Is Citigroup Really Undervalued or Just Misunderstood? A Closer Look at the Global Banking Giant

Citigroup has always been a bit of an enigma. For years, it has been considered too global, too complex, and too difficult to value fairly. But with the second-quarter 2025 earnings now behind us and third-quarter results expected in mid-October, investor perception of Citi has begun to change.

The question today is not whether Citi is big or important. It is whether the market is still clinging to an outdated image of the bank, or if there is something more going on under the hood. Let's take a closer look.

The Global Puzzle That's Starting to Make Sense

Most investors usually prefer banks with simpler business models. That is part of the reason Wells Fargo and Bank of America are perennial market favourites. They are domestic, easy to understand, and deliver steady profits.

Citi, on the other hand, took the harder route. It has exited consumer banking in nearly 14 countries, restructured its leadership and operations, and doubled down on global institutional services. Treasury and Trade Solutions, cross-border payments, and securities services are now the central engine of the company.

That transformation does not come with splashy headlines. But when you strip away the noise, you find a bank that is more streamlined than it has been in over a decade. And yet, it still trades like a legacy institution that cannot change, instead of being viewed as a modernized global competitor.

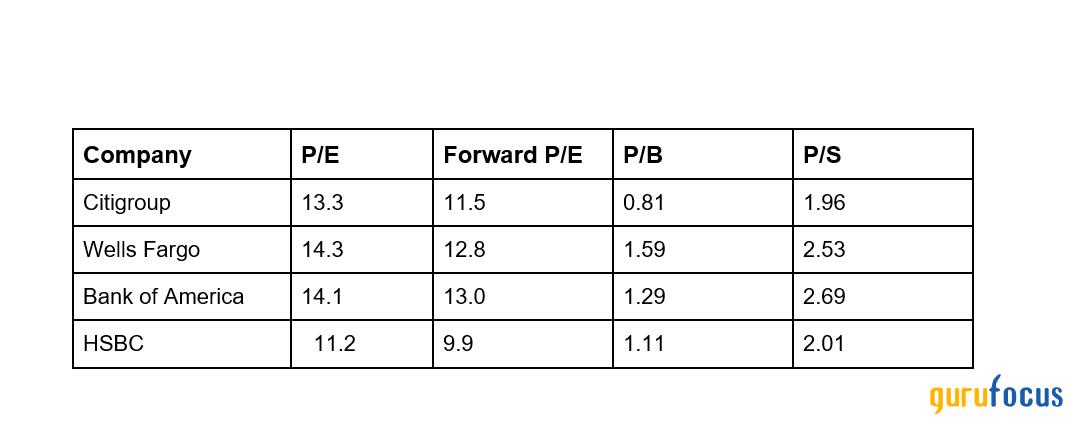

Citi's price-to-book ratio is currently just 0.81, and its forward price-to-earnings ratio is 11.5. Those numbers don't reflect a global banking leader. They reflect skepticism. But before making judgments about value, we have to examine returns.

Citi's Weak Spot: Returns That Still Lag

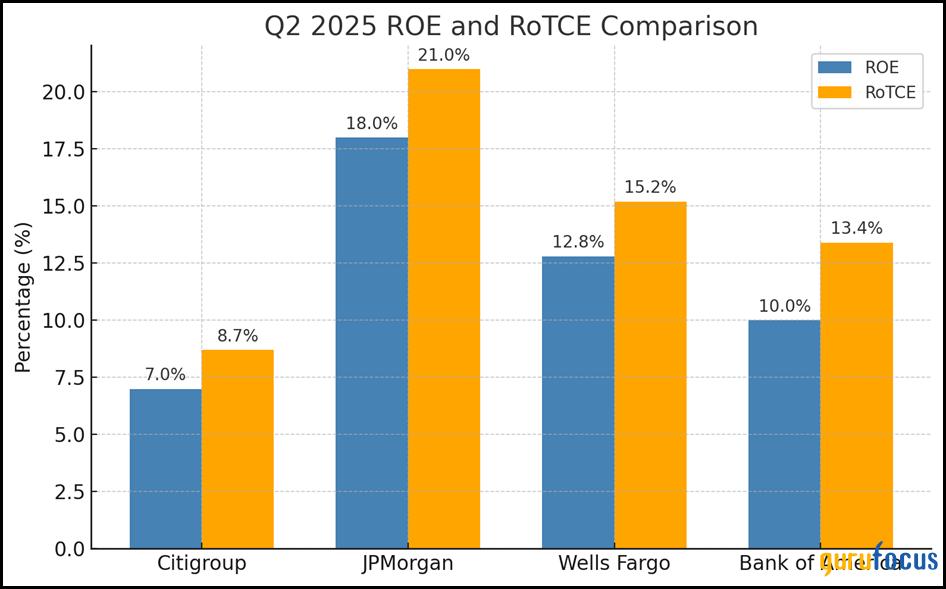

Citi's latest returns show 9.1 percent RoTCE and 7 percent ROE. Those are steady numbers, though they don't grab much attention compared with rivals.

The problem is that its biggest competitors are doing much better. JPMorgan is consistently above 17 percent RoTCE. Bank of America and Wells Fargo regularly hit between 12 and 15 percent. Even HSBC, which has struggled in the past, is edging closer to double digits.

A low ROE means that even if Citi is profitable, the money it reinvests grows slower than it does at other banks. That is a big deal for long-term investors. It suggests that unless something changes, Citi might stay in the discount pile.

And that brings us to the second-quarter numbers.

What Q2 Earnings Told Us About Citi's Momentum

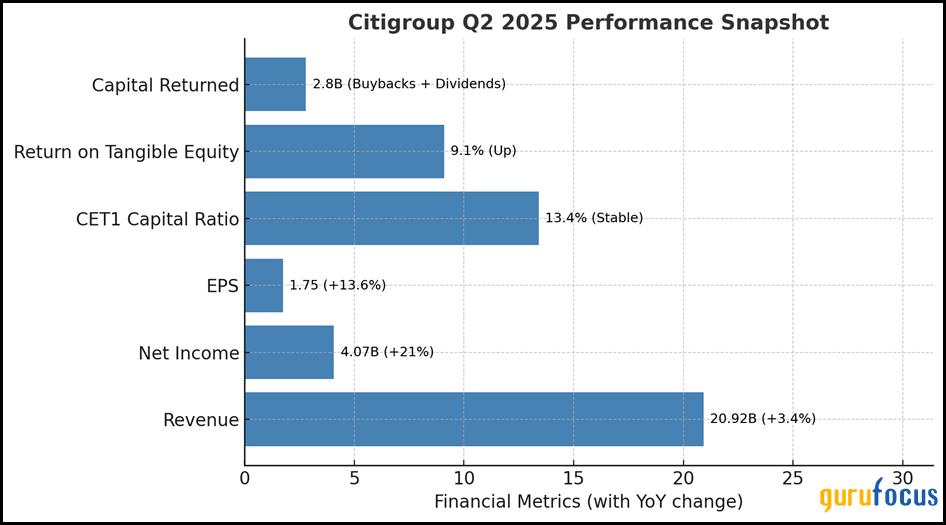

On July 15, Citi reported second-quarter results that were better than many expected. Revenue came in at $20.92 billion, up around 3.4 percent year over year. Net income totaled $4.07 billion, and earnings per share landed at $1.75. The bank also maintained a rock-solid Common Equity Tier 1 capital ratio of 13.4 percent.

Return on Tangible Common Equity ticked up to 9.1 percent, a sign that profitability is improving, even if slowly. Citi also returned $2.8 billion to shareholders during the quarter, combining dividends and share buybacks.

More importantly, Citi's core institutional segments performed well. The Treasury and Trade Solutions division continued to grow, and the Markets business remained resilient. These are not side projects. They are central to Citi's identity going forward.

If there is a path to a re-rating, it starts with these numbers. They show progress. They hint that Citi may finally be unlocking the value of its global infrastructure.

Who Actually Owns Citigroup?

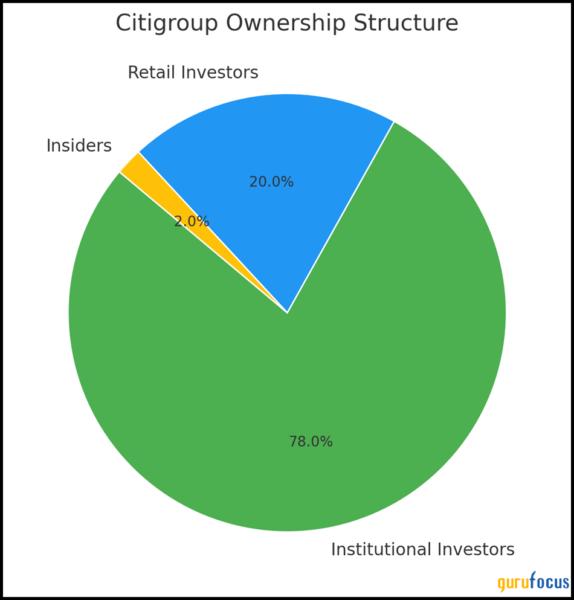

Approximately 78% of Citi's shares are held by institutions like Vanguard, BlackRock, and State Street major investors who look at overall strategy instead of quarterly ups and downs. Retail investors hold about 20%, which may be why many everyday investors haven't gotten excited about Citi yet.

Recent insider activity shows net buying,showing that company leaders feel confident about the path ahead. This shared stance between leaders and major investors suggests Citi may be overlooked rather than mismanaged.

Valuation Only Tells Half the Story

Citi's valuation looks attractive on paper. It trades at a trailing P/E of 13.3, forward P/E of 11.5, and a price-to-book of 0.81. Compare that to Wells Fargo, which trades at 1.59 times book value, or Bank of America at 1.29. Even HSBC, with a similar international footprint, trades at 1.11.

On a price-to-sales basis, Citi comes in at 1.96. That is well below both Wells and BofA. At first glance, it looks like a steal. But this is where the editor's feedback becomes crucial. You cannot talk about valuation without talking about the quality of those returns. And the truth is, Citi's returns have not earned it a higher multipleat least not yet.

The market is discounting Citi not because it misunderstands the story, but because it does not believe the returns will ever match the potential. That is the skepticism bulls need to overcome.

A Tale of Two Camps: Bulls and Bears

Few banks divide opinion quite like Citi. Some respected investors see opportunity. Others want nothing to do with it.

On the bullish side, there are people like Steven Romick (Trades, Portfolio) and the Kahn Brothers (Trades, Portfolio). They have held sizable positions in Citi, betting that its fortress balance sheet, global franchise, and low valuation will eventually pay off. They like the upside, especially if Citi can boost profitability and continue returning capital.

Then there is the other side. Warren Buffett (Trades, Portfolio), Charlie Munger, and Li Lu (Trades, Portfolio) have famously steered clear of Citi. Berkshire Hathaway owns JPMorgan, Bank of America, and Wells Fargo, but never Citi. Their avoidance says something. These skeptics see global sprawl, low capital efficiency, and a business that is simply too slow to change. From their perspective, Citi's complexity is not an edge. It is a burden.

The tension between these two views makes Citi one of the more interesting stocks in the market today.

What Needs to Happen for the Market to Reprice Citi?

If Citi wants to change the narrative, it needs to do a few things.

First, it must get Return on Tangible Common Equity into the double digits and keep it there. That is the clearest signal that the business is creating value for shareholders.

Second, it needs to prove that simplification efforts are working. Investors need to see cleaner operations, better efficiency, and fewer surprises.

Third, it has to keep growing in areas where it has a real edge. That means global cash management, securities services, and cross-border flows.

And finally, it has to communicate better. Investors need to see a roadmap, not just for cost-cutting but for long-term growth.

None of this is easy. But none of it is impossible either.

So is Citi a Bargain or a Trap?

The answer depends on your time horizon and your tolerance for complexity. Citi is not flashy. It is not going to generate massive returns overnight. But it is also not the mess it once was.

This is a bank with a global footprint that most competitors cannot match. It has cleaned up its balance sheet, returned capital to shareholders, and is posting steady progress in its most critical divisions.

The market may be slow to recognize it, but that is often where opportunity hides.

If Citi can close the gap between its potential and its performance, then today's valuation will look like a gift. But if the returns stay mediocre, the discount will stick and maybe even widen.

Either way, this is a story that is finally moving. Whether you are ready to bet on it is up to you.