INVITE-ONLY SCRIPT

GKD-C Swing Line [Loxx]

تم تحديثه

Giga Kaleidoscope GKD-V Swing Line is a Confirmation module included in Loxx's "Giga Kaleidoscope Modularized Trading System".

█ Giga Kaleidoscope Modularized Trading System

What is Loxx's "Giga Kaleidoscope Modularized Trading System"?

The Giga Kaleidoscope Modularized Trading System is a trading system built on the philosophy of the NNFX (No Nonsense Forex) algorithmic trading.

What is the NNFX algorithmic trading strategy?

The NNFX (No-Nonsense Forex) trading system is a comprehensive approach to Forex trading that is designed to simplify the process and remove the confusion and complexity that often surrounds trading. The system was developed by a Forex trader who goes by the pseudonym "VP" and has gained a significant following in the Forex community.

The NNFX trading system is based on a set of rules and guidelines that help traders make objective and informed decisions. These rules cover all aspects of trading, including market analysis, trade entry, stop loss placement, and trade management.

Here are the main components of the NNFX trading system:

1. Trading Philosophy: The NNFX trading system is based on the idea that successful trading requires a comprehensive understanding of the market, objective analysis, and strict risk management. The system aims to remove subjective elements from trading and focuses on objective rules and guidelines.

2. Technical Analysis: The NNFX trading system relies heavily on technical analysis and uses a range of indicators to identify high-probability trading opportunities. The system uses a combination of trend-following and mean-reverting strategies to identify trades.

3. Market Structure: The NNFX trading system emphasizes the importance of understanding the market structure, including price action, support and resistance levels, and market cycles. The system uses a range of tools to identify the market structure, including trend lines, channels, and moving averages.

4. Trade Entry: The NNFX trading system has strict rules for trade entry. The system uses a combination of technical indicators to identify high-probability trades, and traders must meet specific criteria to enter a trade.

5. Stop Loss Placement: The NNFX trading system places a significant emphasis on risk management and requires traders to place a stop loss order on every trade. The system uses a combination of technical analysis and market structure to determine the appropriate stop loss level.

6. Trade Management: The NNFX trading system has specific rules for managing open trades. The system aims to minimize risk and maximize profit by using a combination of trailing stops, take profit levels, and position sizing.

Overall, the NNFX trading system is designed to be a straightforward and easy-to-follow approach to Forex trading that can be applied by traders of all skill levels.

Core components of an NNFX algorithmic trading strategy

The NNFX algorithm is built on the principles of trend, momentum, and volatility. There are six core components in the NNFX trading algorithm:

1. Volatility - price volatility; e.g., Average True Range, True Range Double, Close-to-Close, etc.

2. Baseline - a moving average to identify price trend

3. Confirmation 1 - a technical indicator used to identify trends

4. Confirmation 2 - a technical indicator used to identify trends

5. Continuation - a technical indicator used to identify trends

6. Volatility/Volume - a technical indicator used to identify volatility/volume breakouts/breakdown

7. Exit - a technical indicator used to determine when a trend is exhausted

How does Loxx's GKD (Giga Kaleidoscope Modularized Trading System) implement the NNFX algorithm outlined above?

Loxx's GKD v1.0 system has five types of modules (indicators/strategies). These modules are:

1. GKD-BT - Backtesting module (Volatility, Number 1 in the NNFX algorithm)

2. GKD-B - Baseline module (Baseline and Volatility/Volume, Numbers 1 and 2 in the NNFX algorithm)

3. GKD-C - Confirmation 1/2 and Continuation module (Confirmation 1/2 and Continuation, Numbers 3, 4, and 5 in the NNFX algorithm)

4. GKD-V - Volatility/Volume module (Confirmation 1/2, Number 6 in the NNFX algorithm)

5. GKD-E - Exit module (Exit, Number 7 in the NNFX algorithm)

(additional module types will added in future releases)

Each module interacts with every module by passing data between modules. Data is passed between each module as described below:

GKD-B => GKD-V => GKD-C(1) => GKD-C(2) => GKD-C(Continuation) => GKD-E => GKD-BT

That is, the Baseline indicator passes its data to Volatility/Volume. The Volatility/Volume indicator passes its values to the Confirmation 1 indicator. The Confirmation 1 indicator passes its values to the Confirmation 2 indicator. The Confirmation 2 indicator passes its values to the Continuation indicator. The Continuation indicator passes its values to the Exit indicator, and finally, the Exit indicator passes its values to the Backtest strategy.

This chaining of indicators requires that each module conform to Loxx's GKD protocol, therefore allowing for the testing of every possible combination of technical indicators that make up the six components of the NNFX algorithm.

What does the application of the GKD trading system look like?

Example trading system:

Each GKD indicator is denoted with a module identifier of either: GKD-BT, GKD-B, GKD-C, GKD-V, or GKD-E. This allows traders to understand to which module each indicator belongs and where each indicator fits into the GKD protocol chain.

Giga Kaleidoscope Modularized Trading System Signals (based on the NNFX algorithm)

Standard Entry

1. GKD-C Confirmation 1 Signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

Continuation Entry

1. Standard Entry, Baseline Entry, or Pullback; entry triggered previously

2. GKD-B Baseline hasn't crossed since entry signal trigger

3. GKD-C Confirmation Continuation Indicator signals

4. GKD-C Confirmation 1 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 2 agrees

1-Candle Rule Standard Entry

1. GKD-C Confirmation 1 signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

1-Candle Rule Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

PullBack Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is beyond 1.0x Volatility of Baseline

Next Candle:

1. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

█ GKD-V Swing Line

The swing line indicator is a technical analysis tool used in financial markets to identify the direction of a trend. It is also known as the trendline or zigzag indicator.

The swing line indicator plots a series of lines connecting the highs and lows of price movements over a given time period. Each line represents a swing high or swing low in the price action, depending on whether the trend is bullish or bearish.

In an uptrend, the swing line indicator connects each successive higher low, forming an ascending trendline. In a downtrend, the indicator connects each successive lower high, forming a descending trendline. When the trend changes direction, the indicator will create a new line to reflect the new swing high or low.

Traders use the swing line indicator to identify key levels of support and resistance, as well as potential entry and exit points for trades. A break of the trendline can signal a potential trend reversal, while a bounce off the trendline can indicate that the trend is still intact.

The swing line indicator can be used in conjunction with other technical analysis tools, such as moving averages, to confirm trends and reduce false signals. It is commonly used in forex, stock, and commodity markets, and is available on most charting platforms.

Requirements

Inputs

Confirmation 1 and Solo Confirmation: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Outputs

Confirmation 2 and Solo Confirmation Complex: GKD-E Exit indicator

Confirmation 1: GKD-C Confirmation indicator

Continuation: GKD-E Exit indicator

Solo Confirmation Simple: GKD-BT Backtest strategy

Additional features will be added in future releases.

█ Giga Kaleidoscope Modularized Trading System

What is Loxx's "Giga Kaleidoscope Modularized Trading System"?

The Giga Kaleidoscope Modularized Trading System is a trading system built on the philosophy of the NNFX (No Nonsense Forex) algorithmic trading.

What is the NNFX algorithmic trading strategy?

The NNFX (No-Nonsense Forex) trading system is a comprehensive approach to Forex trading that is designed to simplify the process and remove the confusion and complexity that often surrounds trading. The system was developed by a Forex trader who goes by the pseudonym "VP" and has gained a significant following in the Forex community.

The NNFX trading system is based on a set of rules and guidelines that help traders make objective and informed decisions. These rules cover all aspects of trading, including market analysis, trade entry, stop loss placement, and trade management.

Here are the main components of the NNFX trading system:

1. Trading Philosophy: The NNFX trading system is based on the idea that successful trading requires a comprehensive understanding of the market, objective analysis, and strict risk management. The system aims to remove subjective elements from trading and focuses on objective rules and guidelines.

2. Technical Analysis: The NNFX trading system relies heavily on technical analysis and uses a range of indicators to identify high-probability trading opportunities. The system uses a combination of trend-following and mean-reverting strategies to identify trades.

3. Market Structure: The NNFX trading system emphasizes the importance of understanding the market structure, including price action, support and resistance levels, and market cycles. The system uses a range of tools to identify the market structure, including trend lines, channels, and moving averages.

4. Trade Entry: The NNFX trading system has strict rules for trade entry. The system uses a combination of technical indicators to identify high-probability trades, and traders must meet specific criteria to enter a trade.

5. Stop Loss Placement: The NNFX trading system places a significant emphasis on risk management and requires traders to place a stop loss order on every trade. The system uses a combination of technical analysis and market structure to determine the appropriate stop loss level.

6. Trade Management: The NNFX trading system has specific rules for managing open trades. The system aims to minimize risk and maximize profit by using a combination of trailing stops, take profit levels, and position sizing.

Overall, the NNFX trading system is designed to be a straightforward and easy-to-follow approach to Forex trading that can be applied by traders of all skill levels.

Core components of an NNFX algorithmic trading strategy

The NNFX algorithm is built on the principles of trend, momentum, and volatility. There are six core components in the NNFX trading algorithm:

1. Volatility - price volatility; e.g., Average True Range, True Range Double, Close-to-Close, etc.

2. Baseline - a moving average to identify price trend

3. Confirmation 1 - a technical indicator used to identify trends

4. Confirmation 2 - a technical indicator used to identify trends

5. Continuation - a technical indicator used to identify trends

6. Volatility/Volume - a technical indicator used to identify volatility/volume breakouts/breakdown

7. Exit - a technical indicator used to determine when a trend is exhausted

How does Loxx's GKD (Giga Kaleidoscope Modularized Trading System) implement the NNFX algorithm outlined above?

Loxx's GKD v1.0 system has five types of modules (indicators/strategies). These modules are:

1. GKD-BT - Backtesting module (Volatility, Number 1 in the NNFX algorithm)

2. GKD-B - Baseline module (Baseline and Volatility/Volume, Numbers 1 and 2 in the NNFX algorithm)

3. GKD-C - Confirmation 1/2 and Continuation module (Confirmation 1/2 and Continuation, Numbers 3, 4, and 5 in the NNFX algorithm)

4. GKD-V - Volatility/Volume module (Confirmation 1/2, Number 6 in the NNFX algorithm)

5. GKD-E - Exit module (Exit, Number 7 in the NNFX algorithm)

(additional module types will added in future releases)

Each module interacts with every module by passing data between modules. Data is passed between each module as described below:

GKD-B => GKD-V => GKD-C(1) => GKD-C(2) => GKD-C(Continuation) => GKD-E => GKD-BT

That is, the Baseline indicator passes its data to Volatility/Volume. The Volatility/Volume indicator passes its values to the Confirmation 1 indicator. The Confirmation 1 indicator passes its values to the Confirmation 2 indicator. The Confirmation 2 indicator passes its values to the Continuation indicator. The Continuation indicator passes its values to the Exit indicator, and finally, the Exit indicator passes its values to the Backtest strategy.

This chaining of indicators requires that each module conform to Loxx's GKD protocol, therefore allowing for the testing of every possible combination of technical indicators that make up the six components of the NNFX algorithm.

What does the application of the GKD trading system look like?

Example trading system:

- Backtest: Strategy with 1-3 take profits, trailing stop loss, multiple types of PnL volatility, and 2 backtesting styles

- Baseline: Hull Moving Average

- Volatility/Volume: Volatility Ratio

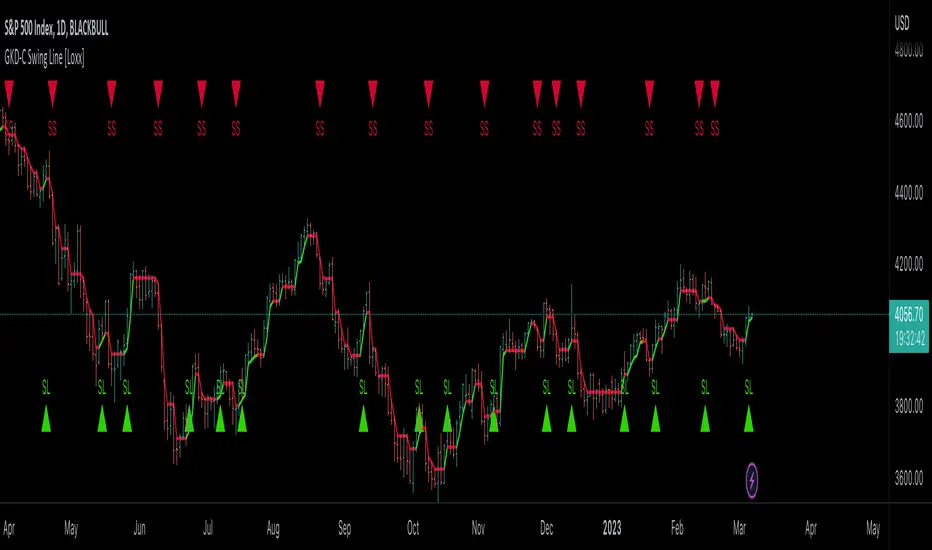

- Confirmation 1: GKD-V Swing Line as shown on the chart above

- Confirmation 2: Williams Percent Range

- Continuation: Fisher Transform

- Exit: Rex Oscillator

Each GKD indicator is denoted with a module identifier of either: GKD-BT, GKD-B, GKD-C, GKD-V, or GKD-E. This allows traders to understand to which module each indicator belongs and where each indicator fits into the GKD protocol chain.

Giga Kaleidoscope Modularized Trading System Signals (based on the NNFX algorithm)

Standard Entry

1. GKD-C Confirmation 1 Signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

Continuation Entry

1. Standard Entry, Baseline Entry, or Pullback; entry triggered previously

2. GKD-B Baseline hasn't crossed since entry signal trigger

3. GKD-C Confirmation Continuation Indicator signals

4. GKD-C Confirmation 1 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 2 agrees

1-Candle Rule Standard Entry

1. GKD-C Confirmation 1 signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

1-Candle Rule Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

PullBack Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is beyond 1.0x Volatility of Baseline

Next Candle:

1. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

█ GKD-V Swing Line

The swing line indicator is a technical analysis tool used in financial markets to identify the direction of a trend. It is also known as the trendline or zigzag indicator.

The swing line indicator plots a series of lines connecting the highs and lows of price movements over a given time period. Each line represents a swing high or swing low in the price action, depending on whether the trend is bullish or bearish.

In an uptrend, the swing line indicator connects each successive higher low, forming an ascending trendline. In a downtrend, the indicator connects each successive lower high, forming a descending trendline. When the trend changes direction, the indicator will create a new line to reflect the new swing high or low.

Traders use the swing line indicator to identify key levels of support and resistance, as well as potential entry and exit points for trades. A break of the trendline can signal a potential trend reversal, while a bounce off the trendline can indicate that the trend is still intact.

The swing line indicator can be used in conjunction with other technical analysis tools, such as moving averages, to confirm trends and reduce false signals. It is commonly used in forex, stock, and commodity markets, and is available on most charting platforms.

Requirements

Inputs

Confirmation 1 and Solo Confirmation: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Outputs

Confirmation 2 and Solo Confirmation Complex: GKD-E Exit indicator

Confirmation 1: GKD-C Confirmation indicator

Continuation: GKD-E Exit indicator

Solo Confirmation Simple: GKD-BT Backtest strategy

Additional features will be added in future releases.

ملاحظات الأخبار

Upgraded to relax signal rules. This only applies to the Full GKD systems. All settings for signals are controlled by the Confirmation 2 indicator. So this means when you build a Full GKD system, the C2 indicator controls the relaxation of all signals including the Continuation indicator that you are required to add on top of the C2 indicator the full GKD system.Added the following signal types:

Volatility/Volume Entry

1. GKD-V Volatility/Volume signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

1-Candle Rule Volatility/Volume Entry

1. GKD-V Volatility/Volume signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close or Short: close > close)

2. GKD-B Volatility/Volume agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-B Baseline agrees

Added the following backtest options

-Super Complex allows for the creation of a GKD system without Confirmation 2 indicator. This backtest type requires the addition of a GKD-C Confirmation indicator

-Stacked allows for the creation of infinitely stackable GKD-C indicators. This is useful for combining two GKD-C indicators to test their synergy together before using these indicators in a full GKD system.

Updated Requirements

Inputs

Confirmation 1: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Continuation: GKD-C Confirmation indicator

Solo Confirmation Simple: GKD-B Baseline

Solo Confirmation Complex: GKD-V Volatility / Volume indicator

Solo Confirmation Super Complex: GKD-V Volatility / Volume indicator

Stacked 1: None

Stacked 2+: GKD-C Stacked 1

Outputs

Confirmation 1: GKD-C Confirmation 2 indicator

Confirmation 2: GKD-C Continuation indicator

Continuation: GKD-E Exit indicator

Solo Confirmation Simple: GKD-BT Backtest

Solo Confirmation Complex: GKD-BT Backtest or GKD-E Exit indicator

Solo Confirmation Super Complex: GKD-C Continuation indicator

Stacked 1: GKD-C Stacked 2+

Stacked 2+: GKD-C Stacked 2+ or GKD-BT Backtest

Additional features will be added in future releases.

ملاحظات الأخبار

GKD-C Swing Line [Loxx]ملاحظات الأخبار

Added volatility signals to continuation signal qualifiers. Added Confirmation 1 + Confirmation 2 backtesting. This allows you to backtest C1 with C2 indicators together without setting up the full GKD system. In the GKD system, the C2 indicator acts as a minor trend filter while the C1 indicator delivers the actual signals and entries. This new backtest allows you to test the entries and signals from the C1 indicator while using the C2 indicator as the macrotrend filter.

ملاحظات الأخبار

Updated for new GKD backtests.ملاحظات الأخبار

Additions and Subtractions:-All signal logic has been transferred to the new GKD-BT Backtests. You can access these backtests using the links provided below:

GKD-BT Giga Confirmation Stack Backtest:

![GKD-BT Giga Confirmation Stack Backtest [Loxx]](https://s3.tradingview.com/u/UkVUjO7c_mid.png)

GKD-BT Giga Stacks Backtest:

![GKD-BT Giga Stacks Backtest [Loxx]](https://s3.tradingview.com/0/0L1bTVBC_mid.png)

GKD-BT Full Giga Kaleidoscope Backtest:

![GKD-BT Full Giga Kaleidoscope Backtest [Loxx]](https://s3.tradingview.com/n/NP3VQKIX_mid.png)

GKD-BT Solo Confirmation Super Complex Backtest:

![GKD-BT Solo Confirmation Super Complex Backtest [Loxx]](https://s3.tradingview.com/o/o3a9L51S_mid.png)

GKD-BT Solo Confirmation Complex Backtest:

![GKD-BT Solo Confirmation Complex Backtest [Loxx]](https://s3.tradingview.com/n/NUnXZDbn_mid.png)

GKD-BT Solo Confirmation Simple Backtest:

![GKD-BT Solo Confirmation Simple Backtest [Loxx]](https://s3.tradingview.com/p/piMjJcbx_mid.png)

-Removed all Confirmation Type options except for "Confirmation" and "Continuation." The "Continuation" type is only used in GKD-BT Solo Confirmation Super Complex Backtest and GKD-BT Full Giga Kaleidoscope Backtest when selecting a Confirmation indicator.

-Added new signal plots based on the selected Confirmation Type. For the "Confirmation" type, only initial Longs and Shorts will be displayed on the indicator. For the "Continuation" type, both initial and continuation signals will be displayed. In both cases, if multiple signal types are present (e.g., middle cross, signal cross), these signals can be controlled using the "Signal Type" option.

-Implemented code optimizations to enhance the rendering speed of signals.

-Streamlined the export process by generating only a single value for export to other indicators or backtests. This exported value is named "Input into NEW GKD-BT Backtest."

ملاحظات الأخبار

Updated for multi-ticker GKD.نص برمجي للمستخدمين المدعوين فقط

الوصول إلى هذا النص مقيد للمستخدمين المصرح لهم من قبل المؤلف وعادة ما يكون الدفع مطلوباً. يمكنك إضافته إلى مفضلاتك، لكن لن تتمكن من استخدامه إلا بعد طلب الإذن والحصول عليه من مؤلفه. تواصل مع loxx للحصول على مزيد من المعلومات، أو اتبع إرشادات المؤلف أدناه.

لا تقترح TradingView الدفع مقابل النصوص البرمجية واستخدامها حتى تثق بنسبة 100٪ في مؤلفها وتفهم كيفية عملها. في كثير من الحالات، يمكنك العثور على بديل جيد مفتوح المصدر مجانًا في نصوص مجتمع الخاصة بنا .

تعليمات المؤلف

″This indicator is only available to ALGX Trading VIP group members. For instructions on how to access, send me a private message here on TradingView or message me using the contact information listed in my TradingView profile.

هل تريد استخدام هذا النص البرمجي على الرسم البياني؟

تحذير: يرجى القراءة قبل طلب الوصول.

Public Telegram Group, t.me/algxtrading_public

VIP Membership Info: patreon.com/algxtrading/membership

VIP Membership Info: patreon.com/algxtrading/membership

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.