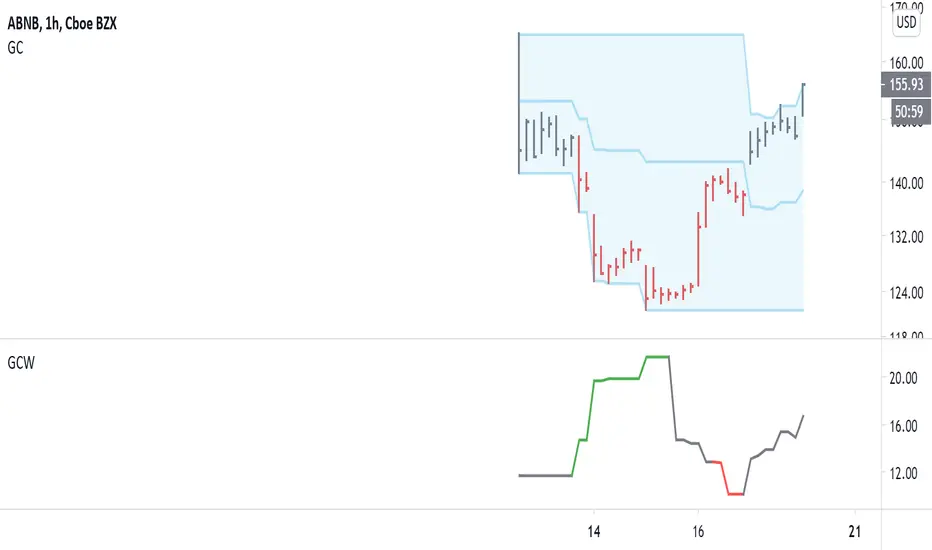

Gregoire Channel Width

This serves two purposes:

1) Volatility adjusted position sizing

2) Options buying/selling

-----------------

The formula for volatility adjusted position size is: (account value * risk) / (GC Width / Entry price).

For example, let's say we have a $15,000 account size and want to risk 2% on a TQQQ trade. The GC Width is $8.77 and entry is $167.59.

That gives us a position size of: (15,000 * 0.02) / (8.77 / 167.59) = $5,732.84. Our stop would be around the middle of the channel, in this case.

We use this so we avoid getting blown out in fast-moving markets, yet still make enough for slow moving markets. Too much risk destroys accounts!

-----------------

The green and red colors indicate areas to buy and sell options. RED = sell options, GREEN = buy options.

Options are priced according to volatility. We want to buy them when volatility is low, and sell them when volatility is high. These can also be used as take-profit areas: we buy options on the green and close for profit on the red areas, etc.

Changed color scheme: GREEN means expansion, RED means contraction.

نص برمجي للمستخدمين المدعوين فقط

يمكن فقط للمستخدمين الذين تمت الموافقة عليهم من قبل المؤلف الوصول إلى هذا البرنامج النصي. ستحتاج إلى طلب الإذن والحصول عليه لاستخدامه. يتم منح هذا عادةً بعد الدفع. لمزيد من التفاصيل، اتبع تعليمات المؤلف أدناه أو اتصل gregoirejohnb مباشرة.

لا توصي TradingView بالدفع مقابل برنامج نصي أو استخدامه إلا إذا كنت تثق تمامًا في مؤلفه وتفهم كيفية عمله. يمكنك أيضًا العثور على بدائل مجانية ومفتوحة المصدر في نصوص مجتمعنا.

تعليمات المؤلف

إخلاء المسؤولية

نص برمجي للمستخدمين المدعوين فقط

يمكن فقط للمستخدمين الذين تمت الموافقة عليهم من قبل المؤلف الوصول إلى هذا البرنامج النصي. ستحتاج إلى طلب الإذن والحصول عليه لاستخدامه. يتم منح هذا عادةً بعد الدفع. لمزيد من التفاصيل، اتبع تعليمات المؤلف أدناه أو اتصل gregoirejohnb مباشرة.

لا توصي TradingView بالدفع مقابل برنامج نصي أو استخدامه إلا إذا كنت تثق تمامًا في مؤلفه وتفهم كيفية عمله. يمكنك أيضًا العثور على بدائل مجانية ومفتوحة المصدر في نصوص مجتمعنا.