OPEN-SOURCE SCRIPT

KAI QUANTUM Candles Analysis - Yearly Breakdown

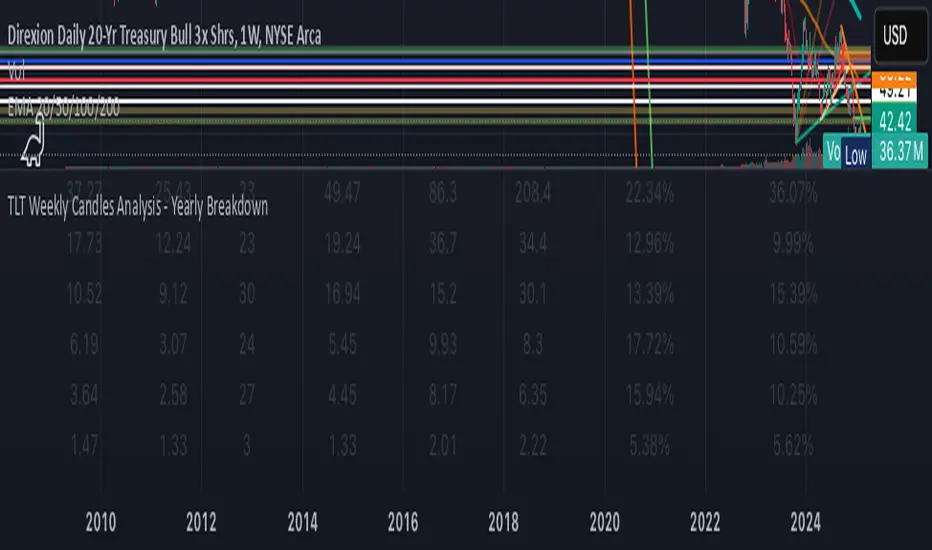

The "KAI QUANTUM Analysis – Yearly Breakdown" indicator offers a comprehensive, year-by-year examination of candlestick behavior, enabling traders and analysts to gauge market dynamics over extended periods. Key features include:

Yearly Aggregation:

The indicator groups candlestick data by year, providing a clear snapshot of market behavior for each period.

Dual-Color Analysis:

It categorizes candles as bullish (green) or bearish (red) and computes statistics separately for each, allowing you to assess both upward and downward market trends.

Average Body Size & Candle Count:

For each year, the indicator calculates the average body size of green and red candles and tracks the total number of each, helping you understand overall market volatility and momentum.

Top 10 Candle Analysis:

It identifies the ten largest candles (by body size) in each year and computes their average size, offering insight into the most significant market moves during that period.

Largest Candle Metrics:

The indicator determines the absolute size of the largest green and red candles in each year.

Percentage Move Calculation:

In addition to absolute values, it computes the largest move as a percentage of the open price for both green and red candles. This allows you to see not only which year experienced the biggest moves but also how those moves compare relative to the opening price.

Clear Tabular Display:

All the computed statistics are organized in an on-chart table, making it easy to compare yearly trends at a glance.

Ideal for daily and higher timeframes, this indicator is a valuable tool for long-term market analysis, enabling you to identify trends, assess volatility, and make informed trading decisions based on historical market behavior.

Yearly Aggregation:

The indicator groups candlestick data by year, providing a clear snapshot of market behavior for each period.

Dual-Color Analysis:

It categorizes candles as bullish (green) or bearish (red) and computes statistics separately for each, allowing you to assess both upward and downward market trends.

Average Body Size & Candle Count:

For each year, the indicator calculates the average body size of green and red candles and tracks the total number of each, helping you understand overall market volatility and momentum.

Top 10 Candle Analysis:

It identifies the ten largest candles (by body size) in each year and computes their average size, offering insight into the most significant market moves during that period.

Largest Candle Metrics:

The indicator determines the absolute size of the largest green and red candles in each year.

Percentage Move Calculation:

In addition to absolute values, it computes the largest move as a percentage of the open price for both green and red candles. This allows you to see not only which year experienced the biggest moves but also how those moves compare relative to the opening price.

Clear Tabular Display:

All the computed statistics are organized in an on-chart table, making it easy to compare yearly trends at a glance.

Ideal for daily and higher timeframes, this indicator is a valuable tool for long-term market analysis, enabling you to identify trends, assess volatility, and make informed trading decisions based on historical market behavior.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.