🔹 W1 – Weekly Bias

Bias: Bullish

SMC: Valid Break of Structure (BOS) to the upside, with consecutive higher highs.

Order Block: Last bullish OB (gray zone) still valid and respected.

Premium/Discount: Price is currently in the premium zone, indicating a higher probability of retracement.

FVG / Imbalance: Unfilled FVG zones remain between 2900 - 2800.

EMA 5/21/50/200: Price trades above all EMAs, confirming strong bullish momentum.

Key POI: 3060 – 3085 (potential reversal or reaction zone).

EQH: Potential Equal Highs forming, suggesting a liquidity grab is likely.

✅ Note: Weekly structure is intact, but we may expect a correction down into discount levels.

🔹 D1 – Daily Bias

Bias: Bullish (with active retracement)

SMC: BOS confirmed + liquidity grab above recent highs.

Price Action: Strong rejection from premium zone with a significant bearish candle.

Order Block: Valid OB between 2970 – 2990, aligning with Daily FVG.

EMA: EMA 5 and 21 are tightening up, signaling a potential short-term bearish cross.

Imbalance: Clear gap between 2985 – 2940 remains unfilled.

Daily POI: 2995 – 2970 → key zone to monitor for bullish reaction.

RSI: Not yet oversold, suggesting more room for downside movement.

🎯 Retracement Target (Daily): 2990 – 2950 for potential long setups.

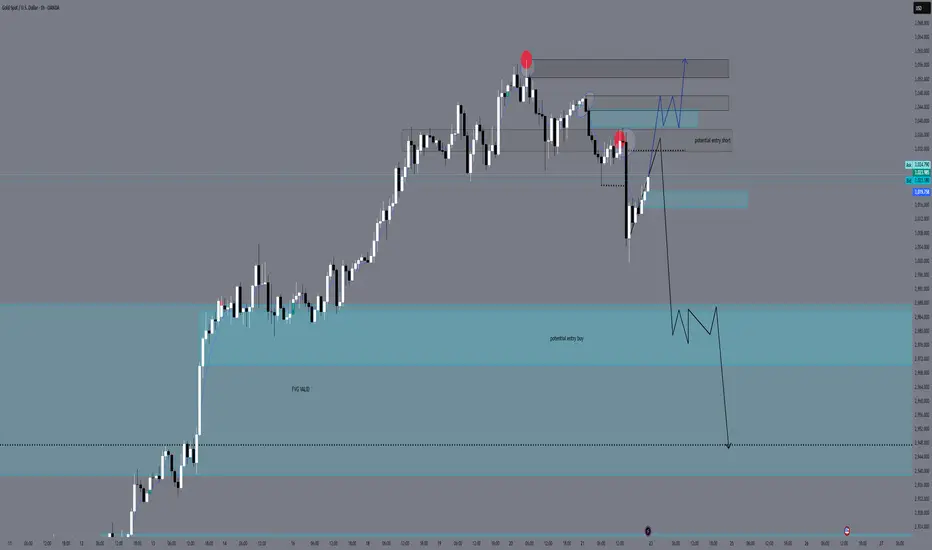

🔹 H4 – Intraday Swing Setup

Bias: Bearish retracement

SMC: Confirmed BOS on H4

Order Block: Strong OB between 3025 – 3035 (origin of previous impulse drop)

FVG: Valid Fair Value Gap between 2988 – 2940

Imbalance: Still unfilled under 2970

EMA: Bearish EMA 5/21 crossover, EMA50 flattening

POI: 3030 (short setup zone), 2970 (potential buy reaction zone)

🔁 Scenario:

If price retests 3025–3030 and shows bearish PA → valid short.

If price drops into 2970–2950 and sweeps liquidity → potential long setup.

🔹 H1 – Entry Refinement

Bias: Temporary bullish correction

SMC: CHoCH printed, but no BOS yet

PA: Last reaction suggests mitigation

OB: OB zone at 3033–3037 still valid for shorting opportunities

EMA: EMA 5 and 21 remain bearish; 50 and 200 beginning to flatten

RSI: Nearing overbought – watch for signs of bearish reversal

POI (H1): 3033–3037 (short setup), 2985–2970 (buy zone)

🔹 M15 – Sniper Entry

Bias: Bullish correction in progress

SMC: CHoCH formed, waiting for confirmation of BOS

OB (M15): 3028 – 3033 → clean Order Block for possible bearish reaction

Imbalance: Unfilled gap at 3029 – 3032

EMA: EMA 5 > EMA 21 → minor bullish trend

RSI: Close to overbought – ideal for a reversal sniper short

EQH: Equal High at 3032 → ideal liquidity inducement

🎯 Sniper Trade Plan (Short):

Sell Entry Zone: 3029 – 3033

TP1: 3010

TP2: 2995

SL: Above 3035 (above OB high)

🔄 Alternative Scenario

If price breaks and closes above 3035 with bullish volume → short invalidated

Long setups only valid if price drops into discount zones (below 2985) with a bullish PA reaction + CHoCH confirmation

✅ Summary

Overall Bias: Bullish on higher timeframes, but currently in retracement → only looking for short-term sells

Sniper Short Zone: 3029 – 3033

Buy Zone to Re-enter: 2970 – 2940 (only on proper confirmations)

✨ If you enjoy my analysis, I’d really appreciate it if you followed my TradingView profile and left a boost\like on the post. Thank you!

Bias: Bullish

SMC: Valid Break of Structure (BOS) to the upside, with consecutive higher highs.

Order Block: Last bullish OB (gray zone) still valid and respected.

Premium/Discount: Price is currently in the premium zone, indicating a higher probability of retracement.

FVG / Imbalance: Unfilled FVG zones remain between 2900 - 2800.

EMA 5/21/50/200: Price trades above all EMAs, confirming strong bullish momentum.

Key POI: 3060 – 3085 (potential reversal or reaction zone).

EQH: Potential Equal Highs forming, suggesting a liquidity grab is likely.

✅ Note: Weekly structure is intact, but we may expect a correction down into discount levels.

🔹 D1 – Daily Bias

Bias: Bullish (with active retracement)

SMC: BOS confirmed + liquidity grab above recent highs.

Price Action: Strong rejection from premium zone with a significant bearish candle.

Order Block: Valid OB between 2970 – 2990, aligning with Daily FVG.

EMA: EMA 5 and 21 are tightening up, signaling a potential short-term bearish cross.

Imbalance: Clear gap between 2985 – 2940 remains unfilled.

Daily POI: 2995 – 2970 → key zone to monitor for bullish reaction.

RSI: Not yet oversold, suggesting more room for downside movement.

🎯 Retracement Target (Daily): 2990 – 2950 for potential long setups.

🔹 H4 – Intraday Swing Setup

Bias: Bearish retracement

SMC: Confirmed BOS on H4

Order Block: Strong OB between 3025 – 3035 (origin of previous impulse drop)

FVG: Valid Fair Value Gap between 2988 – 2940

Imbalance: Still unfilled under 2970

EMA: Bearish EMA 5/21 crossover, EMA50 flattening

POI: 3030 (short setup zone), 2970 (potential buy reaction zone)

🔁 Scenario:

If price retests 3025–3030 and shows bearish PA → valid short.

If price drops into 2970–2950 and sweeps liquidity → potential long setup.

🔹 H1 – Entry Refinement

Bias: Temporary bullish correction

SMC: CHoCH printed, but no BOS yet

PA: Last reaction suggests mitigation

OB: OB zone at 3033–3037 still valid for shorting opportunities

EMA: EMA 5 and 21 remain bearish; 50 and 200 beginning to flatten

RSI: Nearing overbought – watch for signs of bearish reversal

POI (H1): 3033–3037 (short setup), 2985–2970 (buy zone)

🔹 M15 – Sniper Entry

Bias: Bullish correction in progress

SMC: CHoCH formed, waiting for confirmation of BOS

OB (M15): 3028 – 3033 → clean Order Block for possible bearish reaction

Imbalance: Unfilled gap at 3029 – 3032

EMA: EMA 5 > EMA 21 → minor bullish trend

RSI: Close to overbought – ideal for a reversal sniper short

EQH: Equal High at 3032 → ideal liquidity inducement

🎯 Sniper Trade Plan (Short):

Sell Entry Zone: 3029 – 3033

TP1: 3010

TP2: 2995

SL: Above 3035 (above OB high)

🔄 Alternative Scenario

If price breaks and closes above 3035 with bullish volume → short invalidated

Long setups only valid if price drops into discount zones (below 2985) with a bullish PA reaction + CHoCH confirmation

✅ Summary

Overall Bias: Bullish on higher timeframes, but currently in retracement → only looking for short-term sells

Sniper Short Zone: 3029 – 3033

Buy Zone to Re-enter: 2970 – 2940 (only on proper confirmations)

✨ If you enjoy my analysis, I’d really appreciate it if you followed my TradingView profile and left a boost\like on the post. Thank you!

تم فتح الصفقة

The target of 300 pips was reached today. The bounce zone marked from 3015-3020 was successfully mitigated and provided us with the bounce up to the gap from 3029-3033, where we had a potential short entry with a SL at 3035, TP 1 at 3010, and TP 2 at 2995.price making a pullback now, waiting to see how the price is gonna play on asian session

trade smart, trade with me !

don't forget to hit that like button and follow

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.