OPEN-SOURCE SCRIPT

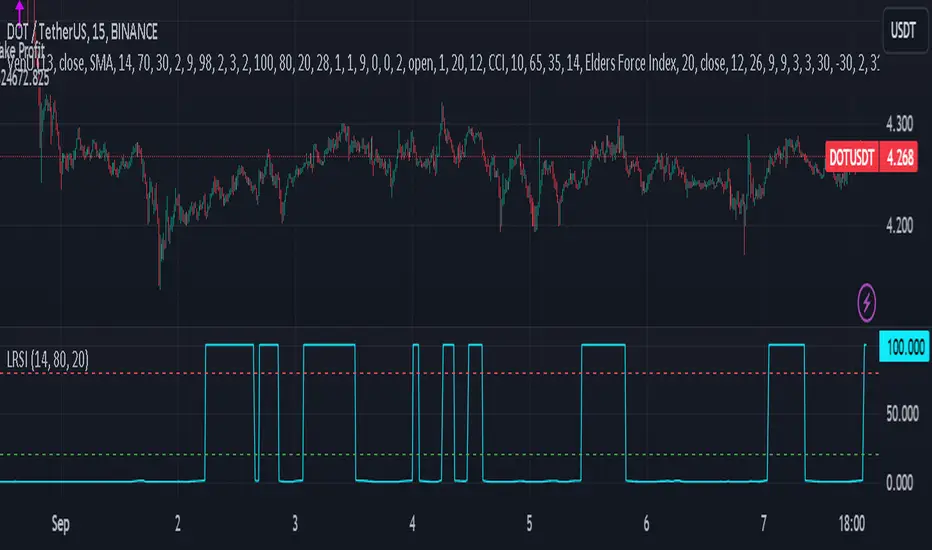

Laguerre RSI - non repainting

It seems that the traditional Laguerre* functions repaint due to the gamma parameter.

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

That goes even for the editorial pick here.

But one could use calculation period instead of "gamma" parameter. This gives us a non-repainting Laguerre RSI fit for scalping trends.

At first glance, I haven't seen anyone do this with a pine script, but I could be wrong because it's not a big deal.

So here is a variation of Laguerre RSI, without repainting. It's a little bit more insensitive, but this is not of great importance, since only the extreme values are used for confirmation.

( * Laguerre RSI is based on John EHLERS' Laguerre Filter to avoid the noise of RSI.)

And if you implement this indicator into a strategy (like I do) I can give you a trick.

Traditionaly the condition is at follows:

LaRSI = cd == 0 ? 100 : cu / (cu + cd)

(this is the final part of the indicator before the plotting)

LongLaguerre= LaRSI<dnb

ShortLaguerre= LaRSI>upb

It's fine for the short (ot exit long), but for the long is better to make a swich between the CD and CU parameters, as follows:

LaRSI1 = cd == 0 ? 100 : cu / (cu + cd)

LaRSI2 = cu == 0 ? 100 : cu / (cu + cd)

LongLaguerre= LaRSI2<dnb

ShortLaguerre= LaRSI1>upb

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.