🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 Swing High / Swing Low

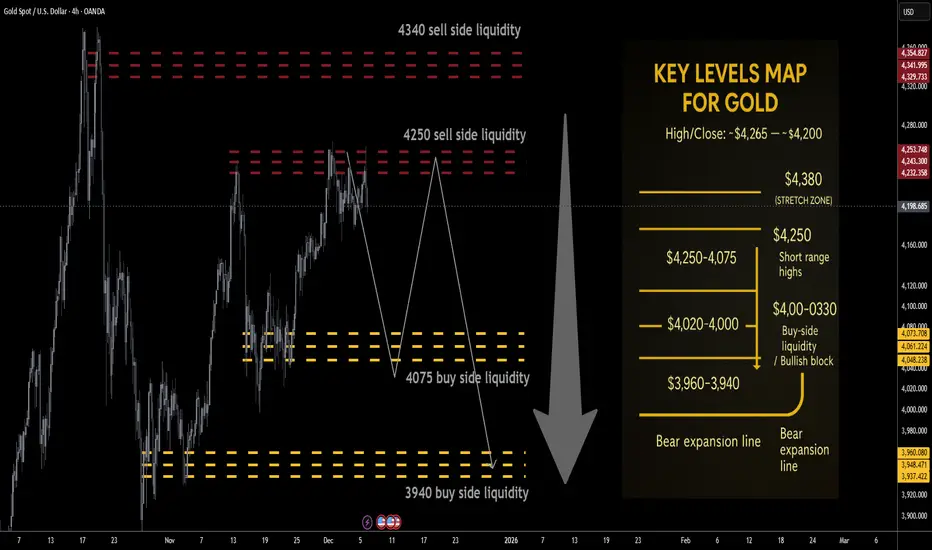

$4,265 → ~$4,164 — clean rejection from the 4,26x breakout zone with a long upper wick, but weekly close still near $4,200, keeping price pinned in the upper part of the broader $4k range.

📈 Trend

Higher-timeframe: Structural bull trend intact while price holds above the $3,940–$4,000 block.

Tactical: Last week’s failed extension above $4,250 and the close back near $4,200 tilt the tape into distributive mode:

Rallies into $4,250 / $4,340 = sell-side liquidity magnets.

Downside liquidity sits lower at $4,075 / $3,940, making upside risk/reward look asymmetric to the downside from current levels.

🛡 Supports – Buy-Side Liquidity / Downside Objectives

$4,130–$4,100:

Short-term intraday pivot where buyers repeatedly stepped in last week; first micro-reaction zone on any flush.

$4,090–$4,075 🟢 Buy-side liquidity #1

First true BSL pocket below the close; ideal TP1 for shorts from above and a spot where responsive dip-buyers are likely to probe.

$4,020–$4,000:

Psychological shelf; loss of 4k would confirm that local distribution is winning and open the deeper BSL run.

$3,960–$3,940 🟢 Buy-side liquidity #2 / structural block

Higher-timeframe demand and key liquidity magnet for a fuller corrective leg. A sustained break/acceptance below $3,940 would signal that the 2025 blow-off is transitioning into broader mean-reversion rather than shallow consolidation.

🚧 Resistances – Sell-Side Liquidity / Short-Side Focus

$4,220–$4,250 🔴 Sell-side liquidity #1

First overhead supply from the prior week’s failed breakout structure and just under recent highs. Clean area for “sell the rip” probes and for late longs to de-risk.

$4,300–$4,340 🔴 Sell-side liquidity #2

Extension / SLI pocket aligned with the upper part of last week’s range and just below the prior $4,38x–$4,40x all-time high band. Ideal for scaling adds if a news-driven squeeze runs stops above 4,250.

Stretch: $4,380–$4,400:

Prior record spike / stop-run area; only expected on a full-on squeeze into the Fed, but a tag here would likely be exhaustion rather than a new sustainable trend leg higher.

🧭 Bias Next Week

Base tactical bias: fade strength / short rallies, not chase upside.

the tape favors a liquidity grab higher → rotation lower scenario:

Look for wicks into $4,220–$4,340 to be sold.

Downside path of least resistance: $4,090–$4,075 → $4,020–$4,000 → $3,960–$3,940.

⚖️ Base Case Scenario

Open/early week:

Price opens near $4,200 and either trades flat or spikes briefly into $4,220–$4,250 on weekend gap/early flow.

Liquidity sweep into resistance:

Rejection from SLI:

Failure to accept above $4,250/4,300 leaves upper wicks on 4H/daily, signaling distribution.

Rotation into BSL:

First objective: $4,090–$4,075 (TP1)

Secondary objective: $4,020–$4,000 (TP2)

Stretch / full flush: $3,960–$3,940 (TP3) into the structural demand block and buy-side liquidity pocket.

🚀 Breakout / Invalidation Trigger

Bearish framework invalidation:

A strong daily/weekly acceptance above $4,380 would imply shorts caught offside and re-open the path toward $4,450+ in line with the higher Street targets for 2026.

In that case, shift from short-the-rip → neutral / buy shallow pullbacks until a new top structure forms.

🔓 Bull / Bear Trigger Lines

Structural bull line:

Above $3,940–$4,000: long-term bull structure remains intact. Even if you’re tactically short, treat deep moves into this area with respect – this is where higher-timeframe players are likely to re-accumulate.

Bear expansion line:

Below $3,940: opens scope for a faster liquidation wave toward $3,880–$3,850 and potentially a broader 2025–26 consolidation phase instead of immediate continuation higher.

🧭 Recommended Strategy – Short at Market Open

⚠️ Illustrative trade plan, not financial advice. Size and risk-manage according to your own rules.

1️⃣ Primary Short – Open + Fade the Rips

Short at/near market open around the $4,195–$4,210 zone if price opens below $4,220 and orderflow confirms rejection of higher bids.

Add / build zones:

Add 1: into $4,220–$4,250 (first SLI band / prior breakout zone).

Add 2 (only if spike): $4,300–$4,340 (second SLI; look for clear blow-off / stop-run behavior before loading the last clip).

Stops / invalidation:

Tactical stop: hard stop above $4,380.

More conservative: soft line at $4,340, hard stop $4,390–$4,400 to allow for intraday wicks.

Targets (aligned with buy-side liquidity):

TP1: $4,090–$4,075 → take partials and reduce risk.

TP2: $4,020–$4,000 → core target for the week if distribution plays out.

TP3: $3,960–$3,940 → full BSL sweep into structural demand; expect responsive buying attempts here.

🏆 Swing High / Swing Low

$4,265 → ~$4,164 — clean rejection from the 4,26x breakout zone with a long upper wick, but weekly close still near $4,200, keeping price pinned in the upper part of the broader $4k range.

📈 Trend

Higher-timeframe: Structural bull trend intact while price holds above the $3,940–$4,000 block.

Tactical: Last week’s failed extension above $4,250 and the close back near $4,200 tilt the tape into distributive mode:

Rallies into $4,250 / $4,340 = sell-side liquidity magnets.

Downside liquidity sits lower at $4,075 / $3,940, making upside risk/reward look asymmetric to the downside from current levels.

🛡 Supports – Buy-Side Liquidity / Downside Objectives

$4,130–$4,100:

Short-term intraday pivot where buyers repeatedly stepped in last week; first micro-reaction zone on any flush.

$4,090–$4,075 🟢 Buy-side liquidity #1

First true BSL pocket below the close; ideal TP1 for shorts from above and a spot where responsive dip-buyers are likely to probe.

$4,020–$4,000:

Psychological shelf; loss of 4k would confirm that local distribution is winning and open the deeper BSL run.

$3,960–$3,940 🟢 Buy-side liquidity #2 / structural block

Higher-timeframe demand and key liquidity magnet for a fuller corrective leg. A sustained break/acceptance below $3,940 would signal that the 2025 blow-off is transitioning into broader mean-reversion rather than shallow consolidation.

🚧 Resistances – Sell-Side Liquidity / Short-Side Focus

$4,220–$4,250 🔴 Sell-side liquidity #1

First overhead supply from the prior week’s failed breakout structure and just under recent highs. Clean area for “sell the rip” probes and for late longs to de-risk.

$4,300–$4,340 🔴 Sell-side liquidity #2

Extension / SLI pocket aligned with the upper part of last week’s range and just below the prior $4,38x–$4,40x all-time high band. Ideal for scaling adds if a news-driven squeeze runs stops above 4,250.

Stretch: $4,380–$4,400:

Prior record spike / stop-run area; only expected on a full-on squeeze into the Fed, but a tag here would likely be exhaustion rather than a new sustainable trend leg higher.

🧭 Bias Next Week

Base tactical bias: fade strength / short rallies, not chase upside.

the tape favors a liquidity grab higher → rotation lower scenario:

Look for wicks into $4,220–$4,340 to be sold.

Downside path of least resistance: $4,090–$4,075 → $4,020–$4,000 → $3,960–$3,940.

⚖️ Base Case Scenario

Open/early week:

Price opens near $4,200 and either trades flat or spikes briefly into $4,220–$4,250 on weekend gap/early flow.

Liquidity sweep into resistance:

Rejection from SLI:

Failure to accept above $4,250/4,300 leaves upper wicks on 4H/daily, signaling distribution.

Rotation into BSL:

First objective: $4,090–$4,075 (TP1)

Secondary objective: $4,020–$4,000 (TP2)

Stretch / full flush: $3,960–$3,940 (TP3) into the structural demand block and buy-side liquidity pocket.

🚀 Breakout / Invalidation Trigger

Bearish framework invalidation:

A strong daily/weekly acceptance above $4,380 would imply shorts caught offside and re-open the path toward $4,450+ in line with the higher Street targets for 2026.

In that case, shift from short-the-rip → neutral / buy shallow pullbacks until a new top structure forms.

🔓 Bull / Bear Trigger Lines

Structural bull line:

Above $3,940–$4,000: long-term bull structure remains intact. Even if you’re tactically short, treat deep moves into this area with respect – this is where higher-timeframe players are likely to re-accumulate.

Bear expansion line:

Below $3,940: opens scope for a faster liquidation wave toward $3,880–$3,850 and potentially a broader 2025–26 consolidation phase instead of immediate continuation higher.

🧭 Recommended Strategy – Short at Market Open

⚠️ Illustrative trade plan, not financial advice. Size and risk-manage according to your own rules.

1️⃣ Primary Short – Open + Fade the Rips

Short at/near market open around the $4,195–$4,210 zone if price opens below $4,220 and orderflow confirms rejection of higher bids.

Add / build zones:

Add 1: into $4,220–$4,250 (first SLI band / prior breakout zone).

Add 2 (only if spike): $4,300–$4,340 (second SLI; look for clear blow-off / stop-run behavior before loading the last clip).

Stops / invalidation:

Tactical stop: hard stop above $4,380.

More conservative: soft line at $4,340, hard stop $4,390–$4,400 to allow for intraday wicks.

Targets (aligned with buy-side liquidity):

TP1: $4,090–$4,075 → take partials and reduce risk.

TP2: $4,020–$4,000 → core target for the week if distribution plays out.

TP3: $3,960–$3,940 → full BSL sweep into structural demand; expect responsive buying attempts here.

ملاحظة

🏅 GOLD WEEKLY SUMMARY — SHORT THE RIPS

🟡 Clean rejection at $4,26x → $4,164, weekly close near $4,200 keeps gold pinned high.

🟡 Trend still bullish HTF, but tactically distributive below $4,250.

🟡 Sell-side liquidity magnets: $4,220–$4,250 → $4,300–$4,340.

🟡 Buy-side targets: $4,090–$4,075 → $4,020–$4,000 → $3,960–$3,940.

🟡 Bias: fade strength; short rips, don’t chase upside.

🟡 Base path: wick into $4,22x–$4,34x → rotation lower into BSL pockets.

🟡 Invalidation: acceptance > $4,380 = squeeze toward $4,450+.

🟡 Bull line: above $3,940–$4,000 structure intact; buyers defend deep dips.

🟡 Bear line: below $3,940 opens liquidation toward $3,88x–$3,85x.

🟡 Strategy: short near open $4,195–$4,210 → add $4,22x/$4,30x → targets $4,075 / $4,000 / $3,940.

ملاحظة

🎁Please hit the like button and🎁Leave a comment to support our team!

ملاحظة

let me know your thoughts on the above in the comments section 🔥🏧🚀taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.