OPEN-SOURCE SCRIPT

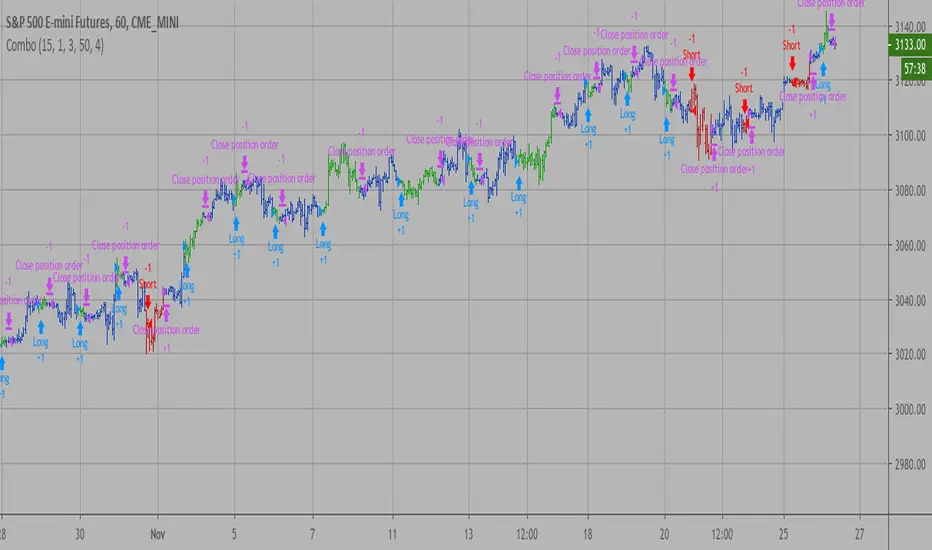

Combo Backtest 123 Reversal & D_ELI (Ehlers Leading Indicator)

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

This Indicator plots a single

Daily DSP (Detrended Synthetic Price) and a Daily ELI (Ehlers Leading

Indicator) using intraday data.

Detrended Synthetic Price is a function that is in phase with the dominant

cycle of real price data. This one is computed by subtracting a 3 pole Butterworth

filter from a 2 Pole Butterworth filter. Ehlers Leading Indicator gives an advanced

indication of a cyclic turning point. It is computed by subtracting the simple

moving average of the detrended synthetic price from the detrended synthetic price.

Buy and Sell signals arise when the ELI indicator crosses over or under the detrended

synthetic price.

See "MESA and Trading Market Cycles" by John Ehlers pages 64 - 70.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

This Indicator plots a single

Daily DSP (Detrended Synthetic Price) and a Daily ELI (Ehlers Leading

Indicator) using intraday data.

Detrended Synthetic Price is a function that is in phase with the dominant

cycle of real price data. This one is computed by subtracting a 3 pole Butterworth

filter from a 2 Pole Butterworth filter. Ehlers Leading Indicator gives an advanced

indication of a cyclic turning point. It is computed by subtracting the simple

moving average of the detrended synthetic price from the detrended synthetic price.

Buy and Sell signals arise when the ELI indicator crosses over or under the detrended

synthetic price.

See "MESA and Trading Market Cycles" by John Ehlers pages 64 - 70.

WARNING:

- For purpose educate only

- This script to change bars colors.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.