India Beyond the Dollar: Navigating a shifting currency order

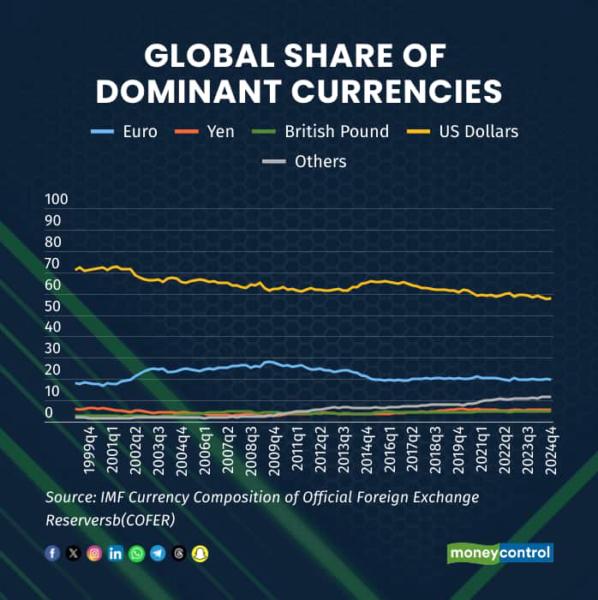

Over the last 15 years, countries across the globe have been gradually attempting to reduce their reliance on the US dollar for international trade, financial transactions, and the holding of foreign exchange reserves. This transformation, long anticipated by economic historians and geopolitical analysts, is no longer a theoretical shift—it is happening in real-time. Evidence from the IMF’s COFER (Composition of Foreign Exchange Reserves) database shows that between Q1 2014 and Q4 2024, the share of the US dollar and the euro in global foreign exchange reserves declined from 63.04% to 57.80% and from 23.27% to 19.83%, respectively.

Over the same period, the share of other non-dominant currencies (excluding the US dollar, euro, Japanese yen, and British pound) increased from 6.34% to 11.82%. Since 2015, the IMF has stopped publishing regional breakdowns of COFER data for emerging and advanced economies, citing disclosure risks—a move that strongly suggests countries may be quietly diversifying their reserves while avoiding overtly publicising such shifts. This subtle yet persistent realignment is steadily reshaping the global financial order. Against this backdrop, India’s position has been pragmatic: while it has pursued local currency trade agreements to mitigate exchange rate risks and uncertainty, the Reserve Bank of India (RBI) has reiterated that de-dollarisation is not a stated objective, nor is the creation of a BRICS currency currently under consideration.

Global Winds of Change

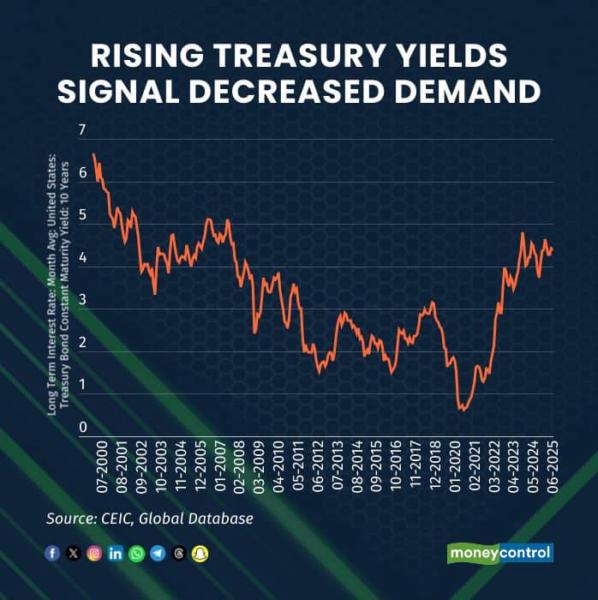

The rationale for this shift is multifaceted. At the macro level, it is driven by concerns over geopolitical tensions, recurring US sanctions, tariffs, the lessons of the Global Financial Crisis (GFC), and vulnerabilities stemming from an over-reliance on a single currency for trade and reserve management. Commodities such as oil and gas—lifelines for developing economies—are traditionally priced in dollars. When US sanctions are imposed on key oil exporters like Iran or Russia, countries dependent on those imports face both financial and diplomatic hurdles. Simultaneously, the rising yields on US 10-year Treasury bills—from 0.87% in March 2020 to 4.38% in June 2025—signal a decreased global appetite for dollar-denominated debt. Investors and governments alike are seeking alternatives, diversifying into other currencies, commodities, and digital assets. The rapid proliferation of bilateral and regional trade agreements further reflects this shift.

According to WTO data, the number of such agreements has surged from 40 in 1990 to nearly 375 in 2025. These new trade pacts often allow member countries to conduct transactions in local currencies, reducing reliance on a third-party currency like the US dollar. To complement this, countries are also entering into currency swap agreements. China’s web of bilateral swaps and the BRICS Contingent Reserve Arrangement (CRA) are prominent examples. India, too, has actively pursued such arrangements with over 20 countries, including Japan, Russia, Nigeria, and South Korea. Overall, we see a clear trend that countries are reducing their reliance on the US dollar to manage currency risks, lessen the impact of US monetary policy, diversify reserves, and avoid sanctions exposure. At the same time, they are creating new payment systems to promote local currency trade, cut conversion and transaction costs, speed up transactions, reduce dependence on SWIFT, and strengthen financial independence in a multipolar world.

India's Calculated Steps

India has not merely observed this global transformation—it has actively engaged with it. Since 2012, the Ministry of Commerce has strategically signed currency swap agreements with a host of trading partners, aiming to lower the transactional friction caused by reliance on the dollar. In 2024, the RBI renewed its Currency Swap Arrangement (CSA) with SAARC countries for 2024–2027, introducing an INR-specific swap window with additional concessions. However, India’s financial architecture is still deeply entwined with the dollar. As of December 2024, US dollar-denominated debt comprised 54.8% of India’s external debt, followed by Indian Rupee (30.6%), Japanese Yen (6.1%), and Euro (3.0%). This means fluctuations in the value of the dollar directly impact India’s debt servicing costs. An appreciating Indian Rupee, while positive for repayment, may also affect export competitiveness. The transition also intersects with how international trade bills are invoiced.

According to a 2025 report from the European Central Bank, the US dollar and Euro still account for over 80% of global trade invoicing. For India, this is crucial. If export receipts are invoiced in a strengthening local currency rather than the dollar, exporters stand to gain. Conversely, if imports are still priced in dollars or euros, an appreciating rupee could make them cheaper—an economic boon. But if currencies used for imports depreciate against the rupee, this could inflate costs. Remittances—another pillar of India’s current account—also face valuation risk. According to the World Bank, remittances make up 3.5% of India’s GDP. The value of these inflows will fluctuate depending on the currency they are received in and how that currency fares against the rupee.

The Road Ahead: Risks and Opportunities

While the march towards reducing dollar dependency opens opportunities for strategic autonomy and financial sovereignty, it is not without risks. In the short term, Indian companies with dollar-denominated loans may face rising borrowing costs as dollar demand fluctuates. Trade settlements may become more complex as the global system transitions towards a multi-currency paradigm. India’s foreign exchange reserves, predominantly held in US dollars, will need careful recalibration to minimise valuation losses. However, this transition also offers a pivotal opportunity for India to assert itself in shaping the future of global finance. The push for greater use of the rupee in cross-border trade—especially with neighbouring countries and trusted partners—can serve as a launchpad for deeper regional integration. India's initiatives like GIFT City, its growing role in BRICS, and efforts in launching a central bank digital currency (CBDC) for cross-border settlements are laying the foundation for this new era. This transition is not just economic—it is also symbolic. It signifies a shift toward a more equitable multipolar global financial system that doesn't disproportionately empower a handful of reserve currency nations. For India, this shift provides an opportunity to limit vulnerabilities from US monetary policy spillovers while strengthening trade and financial systems that align with its long-term strategic and economic priorities.

Conclusion

For India, this presents an opportunity to reduce its dependence on the US dollar for trade and its associated currency risk, limit the influence of US monetary policy, strengthen regional ties, and play a more active role in shaping a fairer and more balanced multipolar global financial system. This shift has become even more relevant in light of the recent increased US tariff on Indian imports, reportedly linked to India’s purchase of Russian oil, which underscores the vulnerability of trade to geopolitical pressure. The road ahead calls for smart policymaking, resilient institutions, and a clear strategic vision. If managed well, India can not only navigate the shifting global currency landscape but also help shape a financial order that better reflects its own priorities and strengths.

{Sargam Gupta, Assistant Professor (Economics), Indira Gandhi Institute of Development Research (IGIDR). Parthajit Kayal, Associate Professor (Finance), Madras School of Economics (MSE).}Views are personal, and do not represent the stand of this publication.