OPEN-SOURCE SCRIPT

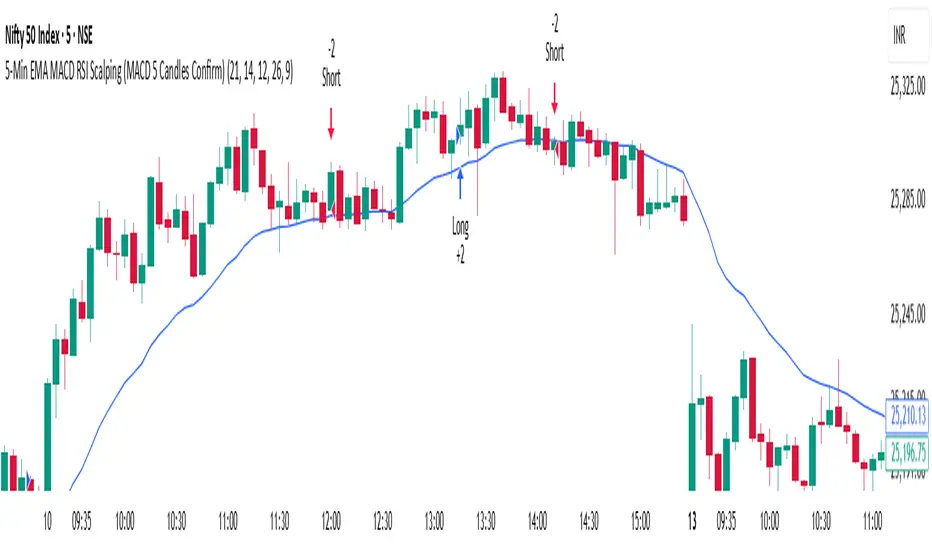

5-Min EMA MACD RSI Scalping (MACD 5 Candles Confirm) - BVK

🔹 5-Min EMA MACD RSI Scalping Strategy – Full Description

The 5-Min EMA MACD RSI Scalping Strategy is a powerful intraday trading technique designed for quick trades on lower timeframes, mainly the 5-minute chart. It combines trend confirmation (EMA), momentum analysis (MACD), and overbought/oversold signals (RSI) to capture short, high-probability price moves in both bullish and bearish markets.

⚙️ Indicators Used:

Exponential Moving Averages (EMA)

EMA 9 – Fast-moving average for entry trigger.

EMA 21 – Medium-term average for trend confirmation.

When EMA 9 crosses above EMA 21 → Bullish bias.

When EMA 9 crosses below EMA 21 → Bearish bias.

MACD (12, 26, 9)

Confirms momentum and possible entry zones.

Bullish confirmation: MACD line crosses above signal line.

Bearish confirmation: MACD line crosses below signal line.

RSI (14-period)

Filters out false signals.

Buy zone: RSI rising above 40–50.

Sell zone: RSI falling below 60–50.

Avoid trades when RSI is near 70 (overbought) or 30 (oversold).

💡 Entry Rules:

Buy Setup (Long Trade):

EMA 9 crosses above EMA 21.

MACD line crosses above signal line (positive momentum).

RSI is above 50 but below 70 (confirming strength).

Enter trade at candle close.

Sell Setup (Short Trade):

EMA 9 crosses below EMA 21.

MACD line crosses below signal line.

RSI is below 50 but above 30 (confirming weakness).

Enter trade at candle close.

🎯 Exit Rules:

Take Profit: 1.5x to 2x of risk or near the opposite EMA crossover.

Stop Loss: Below/above recent swing low/high or 0.3–0.5% away from entry.

Optional trailing stop using EMA 9 for dynamic exits.

📊 Best Timeframes & Assets:

Works best on 5-minute charts.

Suitable for Forex, Indices, Cryptocurrency, and Stocks with good liquidity.

Avoid major news events or low-volume sessions.

⚠️ Tips for Best Results:

Trade only during high-volume market sessions (e.g., London/New York overlap).

Always confirm trend direction on higher timeframes (15m or 1H).

Avoid overtrading—wait for clear signal confluence (EMA + MACD + RSI).

🧠 Strategy Summary:

“EMA gives you the trend, MACD gives you momentum, and RSI keeps you disciplined.”

This strategy is simple yet effective for traders who prefer quick in-and-out trades within minutes, offering a structured approach to scalping with reduced emotional bias.

The 5-Min EMA MACD RSI Scalping Strategy is a powerful intraday trading technique designed for quick trades on lower timeframes, mainly the 5-minute chart. It combines trend confirmation (EMA), momentum analysis (MACD), and overbought/oversold signals (RSI) to capture short, high-probability price moves in both bullish and bearish markets.

⚙️ Indicators Used:

Exponential Moving Averages (EMA)

EMA 9 – Fast-moving average for entry trigger.

EMA 21 – Medium-term average for trend confirmation.

When EMA 9 crosses above EMA 21 → Bullish bias.

When EMA 9 crosses below EMA 21 → Bearish bias.

MACD (12, 26, 9)

Confirms momentum and possible entry zones.

Bullish confirmation: MACD line crosses above signal line.

Bearish confirmation: MACD line crosses below signal line.

RSI (14-period)

Filters out false signals.

Buy zone: RSI rising above 40–50.

Sell zone: RSI falling below 60–50.

Avoid trades when RSI is near 70 (overbought) or 30 (oversold).

💡 Entry Rules:

Buy Setup (Long Trade):

EMA 9 crosses above EMA 21.

MACD line crosses above signal line (positive momentum).

RSI is above 50 but below 70 (confirming strength).

Enter trade at candle close.

Sell Setup (Short Trade):

EMA 9 crosses below EMA 21.

MACD line crosses below signal line.

RSI is below 50 but above 30 (confirming weakness).

Enter trade at candle close.

🎯 Exit Rules:

Take Profit: 1.5x to 2x of risk or near the opposite EMA crossover.

Stop Loss: Below/above recent swing low/high or 0.3–0.5% away from entry.

Optional trailing stop using EMA 9 for dynamic exits.

📊 Best Timeframes & Assets:

Works best on 5-minute charts.

Suitable for Forex, Indices, Cryptocurrency, and Stocks with good liquidity.

Avoid major news events or low-volume sessions.

⚠️ Tips for Best Results:

Trade only during high-volume market sessions (e.g., London/New York overlap).

Always confirm trend direction on higher timeframes (15m or 1H).

Avoid overtrading—wait for clear signal confluence (EMA + MACD + RSI).

🧠 Strategy Summary:

“EMA gives you the trend, MACD gives you momentum, and RSI keeps you disciplined.”

This strategy is simple yet effective for traders who prefer quick in-and-out trades within minutes, offering a structured approach to scalping with reduced emotional bias.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.