OPEN-SOURCE SCRIPT

byquan GP - SRSI Channel

🔍 What Is It?

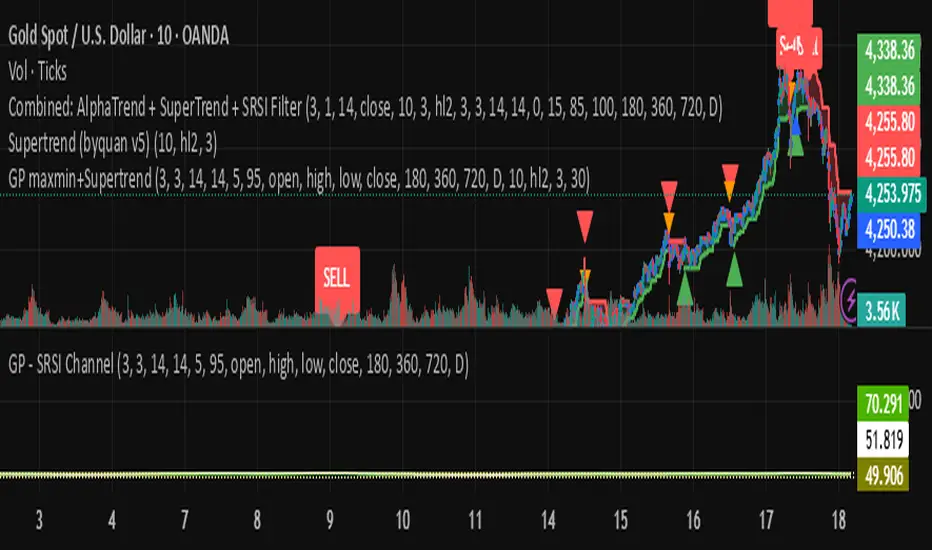

The GP – SRSI Channel is a momentum-based oscillator that measures the relative strength of price movements across multiple timeframes using the Stochastic RSI (SRSI) method.

Instead of using a single RSI line, this indicator analyzes four price inputs and four timeframes to create a dynamic channel that reflects the true market momentum — helping traders identify overbought and oversold zones with higher accuracy.

⚙️ How It Works

The indicator combines multiple layers of analysis to produce a smooth and reliable momentum channel.

1. Multi-Source RSI Calculation

It computes RSI and Stochastic RSI values for four different price sources:

Open

High

Low

Close

Each source generates its own SRSI value:

dsopen, dshigh, dslow, and dsclose

From these, it extracts:

starraymin: the lowest (most oversold) SRSI value

starraymax: the highest (most overbought) SRSI value

This forms a momentum range based on all price inputs.

2. Multi-Timeframe (MTF) Integration

To strengthen signal reliability, it repeats this SRSI analysis across four higher timeframes (configurable by user):

Parameter Default Value Meaning

Time 1 180 minutes 3-hour chart

Time 2 360 minutes 6-hour chart

Time 3 720 minutes 12-hour chart

Time 4 1D Daily chart

Each timeframe produces its own set of minimum, maximum, and close SRSI values.

These are then combined and normalized to a 0–100 scale.

3. Normalization and Channel Plot

The combined results create three main lines:

Min Line (Green–Red gradient) → represents oversold strength

Max Line (Green–Red gradient) → represents overbought strength

Close Line (White) → represents average SRSI value

The area between the Min and Max lines is filled with a color gradient to form the SRSI Channel, visually showing momentum strength and range.

4. Signal & Alerts

Two alert levels are defined:

Alert Min Level → Default = 5 (oversold)

Alert Max Level → Default = 95 (overbought)

When:

oranmin ≤ Alert Min Level → Market is in an oversold state (potential reversal up).

oranmax ≥ Alert Max Level → Market is in an overbought state (potential reversal down).

When either of these thresholds is crossed, the indicator triggers:

A white square marker on the chart.

A custom alert with the message:

“SRSI Channel reached alert threshold (oranmax ≥ MaxLevel or oranmin ≤ MinLevel)”

🧭 How to Use It

🪄 Step 1 — Add to Chart

Copy the code into a new Pine Script in TradingView.

Click Add to chart.

You’ll see three lines and a colored channel between them.

⚙️ Step 2 — Adjust Inputs

Core SRSI Settings

Setting Description

K, D Smoothing factors for Stochastic RSI.

RSI Length Number of bars for RSI calculation.

S Length Period used for %K in Stochastic RSI.

Alert Min/Max Level Defines oversold/overbought zones.

Multi-Timeframe Settings

Change Time 1 to Time 4 to suit your trading style:

Shorter timeframes → faster but more noise.

Longer timeframes → smoother, more reliable momentum.

📈 Step 3 — Interpret the Chart

Indicator Element Meaning

🟩 Lower Boundary (Min) Lowest SRSI reading → momentum weakness / possible rebound area

🟥 Upper Boundary (Max) Highest SRSI reading → strong momentum / possible exhaustion

⚪ Middle Line (Close) Average of all SRSI readings → overall momentum strength

🌈 Channel Fill Visualizes balance between overbought and oversold levels

When the channel widens → market volatility and strength increase.

When it narrows → consolidation or low-momentum phase.

🔔 Step 4 — Alerts

You can create alerts using:

Condition: SRSI Extreme

Message: SRSI Channel reached alert threshold

Use this to receive notifications when the market hits extreme momentum levels (great for reversal traders).

💡 Trading Tips

✅ Combine with Supertrend, MACD, or Moving Averages for confirmation.

✅ Look for SRSI extremes aligning with price support/resistance for stronger reversal entries.

✅ Use different timeframe combinations (e.g., 1H–4H–12H–1D) depending on your trading style.

✅ Treat it as a momentum filter — not a direct buy/sell signal tool.

⚖️ Summary

The GP – SRSI Channel is a sophisticated multi-timeframe momentum indicator that helps traders visualize market strength and identify overbought or oversold conditions with exceptional clarity.

Features:

4 price sources × 4 timeframes = deep momentum insight

Dynamic, color-coded SRSI channel

Built-in alert system for extreme conditions

Clean and intuitive visual design

Best suited for:

Swing and position traders

Traders who use RSI/Stoch indicators

Those seeking to confirm entries with multi-timeframe momentum data

🎯 Understand the market’s true momentum — before it moves.

The GP – SRSI Channel is a momentum-based oscillator that measures the relative strength of price movements across multiple timeframes using the Stochastic RSI (SRSI) method.

Instead of using a single RSI line, this indicator analyzes four price inputs and four timeframes to create a dynamic channel that reflects the true market momentum — helping traders identify overbought and oversold zones with higher accuracy.

⚙️ How It Works

The indicator combines multiple layers of analysis to produce a smooth and reliable momentum channel.

1. Multi-Source RSI Calculation

It computes RSI and Stochastic RSI values for four different price sources:

Open

High

Low

Close

Each source generates its own SRSI value:

dsopen, dshigh, dslow, and dsclose

From these, it extracts:

starraymin: the lowest (most oversold) SRSI value

starraymax: the highest (most overbought) SRSI value

This forms a momentum range based on all price inputs.

2. Multi-Timeframe (MTF) Integration

To strengthen signal reliability, it repeats this SRSI analysis across four higher timeframes (configurable by user):

Parameter Default Value Meaning

Time 1 180 minutes 3-hour chart

Time 2 360 minutes 6-hour chart

Time 3 720 minutes 12-hour chart

Time 4 1D Daily chart

Each timeframe produces its own set of minimum, maximum, and close SRSI values.

These are then combined and normalized to a 0–100 scale.

3. Normalization and Channel Plot

The combined results create three main lines:

Min Line (Green–Red gradient) → represents oversold strength

Max Line (Green–Red gradient) → represents overbought strength

Close Line (White) → represents average SRSI value

The area between the Min and Max lines is filled with a color gradient to form the SRSI Channel, visually showing momentum strength and range.

4. Signal & Alerts

Two alert levels are defined:

Alert Min Level → Default = 5 (oversold)

Alert Max Level → Default = 95 (overbought)

When:

oranmin ≤ Alert Min Level → Market is in an oversold state (potential reversal up).

oranmax ≥ Alert Max Level → Market is in an overbought state (potential reversal down).

When either of these thresholds is crossed, the indicator triggers:

A white square marker on the chart.

A custom alert with the message:

“SRSI Channel reached alert threshold (oranmax ≥ MaxLevel or oranmin ≤ MinLevel)”

🧭 How to Use It

🪄 Step 1 — Add to Chart

Copy the code into a new Pine Script in TradingView.

Click Add to chart.

You’ll see three lines and a colored channel between them.

⚙️ Step 2 — Adjust Inputs

Core SRSI Settings

Setting Description

K, D Smoothing factors for Stochastic RSI.

RSI Length Number of bars for RSI calculation.

S Length Period used for %K in Stochastic RSI.

Alert Min/Max Level Defines oversold/overbought zones.

Multi-Timeframe Settings

Change Time 1 to Time 4 to suit your trading style:

Shorter timeframes → faster but more noise.

Longer timeframes → smoother, more reliable momentum.

📈 Step 3 — Interpret the Chart

Indicator Element Meaning

🟩 Lower Boundary (Min) Lowest SRSI reading → momentum weakness / possible rebound area

🟥 Upper Boundary (Max) Highest SRSI reading → strong momentum / possible exhaustion

⚪ Middle Line (Close) Average of all SRSI readings → overall momentum strength

🌈 Channel Fill Visualizes balance between overbought and oversold levels

When the channel widens → market volatility and strength increase.

When it narrows → consolidation or low-momentum phase.

🔔 Step 4 — Alerts

You can create alerts using:

Condition: SRSI Extreme

Message: SRSI Channel reached alert threshold

Use this to receive notifications when the market hits extreme momentum levels (great for reversal traders).

💡 Trading Tips

✅ Combine with Supertrend, MACD, or Moving Averages for confirmation.

✅ Look for SRSI extremes aligning with price support/resistance for stronger reversal entries.

✅ Use different timeframe combinations (e.g., 1H–4H–12H–1D) depending on your trading style.

✅ Treat it as a momentum filter — not a direct buy/sell signal tool.

⚖️ Summary

The GP – SRSI Channel is a sophisticated multi-timeframe momentum indicator that helps traders visualize market strength and identify overbought or oversold conditions with exceptional clarity.

Features:

4 price sources × 4 timeframes = deep momentum insight

Dynamic, color-coded SRSI channel

Built-in alert system for extreme conditions

Clean and intuitive visual design

Best suited for:

Swing and position traders

Traders who use RSI/Stoch indicators

Those seeking to confirm entries with multi-timeframe momentum data

🎯 Understand the market’s true momentum — before it moves.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.