PROTECTED SOURCE SCRIPT

Adaptive Nadaraya-Watson Envelope with Multi-Timeframe Analysis

# Adaptive Nadaraya-Watson Envelope with Multi-Timeframe Analysis

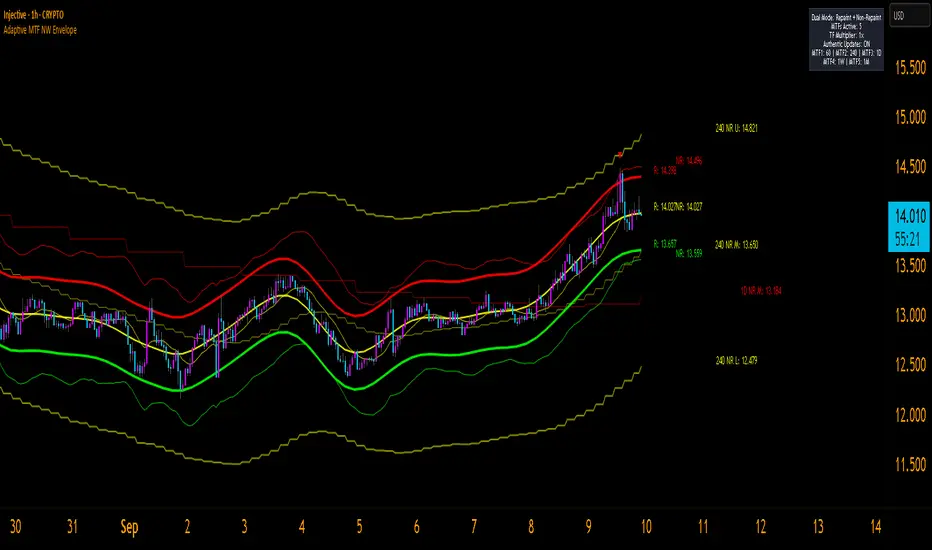

This indicator implements kernel regression analysis using Nadaraya-Watson estimation with comprehensive multi-timeframe capabilities and dual rendering modes for enhanced market analysis.

### Core Features

**Dual Mode Operation**: Offers both repainting and non-repainting envelope calculations with independent display controls. Users can view either mode individually or both simultaneously for comparative analysis.

**Multi-Timeframe Integration**: Supports up to 5 configurable timeframes with proportional scaling capabilities and harmonic relationship maintenance. Each timeframe can be independently enabled with individual display controls.

**Adaptive Kernel Regression**: Utilizes Gaussian kernel weighting with adjustable bandwidth parameters to create dynamic support and resistance zones that adapt to market conditions.

**Smart Color System**: Features multiple color themes including Electric Pulse, Ocean Depth, Fire Gradient, Cyberpunk, Forest Zen, Sunset Vibes, and Ice Crystal for timeframe hierarchy visualization.

### Configuration Options

The indicator provides extensive customization including bandwidth adjustment, multiplier scaling, timeframe selection with proportional multipliers, authentication mode toggle for gap handling, center line display controls, and comprehensive color scheme selection.

**Performance Optimization**: Multiple rendering approaches including polyline drawing for smooth curves and optimized line management for system performance balance.

### Technical Implementation

Built using advanced Pine Script techniques with optimized multi-timeframe data handling, efficient memory management, and intelligent label positioning. The system employs Gaussian window functions for statistical accuracy in envelope calculations.

### Practical Applications

Suitable for trend analysis, dynamic support/resistance identification, multi-timeframe alignment assessment, and kernel regression-based market structure analysis. The envelope boundaries provide adaptive price levels while multi-timeframe analysis offers broader market context.

### Usage Considerations

Multi-timeframe calculations may experience data delays during low-liquidity periods. Performance features allow users to balance visual quality with system responsiveness. The indicator works across all timeframes with adequate historical data for kernel calculations.

**Disclaimer**: This indicator is for educational and analytical purposes only. Kernel regression analysis and multi-timeframe envelope calculations are based on historical data and mathematical models that do not guarantee future price movements. Users should conduct thorough testing before incorporating this tool into their analysis framework.

This indicator implements kernel regression analysis using Nadaraya-Watson estimation with comprehensive multi-timeframe capabilities and dual rendering modes for enhanced market analysis.

### Core Features

**Dual Mode Operation**: Offers both repainting and non-repainting envelope calculations with independent display controls. Users can view either mode individually or both simultaneously for comparative analysis.

**Multi-Timeframe Integration**: Supports up to 5 configurable timeframes with proportional scaling capabilities and harmonic relationship maintenance. Each timeframe can be independently enabled with individual display controls.

**Adaptive Kernel Regression**: Utilizes Gaussian kernel weighting with adjustable bandwidth parameters to create dynamic support and resistance zones that adapt to market conditions.

**Smart Color System**: Features multiple color themes including Electric Pulse, Ocean Depth, Fire Gradient, Cyberpunk, Forest Zen, Sunset Vibes, and Ice Crystal for timeframe hierarchy visualization.

### Configuration Options

The indicator provides extensive customization including bandwidth adjustment, multiplier scaling, timeframe selection with proportional multipliers, authentication mode toggle for gap handling, center line display controls, and comprehensive color scheme selection.

**Performance Optimization**: Multiple rendering approaches including polyline drawing for smooth curves and optimized line management for system performance balance.

### Technical Implementation

Built using advanced Pine Script techniques with optimized multi-timeframe data handling, efficient memory management, and intelligent label positioning. The system employs Gaussian window functions for statistical accuracy in envelope calculations.

### Practical Applications

Suitable for trend analysis, dynamic support/resistance identification, multi-timeframe alignment assessment, and kernel regression-based market structure analysis. The envelope boundaries provide adaptive price levels while multi-timeframe analysis offers broader market context.

### Usage Considerations

Multi-timeframe calculations may experience data delays during low-liquidity periods. Performance features allow users to balance visual quality with system responsiveness. The indicator works across all timeframes with adequate historical data for kernel calculations.

**Disclaimer**: This indicator is for educational and analytical purposes only. Kernel regression analysis and multi-timeframe envelope calculations are based on historical data and mathematical models that do not guarantee future price movements. Users should conduct thorough testing before incorporating this tool into their analysis framework.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.