OPEN-SOURCE SCRIPT

BATOOT

//version=5

indicator('BATOOT', overlay=true)

length = input.int(title='Length', minval=1, maxval=1000, defval=18)

upBound = ta.highest(high, length)

downBound = ta.lowest(low, length)

LONG = ta.cross(high, upBound)

SHORT = ta.cross(low, downBound)

switch_1 = 0

setA = 0

setB = 0

if LONG and switch_1[1] == 0

switch_1 := 1

setA := 1

setB := 0

setB

else

if SHORT and switch_1[1] == 1

switch_1 := 0

setA := 0

setB := 1

setB

else

switch_1 := nz(switch_1[1], 0)

setA := 0

setB := 0

setB

plotshape(setA, title='LONG', style=shape.triangleup, text='BUY', color=color.new(color.green, 0), textcolor=color.new(color.green, 0), location=location.belowbar, size=size.small)

plotshape(setB, title='SHORT', style=shape.triangledown, text='SHORT', color=color.new(color.red, 0), textcolor=color.new(color.red, 0), location=location.abovebar, size=size.small)

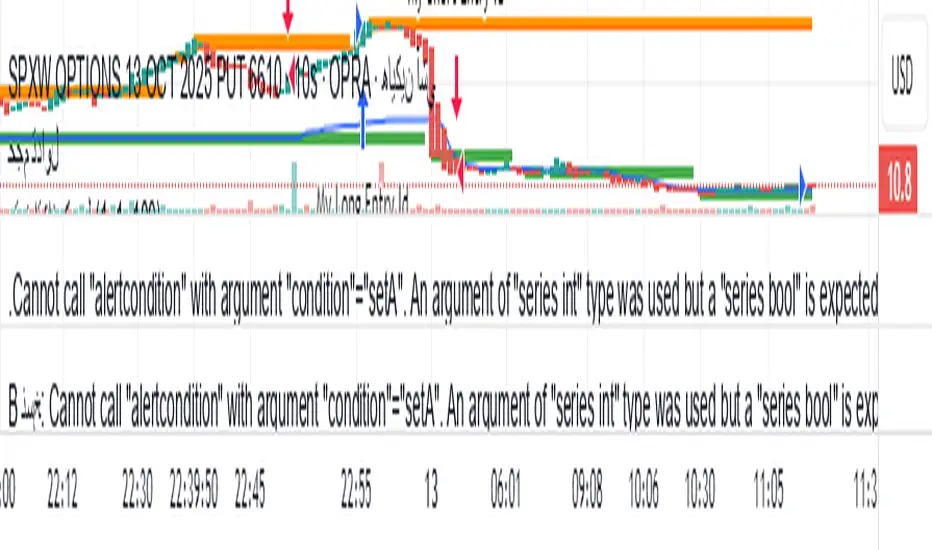

alertcondition(setA, title='LONG', message='LONG!')

alertcondition(setB, title='SHORT', message='SHORT!')

//Support and Resistance

line_width = 3

sr_tf = input.timeframe('', title='S/R Timeframe')

//Legacy RSI calc

rsi_src = close

len = 9

up1 = ta.rma(math.max(ta.change(rsi_src), 0), len)

down1 = ta.rma(-math.min(ta.change(rsi_src), 0), len)

legacy_rsi = down1 == 0 ? 100 : up1 == 0 ? 0 : 100 - 100 / (1 + up1 / down1)

//CMO based on HMA

length1 = 1

src1 = ta.hma(open, 5)[1] // legacy hma(5) calculation gives a resul with one candle shift, thus use hma()[1]

src2 = ta.hma(close, 12)

momm1 = ta.change(src1)

momm2 = ta.change(src2)

f1(m, n) =>

m >= n ? m : 0.0

f2(m, n) =>

m >= n ? 0.0 : -m

m1 = f1(momm1, momm2)

m2 = f2(momm1, momm2)

sm1 = math.sum(m1, length1)

sm2 = math.sum(m2, length1)

percent(nom, div) =>

100 * nom / div

cmo_new = percent(sm1 - sm2, sm1 + sm2)

//Legacy Close Pivots calcs.

len5 = 2

h = ta.highest(len5)

h1 = ta.dev(h, len5) ? na : h

hpivot = fixnan(h1)

l = ta.lowest(len5)

l1 = ta.dev(l, len5) ? na : l

lpivot = fixnan(l1)

//Calc Values

rsi_new = ta.rsi(close, 9)

lpivot_new = lpivot

hpivot_new = hpivot

sup = rsi_new < 25 and cmo_new > 50 and lpivot_new

res = rsi_new > 75 and cmo_new < -50 and hpivot_new

calcXup() =>

var xup = 0.0

xup := sup ? low : xup[1]

xup

calcXdown() =>

var xdown = 0.0

xdown := res ? high : xdown[1]

xdown

//Lines drawing variables

tf1 = request.security(syminfo.tickerid, sr_tf, calcXup(), lookahead=barmerge.lookahead_on)

tf2 = request.security(syminfo.tickerid, sr_tf, calcXdown(), lookahead=barmerge.lookahead_on)

//SR Line plotting

var tf1_line = line.new(0, 0, 0, 0)

var tf1_bi_start = 0

var tf1_bi_end = 0

tf1_bi_start := ta.change(tf1) ? bar_index : tf1_bi_start[1]

tf1_bi_end := ta.change(tf1) ? tf1_bi_start : bar_index

if ta.change(tf1)

tf1_line := line.new(tf1_bi_start, tf1, tf1_bi_end, tf1, color=color.green, width=line_width)

tf1_line

line.set_x2(tf1_line, tf1_bi_end)

var tf2_line = line.new(0, 0, 0, 0)

var tf2_bi_start = 0

var tf2_bi_end = 0

tf2_bi_start := ta.change(tf2) ? bar_index : tf2_bi_start[1]

tf2_bi_end := ta.change(tf2) ? tf2_bi_start : bar_index

if ta.change(tf2)

tf2_line := line.new(tf2_bi_start, tf2, tf2_bi_end, tf2, color=color.orange, width=line_width)

tf2_line

line.set_x2(tf2_line, tf2_bi_end)

indicator('BATOOT', overlay=true)

length = input.int(title='Length', minval=1, maxval=1000, defval=18)

upBound = ta.highest(high, length)

downBound = ta.lowest(low, length)

LONG = ta.cross(high, upBound)

SHORT = ta.cross(low, downBound)

switch_1 = 0

setA = 0

setB = 0

if LONG and switch_1[1] == 0

switch_1 := 1

setA := 1

setB := 0

setB

else

if SHORT and switch_1[1] == 1

switch_1 := 0

setA := 0

setB := 1

setB

else

switch_1 := nz(switch_1[1], 0)

setA := 0

setB := 0

setB

plotshape(setA, title='LONG', style=shape.triangleup, text='BUY', color=color.new(color.green, 0), textcolor=color.new(color.green, 0), location=location.belowbar, size=size.small)

plotshape(setB, title='SHORT', style=shape.triangledown, text='SHORT', color=color.new(color.red, 0), textcolor=color.new(color.red, 0), location=location.abovebar, size=size.small)

alertcondition(setA, title='LONG', message='LONG!')

alertcondition(setB, title='SHORT', message='SHORT!')

//Support and Resistance

line_width = 3

sr_tf = input.timeframe('', title='S/R Timeframe')

//Legacy RSI calc

rsi_src = close

len = 9

up1 = ta.rma(math.max(ta.change(rsi_src), 0), len)

down1 = ta.rma(-math.min(ta.change(rsi_src), 0), len)

legacy_rsi = down1 == 0 ? 100 : up1 == 0 ? 0 : 100 - 100 / (1 + up1 / down1)

//CMO based on HMA

length1 = 1

src1 = ta.hma(open, 5)[1] // legacy hma(5) calculation gives a resul with one candle shift, thus use hma()[1]

src2 = ta.hma(close, 12)

momm1 = ta.change(src1)

momm2 = ta.change(src2)

f1(m, n) =>

m >= n ? m : 0.0

f2(m, n) =>

m >= n ? 0.0 : -m

m1 = f1(momm1, momm2)

m2 = f2(momm1, momm2)

sm1 = math.sum(m1, length1)

sm2 = math.sum(m2, length1)

percent(nom, div) =>

100 * nom / div

cmo_new = percent(sm1 - sm2, sm1 + sm2)

//Legacy Close Pivots calcs.

len5 = 2

h = ta.highest(len5)

h1 = ta.dev(h, len5) ? na : h

hpivot = fixnan(h1)

l = ta.lowest(len5)

l1 = ta.dev(l, len5) ? na : l

lpivot = fixnan(l1)

//Calc Values

rsi_new = ta.rsi(close, 9)

lpivot_new = lpivot

hpivot_new = hpivot

sup = rsi_new < 25 and cmo_new > 50 and lpivot_new

res = rsi_new > 75 and cmo_new < -50 and hpivot_new

calcXup() =>

var xup = 0.0

xup := sup ? low : xup[1]

xup

calcXdown() =>

var xdown = 0.0

xdown := res ? high : xdown[1]

xdown

//Lines drawing variables

tf1 = request.security(syminfo.tickerid, sr_tf, calcXup(), lookahead=barmerge.lookahead_on)

tf2 = request.security(syminfo.tickerid, sr_tf, calcXdown(), lookahead=barmerge.lookahead_on)

//SR Line plotting

var tf1_line = line.new(0, 0, 0, 0)

var tf1_bi_start = 0

var tf1_bi_end = 0

tf1_bi_start := ta.change(tf1) ? bar_index : tf1_bi_start[1]

tf1_bi_end := ta.change(tf1) ? tf1_bi_start : bar_index

if ta.change(tf1)

tf1_line := line.new(tf1_bi_start, tf1, tf1_bi_end, tf1, color=color.green, width=line_width)

tf1_line

line.set_x2(tf1_line, tf1_bi_end)

var tf2_line = line.new(0, 0, 0, 0)

var tf2_bi_start = 0

var tf2_bi_end = 0

tf2_bi_start := ta.change(tf2) ? bar_index : tf2_bi_start[1]

tf2_bi_end := ta.change(tf2) ? tf2_bi_start : bar_index

if ta.change(tf2)

tf2_line := line.new(tf2_bi_start, tf2, tf2_bi_end, tf2, color=color.orange, width=line_width)

tf2_line

line.set_x2(tf2_line, tf2_bi_end)

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.