OPEN-SOURCE SCRIPT

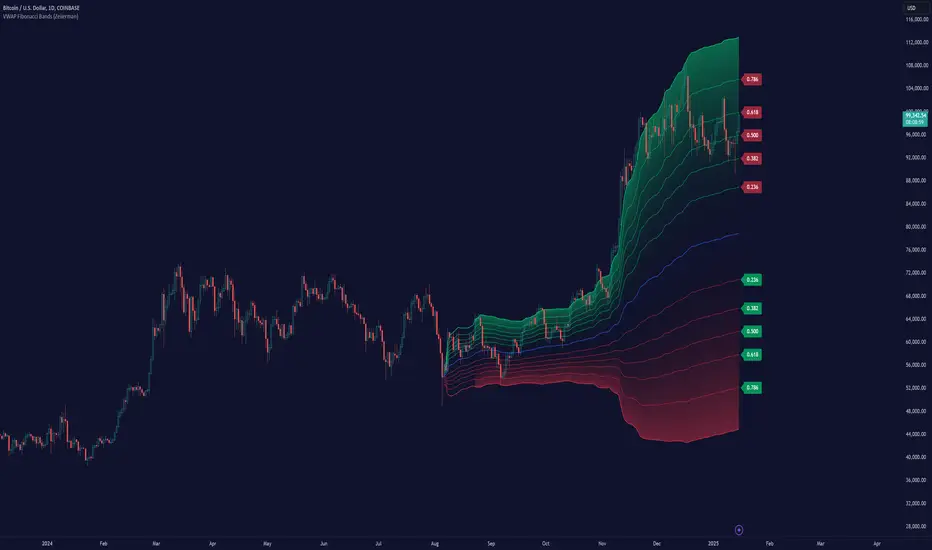

VWAP Fibonacci Bands (Zeiierman)

█ Overview

The VWAP Fibonacci Bands is a sophisticated yet user-friendly indicator designed to assist traders in visualizing market trends, volatility, and potential support/resistance levels. Developed by Zeiierman, this tool integrates the MIDAS (Market Interpretation Data Analysis System) methodology with Standard Deviation Bands and user-defined Fibonacci levels to provide a comprehensive market analysis framework.

This indicator is built for traders who want a dynamic and customizable approach to understanding market movements, offering features that adapt to varying market conditions. Whether you're a scalper, swing trader, or long-term investor.

█ How It Works

⚪ Anchor Point System

The indicator begins its calculations based on an anchor point, which can be set to:

⚪ MIDAS Calculation

The MIDAS calculation is central to this indicator. It uses cumulative price and volume data to compute a volume-weighted average price (VWAP), offering a trendline that reflects the true value weighted by trading activity.

⚪ Standard Deviation Bands

The upper and lower bands are calculated using the standard deviation of price movements around the MIDAS line.

⚪ Fibonacci Levels

User-defined Fibonacci ratios are used to plot additional support and resistance levels between the bands. These levels provide visual cues for potential price reversals or trend continuations.

█ How to Use

⚪ Trend Identification

⚪ Support and Resistance

⚪ Volatility Analysis

⚪ Overbought/Oversold Conditions

Look for the price beyond the upper or lower bands to identify extreme conditions.

█ Settings

Set Anchor Method

Set Std Dev Multiplier

Controls the width of the bands:

Set Fibonacci Levels

Define custom Fibonacci ratios (e.g., 0.236, 0.382) to plot intermediate levels between the bands.

█ Tips for Fine-Tuning

⚪ For Trend Trading:

Use higher Std Dev Multipliers to focus on long-term trends and avoid noise. Adjust Anchor Timeframe to Weekly or Monthly for broader trend analysis.

⚪ For Reversal Trading:

Tighten the bands with a lower Std Dev Multiplier.

Use shorter anchor timeframes for intraday reversals (e.g., Hourly).

⚪ For Volatile Markets:

Increase the Std Dev Multiplier to accommodate wider price swings.

⚪ For Quiet Markets:

Decrease the Std Dev Multiplier to highlight smaller fluctuations.

-----------------

Disclaimer

The information contained in my Scripts/Indicators/Ideas/Algos/Systems does not constitute financial advice or a solicitation to buy or sell any securities of any type. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My Scripts/Indicators/Ideas/Algos/Systems are only for educational purposes!

The VWAP Fibonacci Bands is a sophisticated yet user-friendly indicator designed to assist traders in visualizing market trends, volatility, and potential support/resistance levels. Developed by Zeiierman, this tool integrates the MIDAS (Market Interpretation Data Analysis System) methodology with Standard Deviation Bands and user-defined Fibonacci levels to provide a comprehensive market analysis framework.

This indicator is built for traders who want a dynamic and customizable approach to understanding market movements, offering features that adapt to varying market conditions. Whether you're a scalper, swing trader, or long-term investor.

█ How It Works

⚪ Anchor Point System

The indicator begins its calculations based on an anchor point, which can be set to:

- A specific date for historical analysis or alignment with significant market events.

- A timeframe-based reset, dynamically restarting calculations at the beginning of each selected period (e.g., daily, weekly, or monthly).

This dual-anchor method ensures flexibility, allowing the indicator to align with various trading strategies.

⚪ MIDAS Calculation

The MIDAS calculation is central to this indicator. It uses cumulative price and volume data to compute a volume-weighted average price (VWAP), offering a trendline that reflects the true value weighted by trading activity.

⚪ Standard Deviation Bands

The upper and lower bands are calculated using the standard deviation of price movements around the MIDAS line.

⚪ Fibonacci Levels

User-defined Fibonacci ratios are used to plot additional support and resistance levels between the bands. These levels provide visual cues for potential price reversals or trend continuations.

█ How to Use

⚪ Trend Identification

- Uptrend: The price remains above the MIDAS line.

- Downtrend: The price stays below the MIDAS line and aligns with the lower bands.

⚪ Support and Resistance

- The upper and lower bands act as support and resistance levels.

- Fibonacci levels provide intermediate zones for potential price reversals.

⚪ Volatility Analysis

- Wider bands indicate periods of high volatility.

- Narrower bands suggest low-volatility conditions, often preceding breakouts.

⚪ Overbought/Oversold Conditions

Look for the price beyond the upper or lower bands to identify extreme conditions.

█ Settings

Set Anchor Method

- Anchor Method: Choose between Timeframe or Date to define the starting point of calculations.

- Anchor Timeframe: For Timeframe mode, specify the interval (e.g., Daily, Weekly).

- Anchor Date: For Date mode, set the exact starting date for historical alignment.

Set Std Dev Multiplier

Controls the width of the bands:

- Higher values widen the bands, filtering out minor fluctuations.

- Lower values tighten the bands for more responsive analysis.

Set Fibonacci Levels

Define custom Fibonacci ratios (e.g., 0.236, 0.382) to plot intermediate levels between the bands.

█ Tips for Fine-Tuning

⚪ For Trend Trading:

Use higher Std Dev Multipliers to focus on long-term trends and avoid noise. Adjust Anchor Timeframe to Weekly or Monthly for broader trend analysis.

⚪ For Reversal Trading:

Tighten the bands with a lower Std Dev Multiplier.

Use shorter anchor timeframes for intraday reversals (e.g., Hourly).

⚪ For Volatile Markets:

Increase the Std Dev Multiplier to accommodate wider price swings.

⚪ For Quiet Markets:

Decrease the Std Dev Multiplier to highlight smaller fluctuations.

-----------------

Disclaimer

The information contained in my Scripts/Indicators/Ideas/Algos/Systems does not constitute financial advice or a solicitation to buy or sell any securities of any type. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My Scripts/Indicators/Ideas/Algos/Systems are only for educational purposes!

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.

نص برمجي مفتوح المصدر

بروح TradingView الحقيقية، قام مبتكر هذا النص البرمجي بجعله مفتوح المصدر، بحيث يمكن للمتداولين مراجعة وظائفه والتحقق منها. شكرا للمؤلف! بينما يمكنك استخدامه مجانًا، تذكر أن إعادة نشر الكود يخضع لقواعد الموقع الخاصة بنا.

Access my indicators at: zeiierman.com

Join Our Free Discord: discord.gg/zeiiermantrading

Join Our Free Discord: discord.gg/zeiiermantrading

إخلاء المسؤولية

لا يُقصد بالمعلومات والمنشورات أن تكون، أو تشكل، أي نصيحة مالية أو استثمارية أو تجارية أو أنواع أخرى من النصائح أو التوصيات المقدمة أو المعتمدة من TradingView. اقرأ المزيد في شروط الاستخدام.