs.

🚀 Breakout / Breakdown Triggers

• Bull trigger: Sustained acceptance > ~$4,120–$4,175 turns the tone constructive again and reopens $4,200+.

• Bear trigger: Daily close < $3,900 increases odds of full $3,850 test; failure of $3,850 risks momentum spill.

💡 Market Drivers to watch

• Fed path / real yields (rate-cut odds vs. sticky inflation narrative in WSJ copy).

• USD swings (no broad USD weakness → upside attempts stall).

• ETF/CB flows (Kitco interviews highlight split sentiment; dip-buyers active, momentum players cautious).

• Event risk (headline sensitivity remains high; quick squeezes into resistance possible).

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,120–$4,175 (sustained).

• Bearish below: $3,900 → $3,850 (risk expands under $3,850).

🧭 Strategy for this week

Short from resistance: Scale in around $4,040 → $4,080 → $4,120;

TP #1: $3,950; TP #2: $3,850;

Risk: Hard stop on a daily close above $4,120 (or intraday breach that holds on retest). Consider trimming if a news-driven squeeze tags $4,175 and fails.

🏆 High/Close: $4,024.9 → ~$4,003 — sellers faded upticks; weekly close soft but back above the round $4k.

📈 Trend: Neutral / mild correction inside range; not expecting immediate new highs while <$4,080–4,120.

🛡 Supports: $3,950 → $3,900 → $3,850 — pivotal shelves for bears’ take-profit and control.

🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply zones; first taps favored for fades.

🧭 Bias next week: Short sells into $4,040–$4,120; TP $3,950 then $3,850 (your plan). Invalidation on sustained reclaim > $4,120–$4,175; loss of $3,850 risks extension lower.

🌍 Macro tailwinds/headwinds (this week’s tape):

• Narrative tone: Kitco flagged “razor’s edge” near $4,000 with mixed views (bubble vs. consolidation), while another Kitco piece framed the stall as a “healthy pause.”

• WSJ flow: Headlines oscillated between “slips below $4,000” and modest up-days; net read is consolidation around $4k with quick two-way trade.

• Levels: Spot finished the week essentially on $4k; intrawEEK high couldn’t clear early-week $4.02–4.03k cap.

🎯 Street view: After last month’s print above $4,000 (first ever), WSJ tone shifted to digestion; rallies still attract supply until a decisive reclaim of upper resistance.

________________________________________

🔝 Key Resistance Zones

• $4,040 — immediate ceiling; weekly high proximity, likely to cap first tests.

• $4,080 — secondary supply ledge from recent failures.

• $4,120 — upper band; acceptance above here starts to neutralize the correction.

🛡 Support Zones

• $3,950 — first defense / first TP.

• $3,900 — round-number shelf; loss invites momentum probes.

• $3,850 — critical structural base and second TP; break risks downside acceleration.

________________________________________

⚖️ Base Case Scenario

Compression within a rising-wedge-like structure, ranging $3,850–$4,120. First pushes into $4,040–$4,120 are sellable for rotations toward $3,950 → $3,850 while the market respects weekly lower highs.

🚀 Breakout / Breakdown Triggers

• Bull trigger: Sustained acceptance > ~$4,120–$4,175 turns the tone constructive again and reopens $4,200+.

• Bear trigger: Daily close < $3,900 increases odds of full $3,850 test; failure of $3,850 risks momentum spill.

💡 Market Drivers to watch

• Fed path / real yields (rate-cut odds vs. sticky inflation narrative in WSJ copy).

• USD swings (no broad USD weakness → upside attempts stall).

• ETF/CB flows (Kitco interviews highlight split sentiment; dip-buyers active, momentum players cautious).

• Event risk (headline sensitivity remains high; quick squeezes into resistance possible).

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,120–$4,175 (sustained).

• Bearish below: $3,900 → $3,850 (risk expands under $3,850).

🧭 Strategy for this week

Short from resistance: Scale in around $4,040 → $4,080 → $4,120;

TP #1: $3,950; TP #2: $3,850;

Risk: Hard stop on a daily close above $4,120 (or intraday breach that holds on retest). Consider trimming if a news-driven squeeze tags $4,175 and fails.

ملاحظة

🏆 GOLD WEEKLY OUTLOOK — RANGE COMPRESSION PLAY💰 $4,024 → $4,003 — Weekly close steady above $4k; sellers capped upside.

⚖️ Trend: Neutral / corrective; range-bound under $4,080–$4,120.

🏗 Structure: Rising wedge compression — momentum fading.

🎯 Strategy: Short $4,040–$4,120; targets $3,950 → $3,850.

🧱 Supports: $3,950 / $3,900 / $3,850 — bears’ take-profit zones.

🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply caps.

🌍 Macro tone: WSJ & Kitco — “consolidation near $4k,” real yields firm, USD mixed.

🔥 Bear trigger: Daily close < $3,900 → opens $3,850 test.

🚀 Bull trigger: Sustained > $4,120–$4,175 → reversal risk.

🧭 Bias: Sell strength, stay nimble; rising wedge = fade rallies, book profits on dips.

ملاحظة

🎁Please hit the like button and🎁Leave a comment to support our team!

ملاحظة

let me know your thoughts on the above in the comments section 🔥🏧🚀ملاحظة

🪙 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE🏆 High/Close: $4,244 → $4,085 — wide-range week but close comfortably above $4,000, confirming buyers defended the key psychological pivot.

📉 Trend: Uptrend moderates after testing fresh highs; momentum cooling yet structure remains constructive above $4,000. Bulls still in control but losing short-term traction.

🛡 Supports: $4,000 / $3,960 / $3,920 — the $4,000 zone is now first-line defense; sustained closes below would weaken near-term tone.

🚧 Resistances: $4,200 / $4,225 / $4,250 — upper boundary of current range; breakout attempts likely fade into offers unless macro catalyst emerges.

🧭 Bias next week: Neutral → Range-bound. Expect consolidation between $4,000 and $4,250. Dip-buyers active near $4,000, but upside likely capped by profit-taking into $4,240–$4,250. A daily close below $4,000 turns bias short-term bearish toward $3,950; close above $4,250 revives momentum to $4,300+.

ملاحظة

🏅 GOLD WEEKLY SUMMARY — SHORT THE RIPS🪙 Trend: Uptrend intact long-term, but near-term tape turning distributive.

🏔️ Key Sell Zone: $4,220–$4,320 — prime area to short rips into supply.

🐻 Bear Liquidity: $4,350 (fresh liquidity) → expect rejection / reversal.

📉 Stretch Stop-Run: $4,380 — only hit on squeeze; short bias still valid below here.

📊 Downside Targets: $4,060 → $4,000 → $3,960.

🛡️ Major Support: $3,930–$3,940 bullish block (HTF buyers defend).

⛔ Bear Expansion: Break below $3,930 = opens $3,880–$3,850.

💱 Macro: Lower real yields + softer USD = supportive but not enough to chase highs.

🏦 Flows: Strong central-bank buying keeps floor firm but upside crowded.

🎯 Strategy: Fade all strength into $4,220–$4,350; take profits down into $4,060–$3,960.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.