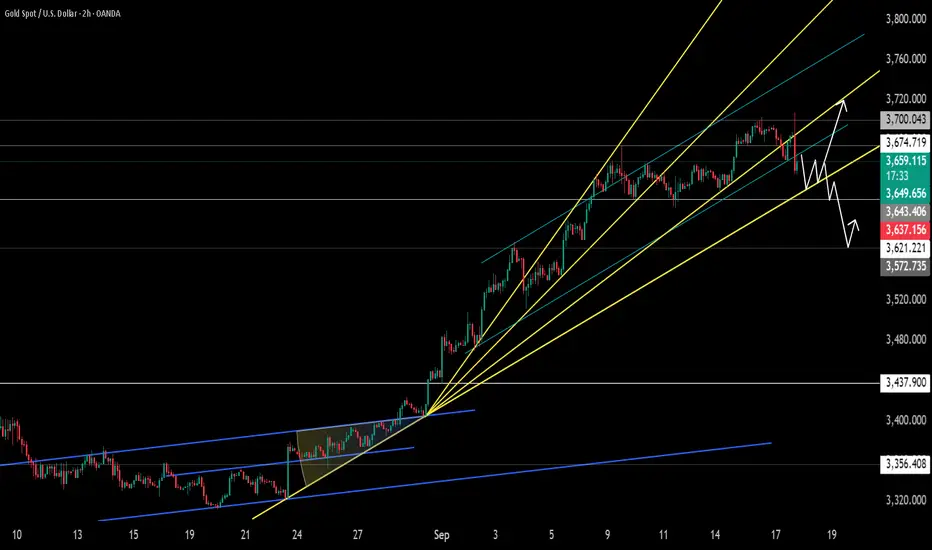

Analysis of the Most Likely Future Gold Price Trend

Watch for fluctuations above $3,600.

Based on the combination of expected rate cuts and hawkish dot plot guidance, the gold market logic has shifted:

Short-term trend:

Technical adjustments and downward volatility.

The market needs to digest the impact of a hawkish stance and previous heavy profit-taking.

The most likely trend for gold prices is a repeated struggle around the $3,600 mark.

If $3,600 is effectively broken, gold prices will fall further to $3,570-3,580 (50-day moving average) for support, and may even test $3,550.

A rebound would be an opportunity to short on rallies, not the start of a trend reversal.

The main resistance level for the rebound is around $3,620.

Summary: The Fed's tough rate cuts have dealt a heavy blow to gold bulls. The short-term technical outlook has turned bearish, and gold prices are entering a correction.

In terms of operations, we should shift from the previous "buy on dips" approach to "short on rebounds" and pay close attention to the rise and fall of the key level of $3,600.

Watch for fluctuations above $3,600.

Based on the combination of expected rate cuts and hawkish dot plot guidance, the gold market logic has shifted:

Short-term trend:

Technical adjustments and downward volatility.

The market needs to digest the impact of a hawkish stance and previous heavy profit-taking.

The most likely trend for gold prices is a repeated struggle around the $3,600 mark.

If $3,600 is effectively broken, gold prices will fall further to $3,570-3,580 (50-day moving average) for support, and may even test $3,550.

A rebound would be an opportunity to short on rallies, not the start of a trend reversal.

The main resistance level for the rebound is around $3,620.

Summary: The Fed's tough rate cuts have dealt a heavy blow to gold bulls. The short-term technical outlook has turned bearish, and gold prices are entering a correction.

In terms of operations, we should shift from the previous "buy on dips" approach to "short on rebounds" and pay close attention to the rise and fall of the key level of $3,600.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.