Gold next week: Key S/R Levels and Outlook for Traders

🏆 Friday’s Close & Recent ATH:

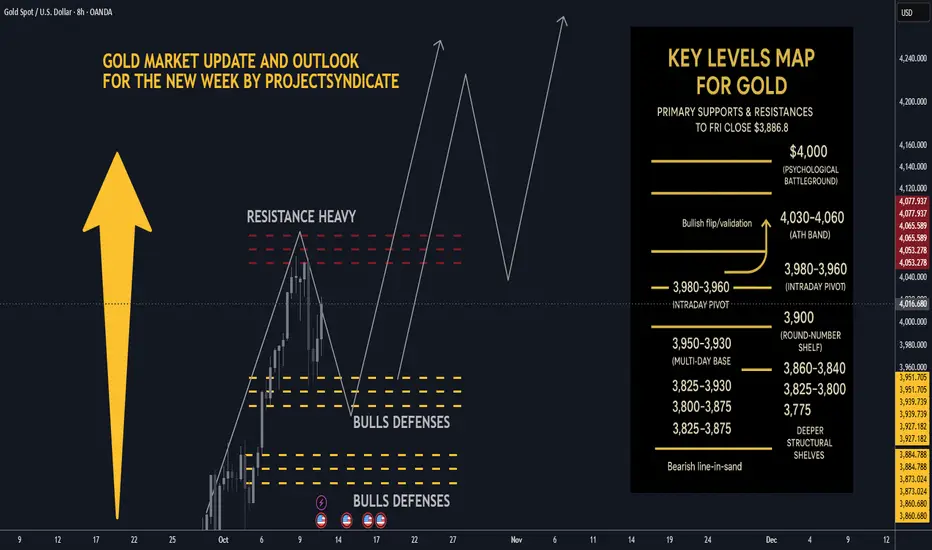

Gold XAUUSD closed Friday around ~$3,990–$4,020/oz depending on venue most consolidated feeds show prints near $3.99–$4.02k at Friday close. The nearest recent intraday highs printed in the $4,030–$4,060 area across data providers this week, putting $4,000 as the immediate psychological battleground and $4,050–$4,060 as the latest short-term ATH band. YTD performance remains extraordinary 2025 YTD still showing a very large gain.

📈 Trend Structure:

Price continues to track a well-defined ascending channel on 1H/4H with clear impulsive legs out of recent consolidations. Market character = higher highs / higher lows, persistent dip-buying, and strong trend adherence into quarter-turn 25/50 handles near round thousands. Momentum has been resilient into week-end despite tariff headlines, suggesting structural demand and participation from official buyers.

🔑 Key Resistance Levels:

The most critical resistances to watch updated from Friday close ≈ $4,000:

• 4000 — immediate psychological round-number battleground.

• 4,030–4,060 — recent intraday ATH band / short-term supply recent highs printed here across venues.

• 4,075 → 4,100 — measured move / extension band if acceptance above the ATH zone occurs.

• 4,150–4,200 — stretch momentum targets on sustained risk-off and break/acceptance above 4,100 structural extension.

Quick note: different data vendors quote small differences in ticks — I used consolidated high prints to identify the ATH band.

🛡️ Support Zones:

Immediate supports step down as follows

• 3,980–3,960 intraday pivot just under Friday close.

• 3,950–3,930 multi-day base / near-week lows.

• 3,900–3,888 round-number shelf and the prior week’s consolidation band.

• Deeper structural shelves: 3,860–3,840, 3,825, 3,800 → 3,775.

A sustained break below ~3,900–3,888 would signal increasing corrective risk; daily close under ~3,825 would more clearly shift the regime.

⚖️ Likely Scenarios:

• Scenario 1 Base Case – Controlled dip toward 3,950–3,930 or the 3,900 area to reload bids, then rotation higher toward 4,030–4,060 as buyers re-engage.

• Scenario 2 Momentum Break – Quick clearance of the 4,030–4,060 ATH band → sustained acceptance above 4,075–4,100, unleashing momentum into 4,150–4,200. Overbought readings exist intraday, but structural demand has kept pullbacks shallow.

📊 Short-Term Targets:

On continuation: 4,020 → 4,030–4,060 → 4,075 → 4,100, with 4,150–4,200 as higher extensions if acceptance holds.

On retrace: 3,980 → 3,950 → 3,930 → 3,900 as the key retrace ladder.

💡 Market Sentiment Drivers updated:

• Tariff shock / geopolitical risk: President Trump announced proposals for large new tariffs reports of a 100% tariff threat and expanded export controls on Chinese imports this week, escalating trade-war risk and knocking risk sentiment — that increases safe-haven demand for gold. News outlets Reuters, AP, WaPo and market reactions were visible Friday.

• Rate & policy expectations: Markets continue to price material odds of rate easing/softer Fed path relative to earlier in the year; that reduces real yields and supports gold. Feeds and FedWatch implied pricing show elevated cut odds that underpin lower opportunity cost for gold.

• Official demand: Central bank buying has remained constructive — WGC/official stats show continued net purchases in recent months monthly buying rebounded in August. This adds structural support to dips.

• Macro/flow: Risk-off from tariff headlines, rare-earth export controls, and supply-chain concerns are the immediate drivers that could catalyze pushes toward the ATH band.

🔄 Retracement Outlook:

A tag of 3,950–3,930 or a short stop-run into 3,900–3,888 would be a typical healthy pullback inside the trend. Fast reclaim of the first support band after a liquidity flush often precedes fresh ATH tests. Breaks under 3,900 that fail to reclaim quickly increase the probability of a deeper slide into the 3,860–3,825 shelf.

🧭 Risk Levels to Watch:

• Bullish structure intact: holding above ~3,950–3,930 or more conservatively, above 3,900 keeps the bull case intact.

• Bearish line-in-sand: daily close < 3,825 weakens trend; daily close < 3,775–3,750 signals a bigger corrective phase and opens lower targets.

🚀 Overall Weekly Outlook:

Gold remains in a strong uptrend with $4,020–$4,030/ATH band $4,030–$4,060 → $4,000 as the immediate battleground after Friday’s close. Expect buyable dips while supports hold; the topside roadmap favors 4,075–4,100 and 4,150–4,200 as measured extensions if the market digests tariff news into a longer-running risk-off regime.

Gold XAUUSD closed Friday around ~$3,990–$4,020/oz depending on venue most consolidated feeds show prints near $3.99–$4.02k at Friday close. The nearest recent intraday highs printed in the $4,030–$4,060 area across data providers this week, putting $4,000 as the immediate psychological battleground and $4,050–$4,060 as the latest short-term ATH band. YTD performance remains extraordinary 2025 YTD still showing a very large gain.

📈 Trend Structure:

Price continues to track a well-defined ascending channel on 1H/4H with clear impulsive legs out of recent consolidations. Market character = higher highs / higher lows, persistent dip-buying, and strong trend adherence into quarter-turn 25/50 handles near round thousands. Momentum has been resilient into week-end despite tariff headlines, suggesting structural demand and participation from official buyers.

🔑 Key Resistance Levels:

The most critical resistances to watch updated from Friday close ≈ $4,000:

• 4000 — immediate psychological round-number battleground.

• 4,030–4,060 — recent intraday ATH band / short-term supply recent highs printed here across venues.

• 4,075 → 4,100 — measured move / extension band if acceptance above the ATH zone occurs.

• 4,150–4,200 — stretch momentum targets on sustained risk-off and break/acceptance above 4,100 structural extension.

Quick note: different data vendors quote small differences in ticks — I used consolidated high prints to identify the ATH band.

🛡️ Support Zones:

Immediate supports step down as follows

• 3,980–3,960 intraday pivot just under Friday close.

• 3,950–3,930 multi-day base / near-week lows.

• 3,900–3,888 round-number shelf and the prior week’s consolidation band.

• Deeper structural shelves: 3,860–3,840, 3,825, 3,800 → 3,775.

A sustained break below ~3,900–3,888 would signal increasing corrective risk; daily close under ~3,825 would more clearly shift the regime.

⚖️ Likely Scenarios:

• Scenario 1 Base Case – Controlled dip toward 3,950–3,930 or the 3,900 area to reload bids, then rotation higher toward 4,030–4,060 as buyers re-engage.

• Scenario 2 Momentum Break – Quick clearance of the 4,030–4,060 ATH band → sustained acceptance above 4,075–4,100, unleashing momentum into 4,150–4,200. Overbought readings exist intraday, but structural demand has kept pullbacks shallow.

📊 Short-Term Targets:

On continuation: 4,020 → 4,030–4,060 → 4,075 → 4,100, with 4,150–4,200 as higher extensions if acceptance holds.

On retrace: 3,980 → 3,950 → 3,930 → 3,900 as the key retrace ladder.

💡 Market Sentiment Drivers updated:

• Tariff shock / geopolitical risk: President Trump announced proposals for large new tariffs reports of a 100% tariff threat and expanded export controls on Chinese imports this week, escalating trade-war risk and knocking risk sentiment — that increases safe-haven demand for gold. News outlets Reuters, AP, WaPo and market reactions were visible Friday.

• Rate & policy expectations: Markets continue to price material odds of rate easing/softer Fed path relative to earlier in the year; that reduces real yields and supports gold. Feeds and FedWatch implied pricing show elevated cut odds that underpin lower opportunity cost for gold.

• Official demand: Central bank buying has remained constructive — WGC/official stats show continued net purchases in recent months monthly buying rebounded in August. This adds structural support to dips.

• Macro/flow: Risk-off from tariff headlines, rare-earth export controls, and supply-chain concerns are the immediate drivers that could catalyze pushes toward the ATH band.

🔄 Retracement Outlook:

A tag of 3,950–3,930 or a short stop-run into 3,900–3,888 would be a typical healthy pullback inside the trend. Fast reclaim of the first support band after a liquidity flush often precedes fresh ATH tests. Breaks under 3,900 that fail to reclaim quickly increase the probability of a deeper slide into the 3,860–3,825 shelf.

🧭 Risk Levels to Watch:

• Bullish structure intact: holding above ~3,950–3,930 or more conservatively, above 3,900 keeps the bull case intact.

• Bearish line-in-sand: daily close < 3,825 weakens trend; daily close < 3,775–3,750 signals a bigger corrective phase and opens lower targets.

🚀 Overall Weekly Outlook:

Gold remains in a strong uptrend with $4,020–$4,030/ATH band $4,030–$4,060 → $4,000 as the immediate battleground after Friday’s close. Expect buyable dips while supports hold; the topside roadmap favors 4,075–4,100 and 4,150–4,200 as measured extensions if the market digests tariff news into a longer-running risk-off regime.

ملاحظة

🎁Please hit the like button and🎁Leave a comment to support our team!

ملاحظة

📊 Friday Close: ~$3,990–$4,020📈 Trend: Strong uptrend — higher highs/lows, dip-buying persists.

🔝 Key Resistances: $4,000 → $4,030–$4,060 (ATH) → $4,075–$4,200

🛡 Supports: $3,980–$3,960 → $3,950–$3,930 → $3,900–$3,888

⚖️ Base Case: Buyable dips toward $3,950–$3,900 before ATH retest.

🚀 Momentum Break: Above $4,060 = $4,100–$4,200 targets.

💡 Drivers: Tariff headlines, softer Fed path, central bank demand.

🧭 Bullish above: $3,900 ✅ | Bearish below: $3,825 ⚠️

📍 Strategy: Accumulate dips >$3,900; target $4,075–$4,200 on breakout.

ملاحظة

pullback possible near market on latest developments butany pullbacks / dips will get scooped up fast no doubt about that

تم فتح الصفقة

4,020 → 4,030–4,060 → 4,075 TP cleared alreadyملاحظة

4,100, with 4,150–4,200 up nextأغلقت الصفقة: تم الوصول للهدف

MOST BULLISH TARGETS ALREADY HIT THIS WEEKملاحظة

4 100 USD TP hit already. 4 150 USD final TP pending.ملاحظة

ALL TARGETS ALREADY HIT FOR THIS WEEK INCLUDING 4 150 USDملاحظة

🏆 Short summary overview💥 Gold ~$4,120/oz — near record highs!

🧭 Fed still in focus: Rate cuts likely into year-end — real yields falling = top bullish driver (9/10).

💵 Dollar soft (~99 DXY): FX tailwind keeps gold bid (8/10).

🏦 Central banks buying: EM demand strong, underpinning prices (8.5/10).

⚔️ U.S.–China tariff escalation: New tariff threats fuel inflation & safe-haven demand (8.5/10).

📈 ETF inflows: Biggest monthly inflows of 2025, Europe leading (7.5/10).

🔄 CTAs & options: Whipsaws near $4,100–$4,200 add short-term volatility (6.5/10).

🏚️ China growth stress & U.S. deficits: Both keep hedge demand alive (6/10).

💍 Jewelry weak, investors strong: Physical demand lags but funds dominate (4.5/10).

🚀 Street targets: BofA & SocGen eye $5,000/oz by 2026 on easing policy & de-dollarization.

📊 Key levels: Support $4,000–$4,100 🔽 | Resistance $4,200–$4,300 🔼 — buy dips while macro tailwinds stay hot.

ملاحظة

all targets hit already this week. stay tuned for future updates.if you made money this week, get subbed for new updates next week.

ملاحظة

NEW ATH PRINTED AT 4 218 USDملاحظة

I've posted about gamma squeeze in gold markets with target at 5 000 usd on September 7th 2025. Fast forward today, we are trading > 4 200 usd already

ملاحظة

🔥 2026 Gold & Silver Supercycle — The Syndicate Metals Playbook 🔥🏛 1️⃣ Parabolic Setup: Gold eyeing $5,500–$6,500/oz by 2026 — 2025 already lit the fuse.

💰 2️⃣ Miner Torque: GDX +123% YTD, gold +51%; leveraged miners (NUGT, JNUG, GDXU) +360–700% — pure rocket fuel.

⚡ 3️⃣ Leverage Engine: Target mix = 60% leveraged (2×/3×) + 40% unlevered exposure.

🔱 4️⃣ Top Performers 2025: GDXU +706%, NUGT +361%, JNUG +394%, AGQ +159%, UGL +125%.

📈 5️⃣ Base Case: Gold +40–60% → portfolio ~+100% potential (if trend smooth).

🚀 6️⃣ Stretch Case: Miners keep over-beta → +200% portfolio upside if 3× exposure compounds cleanly.

🧠 7️⃣ Risk Reality: Leveraged ETFs reset daily — whipsaws hurt. Cap each ETF at 10% max; diversify metals vs. miners.

💎 8️⃣ Allocation Blueprint: 10% each: GDXU, NUGT, JNUG, AGQ, UGL, DGP, GDX, GLD, SIL, SLV (or IAU).

🧭 9️⃣ Execution Tips: Stagger entries, trade liquid hours, rebalance monthly ±3–5%; expect deep pullbacks (>60% on 3×).

⚠️ 🔟 Disclosure: Info only. Leveraged products = high risk, high reward — know your tolerance before chasing gold’s next leg.

ملاحظة

🔱 GOLD WEEKLY OUTLOOK | Spot gold now trades near ATH (~$4,230 USD) — fresh highs, strong bullish breakout above $4,000.

Current Price: ~$4,230 USD (just set new all-time high this week)

📈 Momentum: Bullish thrust — gold broke above $4,000 cleanly; dip buyers remain aggressive.

🔝 Key Resistance Zones:

$4,230–$4,260 (near-ATH cluster)

$4,300–$4,350 (extension target zone)

Above that, $4,400+ is the ambitious breakout ceiling

🛡 Support Zones:

$4,200–$4,170 (near prior breakout retest)

$4,140–$4,100

$4,000–$3,980

⚖️ Base Case Scenario:

Expect shallow pullbacks into $4,170–$4,100 to be bought — then retest ATH zone.

🚀 Breakout Trigger:

A sustained move above ~$4,260 opens room for $4,300 → $4,350+.

💡 Market Drivers:

Geopolitics, Fed rate cut bets, central bank bullion demand, USD softness.

🔓 Bull / Bear Trigger Lines:

Bullish above $4,100–$4,140

Bearish below $4,000–$3,980

🧭 Strategy:

Accumulate on dips above $4,100. Target zones $4,300–$4,350+ on breakout. Maintain tight stops under support.

ملاحظة

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: $4,379 → ~$4,210 — orderly pullback after a vertical run.

📈 Trend: Uptrend intact above $4,000 key psych — dip-buyers still in control.

🛡 Supports: $4,120–$4,080 → $4,000 must hold.

🚧 Resistances: $4,300 / $4,350 / $4,380 → stretch $4,420.

🧭 Bias next week: Buy-the-dip > $4,000; momentum regain targets $4,300–$4,380+. Invalidation < $3,980 → risk $3,920/3,880.

🌍 Macro tailwinds:

• Fed cut odds into Oct 28–29 lift gold; “another 25bp” widely expected.

• DXY sub-99 = FX tailwind

• Record ETF inflows (Sep/Q3); AUM at highs.

• Central-bank demand & reserve shifts underpin dip-support.

🎯 Street view: Major houses now float $5,000/oz by 2026 (HSBC/BofA/SocGen).

ملاحظة

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE💰 Close: $4,379 → $4,252 — higher close, trend still strong.

📈 Trend: Uptrend > $4,000; dip buyers still in charge.

🛡 Supports: $4,180 → $4,000 (key line to defend).

🚧 Resistances: $4,260 / $4,300 / $4,350 → stretch $4,420.

🧭 Next Week Bias: Buy dips $4,140–$4,200 → target $4,300–$4,380+.

🏦 Macro Tailwinds: Fed cut bets + weak USD + CB gold demand.

🌍 Geopolitics: Trade & regional risks = safe-haven flows.

🎯 Street View: $5,000/oz by 2026 in play.

🚀 Breakout: >$4,280 → opens path to $4,350–$4,420.

⚖️ Strategy: Accumulate dips; protect under $4,050–$4,000.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

منشورات ذات صلة

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.