PROTECTED SOURCE SCRIPT

Cross-Asset Risk Appetite Index

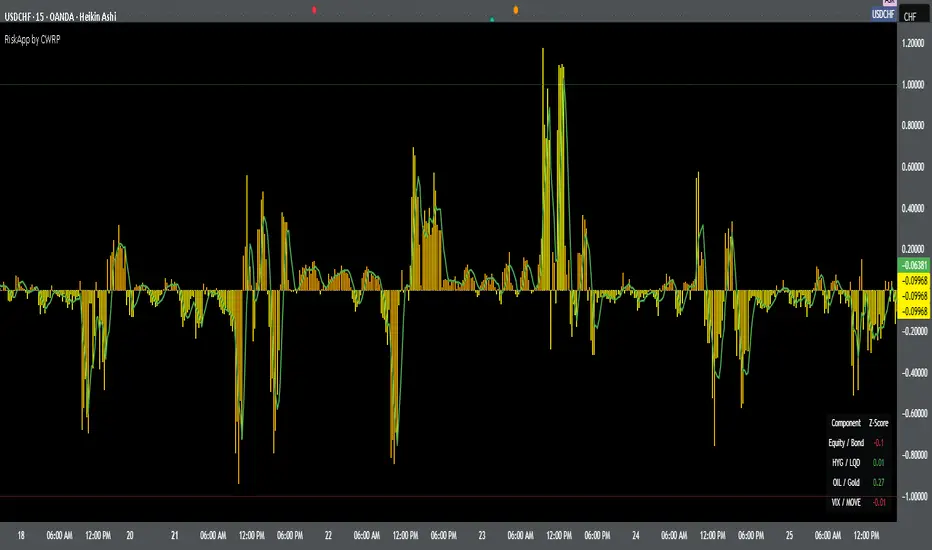

Cross-Asset Risk Appetite Index (RiskApp) by CWRP combines multiple asset classes into a single risk sentiment signal to help traders and investors detect when the market is in a risk-on or risk-off regime.

It calculates a composite Z-score index based on relative performance between:

SPY / IEF: Equities vs Bonds

HYG / LQD: High Yield vs Investment Grade Credit

CL / GC: Oil vs Gold

VIX / MOVE: Equity vs Bond Market Volatility (inverted)

Each component reflects capital flows toward riskier or safer assets, with dynamic weighting (Equity/Bond: 30%, Credit: 25%, Commodities: 25%, Volatility: 20%) and smoothing applied for a cleaner signal.

How to Read:

Highlighting

Yellow = Risk-On sentiment (market favors risk assets)

Orange = Risk-Off sentiment (flight to safety)

Black Background = Neutral design for emotional detachment

Table

Equity/Bond Z-Score:

Positive (> +1) --> Stocks outperforming bonds --> Risk-On

Negative (< -1) --> Bonds outperforming stocks --> Risk-Off

Credit Spread Z-Score (HYG/LQD):

Positive --> High yield outperforming --> Investors seeking yield

Negative --> Flight to quality --> Credit concerns

Oil/Gold Z-Score:

Positive --> Oil outperforming --> Economic optimism

Negative --> Gold outperforming --> Defensive positioning

Volatility Spread (VIX/MOVE):

Positive --> Equity vol falling relative to bond vol --> Risk stabilizing

Negative --> Equity vol rising --> Caution / Risk-Off

Composite Index:

> +1 --> Strong Risk Appetite

< -1 --> Strong Risk Aversion

Between -1 and +1 --> Neutral regime

Thank you for using the Cross-Asset Risk Appetite Index by CWRP!

I'm open to all critiques and discussion around macro-finance and hope this model adds clarity to your decision-making.

It calculates a composite Z-score index based on relative performance between:

SPY / IEF: Equities vs Bonds

HYG / LQD: High Yield vs Investment Grade Credit

CL / GC: Oil vs Gold

VIX / MOVE: Equity vs Bond Market Volatility (inverted)

Each component reflects capital flows toward riskier or safer assets, with dynamic weighting (Equity/Bond: 30%, Credit: 25%, Commodities: 25%, Volatility: 20%) and smoothing applied for a cleaner signal.

How to Read:

Highlighting

Yellow = Risk-On sentiment (market favors risk assets)

Orange = Risk-Off sentiment (flight to safety)

Black Background = Neutral design for emotional detachment

Table

Equity/Bond Z-Score:

Positive (> +1) --> Stocks outperforming bonds --> Risk-On

Negative (< -1) --> Bonds outperforming stocks --> Risk-Off

Credit Spread Z-Score (HYG/LQD):

Positive --> High yield outperforming --> Investors seeking yield

Negative --> Flight to quality --> Credit concerns

Oil/Gold Z-Score:

Positive --> Oil outperforming --> Economic optimism

Negative --> Gold outperforming --> Defensive positioning

Volatility Spread (VIX/MOVE):

Positive --> Equity vol falling relative to bond vol --> Risk stabilizing

Negative --> Equity vol rising --> Caution / Risk-Off

Composite Index:

> +1 --> Strong Risk Appetite

< -1 --> Strong Risk Aversion

Between -1 and +1 --> Neutral regime

Thank you for using the Cross-Asset Risk Appetite Index by CWRP!

I'm open to all critiques and discussion around macro-finance and hope this model adds clarity to your decision-making.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي محمي

تم نشر هذا النص البرمجي كمصدر مغلق. ومع ذلك، يمكنك استخدامه بحرية ودون أي قيود - تعرف على المزيد هنا.

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.